"Mr. Market really liked the numbers, the stock soared over 7 percent to close just above 98 Dollars, a 52 week high. And seeing as all things China have been under pressure, the stock is up really smartly from the 57 Dollar low reached last October, and 60 Dollars in February this year. The company has an amazing network now, 427 million monthly mobile users in China."

To market to market to buy a fat pig Some fellow said on the wireless this morning, whilst I was listening on my way to work that if life throws you lane 8 on a Monday, do not despair, just Wayde van Niekerk your way through it. Ha-ha. That is a good one. Friday was a while back, a few medals for Mzansi and some great performances from the folks around these parts. We punch above our weight globally, I am reminded that the USA has bigger resources than most, when it comes to most things, be it Wall Street, Main Street or in this case Fleet Street.

It was a fleet footed performance from the local stock market Friday, stocks closed the session up just over nine-tenths of a percent, financial stocks continued the charge northwards. The year performance, i.e. the last 12 months, has been minus seven percent, the last three months have shown a positive 7 percent return. In large part the inflationary outlook has improved somewhat, with the stronger Rand. Strong emerging market inflows have masked other overhangs, I am mindful that our credit rating is due for another long and hard look towards the end of the year. Stand by there. The Dollar index (a basket of currencies versus the greenback) is down nearly three percent YTD. We are in a holding pattern, with regards to rates globally. Europe and the US stuck at record low levels, the English have just joined that club.

There is some talk about rates coming down in places like South Africa. I would say that you should watch the inflation numbers closely, if that starts to level out, or drop, that may well give the Reserve Bank some scope to indicate that they are closer to taking a step backwards. Perhaps that wouldn't be a "bad" thing. It would mean that Joe Consumer is probably in a position to be better placed in the coming months. And that is why financials, banks, and geared retailers have caught a bid. An improving outlook locally and an improving outlook in general for emerging markets.

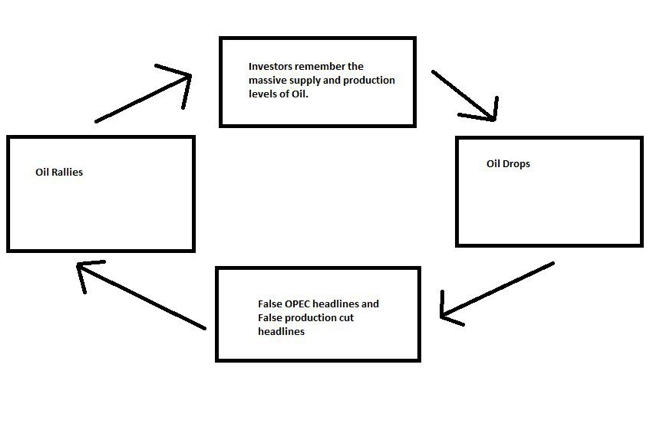

Over the seas and far away, across the oceans vast and wide, stocks closed mixed in New York, New York. The Dow Jones Industrial Average lost one-fifth of a percent, the broader market S&P 500 closed down a smidgen, whilst the nerds of NASDAQ nearly eked out a one-tenth of a percent gain on the day. Energy stocks actually ruled the roost, there was a very funny chart via the inter webs which we all had a proper chuckle about here Friday:

Exactly! Everyone is threatening to make cuts to production, unfortunately human nature is responsible for two things. First, when the oil price went and stayed beyond 100 Dollars a barrel for a long time, governments got used to the revenues generated from state oil production. The ones that were most reliant, Saudi, Russia and then the smaller economies like Nigeria, Angola, Venezuela (the list goes on and on) might well talk about diversification away from the oil price, this wasn't visible in terms of their national budgets. So now, when the price of oil came crashing down, various scramble meetings of OPEC and other producers talking about production cuts led to naught. In the words of Sarah Palin (who was once nearly a single heart beat away from the most important political job in the world) - "Drill, baby, drill!"

This is good for global consumers, being awash with oil. This is not so good for the purveyors of alternative energies. The economics needs to make sense. According to the US Energy Information Administration via this recent document - Annual Energy Outlook 2016 by 2040 renewable energy usage will be 14 percent of all US consumption. Coal will still be at 10 percent (from 16 percent nowadays). Now that does not account for what we know now about Solar Panel technology.

For all we know, Solar might be the cheapest (it certainly is abundant) form of electricity generation in ten years time. Being off the grid may be better from a costs point of view rather than being on the grid. Obviously this is very important for all of us, and warrants watching this very closely. I think Musk is right, it is the storage thing and a social conscience that will make it work. i.e. When you become rich enough that you have a social pact with humanity, that will happen more and more. The more rich people that adopt these technologies, the cheaper they get and more affordable for middle income groups. It is going to be a very interesting couple of decades on the global energy front. I am going to back commercial innovations and technological advances from capitalist tendencies over the ability of governments to evolve, i.e. I am backing Musk and co. over big oil.

Company corner

Ali Baba might have fought off the 40 thieves, the founder and CEO of the Alibaba group certainly had bigger hurdles to overcome. The story goes that Jack Ma invited 24 friends to his house and presented his ideas for the business to them, they listened for two hours. Only 1 out of the 24 folks there thought that the idea of the marketplace that Ma put to them would be a commercial success. Ma is known for his pithy quotes, saying stuff like "if you are not rich by 35, then you only have yourself to blame". In fact he was harsher than that, he suggested that you were poor because you have no ambition. Which is a little harsh. Like most entrepreneurial types, he is more than a little crazy and a whole lot quirky. He is in many ways not too different to Musk, to Bezos, those types of people who relentlessly put their ideas into action.

Enough about the man, people and their ideas are as good as customer adoption. I remember first coming across the business around ten years ago, it seemed like a wonderful idea. A business to business portal, putting you in touch with a business somewhere else around the world and being able to get the goods directly to your front door, no matter where you are and where the goods are. This business is as dominant in China as Amazon is in the US, they are pretty much to online retail as Google are to search, one and the same in consumers minds. A quick squiz at the Tmall website sees that you can pretty much buy anything you want. I am still surprised in 2016 that shopping isn't dominated by online. We will get there, young people just need to become richer, that will happen too. I can imagine that the malls of the future will become more entertainment destinations. Last week we saw Macy's closing 100 stores, all unprofitable no doubt. JC Penney and Sears have also been closing stores.

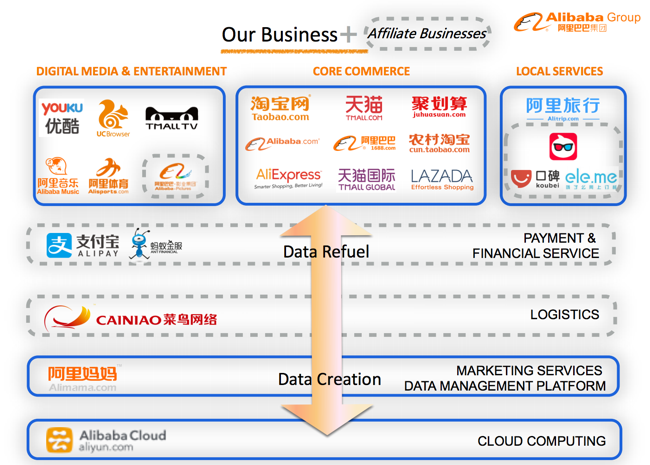

OK, to the results from the other night, we all have a fair idea of the history of the business and the founder, and we all understand that future retail will continue to take place online. It has to. Here is the press releases of the results themselves - Alibaba Group Announces June Quarter 2016 Results. I am amazed that revenues for the quarter continue to clock such huge increases, most especially now that the group revenues for the quarter are 4.838 billion Dollars. Adjusted EBITDA increased by 43 percent to just over 2 billion Dollars. On a per share basis EPS clocked 74 US cents. The group continued to make progress across all brands. Here is the structure, looks a little Naspers, not so?

Mr. Market really liked the numbers, the stock soared over 7 percent to close just above 98 Dollars, a 52 week high. And seeing as all things China have been under pressure, the stock is up really smartly from the 57 Dollar low reached last October, and 60 Dollars in February this year. The company has an amazing network now, 427 million monthly mobile users in China. And remarkably, off an ever increasing base, the revenue growth is not the fastest since the company IPO'ed in September 2014. Whilst you cannot own everything, and one owns loads of Naspers in the local environment, if you need direct access to a Chinese consumer that is in the next phase of growth, consumer focused, look no further than this business. New York listed and US audited, I reckon trust will eventually arrive for Chinese companies, the stock trades on 23 times earnings. The chattering classes may think that you can fudge the national numbers, you can't fudge these numbers.

Linkfest, lap it up

It is very interesting to see how central the capital cities of European nations are to their growth. As international business becomes more central to growth, global organisations normally have their offices in the capital cities of countries, to sit along side other organisations offices - The Capital Effect

You will find more statistics at Statista

Taking the long term view on equity investing, it can be very difficult to sit on your hands and do nothing at times of great uncertainty - Distractions Cost Investors 115%. The recovery since 2009 has not been without its bumps in the road but it paid to do nothing when things looked bleak. There will be times though when sitting on your hands and doing nothing will result in a 20% fall in stock prices over a 12 month, 18 month or 24 month period. Doing nothing and adding to the quality is still the best strategy though.

It seems like babies learn their native tongue before they are even born. Research also shows that learning how to speak more than one language improves the brains cognitive functions - This is the best time to become bilingual, according to brain science

Home again, home again, jiggety-jog. Japanese GDP reported this morning was flat, quarter-on-quarter. Chinese stocks both in Shanghai and Hong Kong were much stronger, on the local front stocks have started mixed to better really. There are some numbers from the likes of Massmart and AngloGold Ashanti, a trading statement and sales update from the retailer and actual numbers from the gold producer. Olympic glory awaits sports lovers! Remember we spoke about the Olympics of investing last week, I am starting to think that we should view investing like growing and nurturing a bonsai rather! It takes time and constant attention, sometimes you can't speed up the result. And if you meddle, you may well fall flat on the result.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment