"At the end of the day, you are buying a software solutions provider to the healthcare industry, and as such, this is a pretty niche market. We continue to believe that legacy systems across the globe will be replaced with better cloud based solutions and practical cost saving solutions that will encourage healthcare groups to adopt these types of software"

To market to market to buy a fat pig That was a busy day, Thursday. In part it was catch up, the stronger currency as a result of a weakening Dollar, led to local retails and banks getting a proper lift, whilst Rand hedges came under pressure. That was understandable. As I sit here and write this, the Rand is last trading at 13.69 to the US Dollar, 17.94 to the Pound and 15.24 to the Euro. Remember the Barmy Army song, I have got 22 (and then 23 and then 24) Rand to the Pound late last year, and earlier in January? She gone, as they say in the classics. Emerging market excitement has returned and local retailers and banks all look attractive.

The upshot is that when the big uber caps like British American Tobacco don't do well as a result of the currency translation, the weaker Pound is certainly good for their global businesses, however. The stock in Pounds is up mid teens since Brexit, in Rand terms it is down 4 percent. Does that make them a "good one" or a "bad one"? The market has significantly upgraded the stock, the earnings are likely to be given a big boost by the weaker reporting currency, the Pound.

Yesterday the bank of England cut rates to an all time low. The pensioners who voted Brexit now are stuck with lower interest on their cash deposits. And the lower income groups that voted against immigrants still can't afford a loan as the income levels are not what they should be, even with the lowest rate on record. When searching for information on the oldest Italian bank (Monte Paschi) that is wobbling all over the show, I found that the Bank of England was one of the oldest banks in the world, 322 years old at last count. The original purpose was to act for the government, the fact that democracy existed that far back (1694) is a testament to the durability of the model. Although, to be fair to the word democracy, you only voted if you were rich and a man, hardly counts "free and fair", right?

Since Brexit, the Pound has lost nearly 11 percent to the US Dollar. More worrying, and this may well be very short term, permanent job placements in the UK fell at the sharpest pace since May 2009. This may be a wait and see type scenario, stick it in the unintended consequences drawer. To finish off the markets segment, stocks locally as a collective closed a handful of points higher, up a whole 0.02 percent on the day. Financials added nearly three-quarters of a percent, whilst industrials were dragged down nearly one-third of a percent.

MTN basically aired all of their dirty laundry and made sure that they shunt the lot through. So, as such, the company is likely to report a wide loss when they deliver their six month numbers today. And rightly so, they must make sure that Mr. Market sees all of the horrible bits. The Nigerian fine will shave off 474 cents per share, forex losses will shave another 135 cents per share, whilst losses by tower companies a roughly equivalent amount. Equally the hyperinflationary environment in Iran and further weakness in their other two core markets, Nigeria and South Africa will impact negatively on earnings. Push the lot through, make the most of what is a horrible situation. After taking a dive at the open yesterday, the stock recovered and added three-quarters of a percent. We will cover these in more detail.

Over the seas and far away, across the second largest ocean on the planet (we do like numbers), stocks closed mixed in New York, New York. Choppy is the word used to describe an oscillating session, time is always against you, you cannot stop it. Or make it go faster, I don't know why you would ever want to though. The Dow Jones Industrial Average may have snapped a losing streak in the session prior, last evening the blue chip index shed all of 2.95 points (that is a whopping 0.02 percent), whilst the broader market S&P 500 gained that percentage amount. The nerds of NASDAQ added 0.13 percent by the close. Facebook had a decent day after a little softness post their results (and a surge too, don't forget that), Apple continues to creep higher. Over the last month Apple is up nearly ten and a half percent. Still, the one year return is nearly minus thirteen percent, not a great outcome for stock holders in recent times. For accumulators of the stock, this is great.

Company corner

Cerner, the information technology healthcare business, released results a couple of sessions ago. The company is in a sweet spot, the more time goes on, the more electronic all healthcare records are likely to be. I think that there is an incredible amount of runway left, anyone who visits their local healthcare professional can attest to this. Equally, a procedure at the hospital amounts in a small forest being cleared, so many forms are needed to be filled in. Equally, in the aftercare environment, the more people involved, the more mistakes. From medicine not administered properly, to the incorrect patient receiving the wrong procedure, technology will help prevent mistakes. At the end of the day, that is the company mission: "to contribute to the systemic improvement of health care

delivery and the health of communities."

The name itself comes from the Latin word "to discern". The results themselves - Second Quarter 2016 Results, were Mr. Market showing the company the same good judgement. You almost got the sense that the stock was primed for ordinary. Revenues of 1.216 billion Dollars represented a 8 percent increase on this time last year, earnings per share for the quarter clocked 58 cents and were 12 percent better than the 52 cents recorded this time last year. Bookings (i.e. future orders) jumped 9 percent, the total backlog now has grown to 15 billion Dollars.

Bloomberg pegs this years earnings at 2.36 Dollars (or as near to that as possible). That means after the recent price spike to 66 Dollars, in which the stock rallied around 7 percent post results, the price is probably at the correct valuation, 28 times forward. That does seem a little rich, the stock always trades at a slight premium. That is as a result of the company being in an industry that is expected to continue to show the same kind of growth both in North America and across any new territories that they would expand into, high single digit or low double digit revenue growth. The company guided both the next quarter and full year in about the place that the Street had pencilled in numbers, around 5 billion Dollars at the top end of the range (for the full year) and 2.30 to 2.40 in earnings for the full year, slap bang where Mr. Market and Street had expected.

I suspect that whilst this is a difficult company for most to get a handle on, it certainly is a company that has tremendous growth prospects. From making front end reception payment systems in waiting rooms easier to integrate with health insurance products, to the Smart Room, which makes it easier for patient and care staff to know exactly what is going on at all moments, with the touch of a button and a screen to examine vitals and progress. We all know that medical costs can, not only take you several leaps backwards, it can also cripple families with limited (or even comprehensive) health insurance. A company like Cerner continues to use technology to reduce the costs of pharmacies, doctors and hospitals, who in turn pass that onto patients. And ultimately that means more money for healthcare development and progress.

Their most important business, from a sales point of view, is their ongoing annuity income associated with their services business, and the maintenance thereof. Whilst it is important for the company to fulfil that backlog as soon as possible, the ongoing work is equally important. The company are using cloud based services to make their integration systems a lot more affordable, smaller hospital groups no longer need the big capital outlay in order to own all the moving parts with this type of expensive technology. All you need is a quick internet speed (and redundancy) and staff that can adapt easier.

At the end of the day, you are buying a software solutions provider to the healthcare industry, and as such, this is a pretty niche market. We continue to believe that legacy systems across the globe will be replaced with better cloud based solutions and practical cost saving solutions that will encourage healthcare groups to adopt these types of software. The company has also been the speculation of buyout rumours, specifically from IBM, the current market cap is 24 billion Dollars, the premium would be pretty significant were it to happen, and whilst IBM has the ammo, it may be unpalatable for their shareholders to pay that much. We continue to accumulate the business on weakness, we are happy that the market continues to validate the investment thesis.

Linkfest, lap it up

The heading says it all - 5 Ways Capitalist Chile is Much Better Than Socialist Venezuela. When voters are promised the world, it may transpire in reality for a limited time only, and then the whole lot breaks down. The state cannot do, it can only enable.

This is another step closer to getting real time health data for populations. I can see scientists and data researchers drooling at the prospect of seeing real time data from chosen regions of a city - MIT researchers are sending robots into sewers to monitor city dwellers' waste

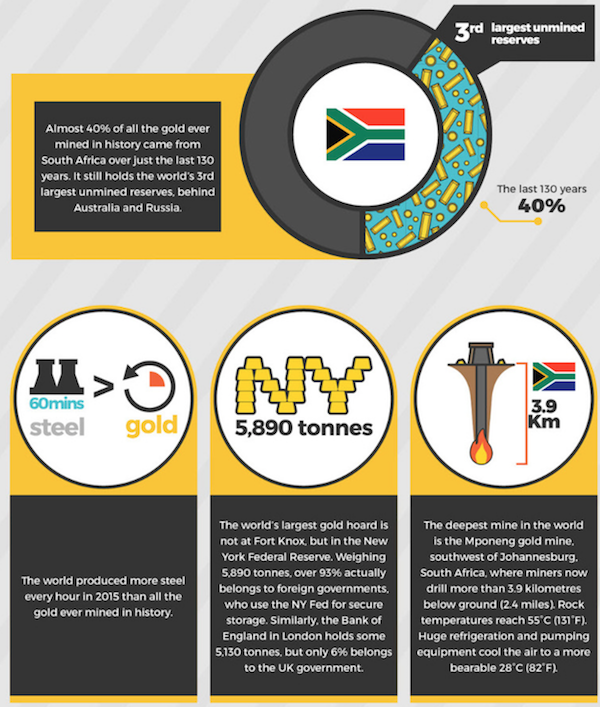

Some interesting facts about Gold. Given its properties of durability, malleability and rareness it makes sense as to why gold was used as a store of value - 31 Incredible Facts About Gold

It is amazing to think that a private company has the resources to land on the moon. Thanks to technology the cost will be around 'only' $25 million - The US government has approved the first private landing on the moon

Home again, home again, jiggety-jog. A company that I like a lot, Priceline, reported good numbers overnight. MTN report today, we still owe you news on Tesla as well as doing Twitter in some detail. Always a whole lot going on, if that wasn't enough for you, there is a small matter of local government elections to keep you busy of course.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment