To market, to market to buy a fat pig. Time flies. I heard some fellow on the wireless try and explain why time seems to go faster as you get older, and I must admit that his argument was pretty compelling. When you are 1, and you add another year, you have effectively doubled the number of years that you have lived. Even from 10 to 11 is ten percent of your life, a long time by most measures. When you are fifty however and you add a year, that is only around 2 percent of your life. If you manage to make it to 100, an extra year is only a percent, or roughly 3 days in the life of a 1 year old. Makes sense, not so? Or not......

So time does not really fly, it remains constant. Every four years we squeeze in an extra day, that is not exactly scientific, because as Wiki points out: "The marginal difference of 0.000125 days between the average Gregorian calendar year and the actual year means that in 8,000 years the calendar will be about one day behind where it is now. But in 8,000 years, the length of the vernal equinox year will have changed by an amount that cannot be accurately predicted."

Enough of this nonsense! As John Maynard Keynes said, in the long run we are all dead! So your investment time frames must be set, because you are not going to live forever. Equally they must be more than a little open ended, because you might outlive the rest of us! For instance, in Medieval Britain you were not expected to live beyond 30. The global average nowadays is somewhere closer to 70, 68 or so. The long term has certainly changed from a decade to a number of decades!!!

Yesterday in the city founded on gold deposits richer than any other ever found, the local market touched and reached for all time highs during the session, but failed to take a foothold at the 42 thousand point mark, after touching that point at almost midday. We fell away as US markets opened, perhaps the taper talk and the tepid jobs report is starting to squirm into the collectives psyche. How am I to know anything! Wall Street closed mixed, tech stocks were higher, but the S&P 500 was marginally lower, with blue chips off around one third. Mixed at best. Apple caught a bid as the US President had vetoed a ban of sales on earlier models, the iPhone 4. The stock traded at their best level since the first half of February.

I was asked yesterday as to why it was that Naspers has had such a run, why the stock price was up so much. I thought for a while and then applied myself and came up with this answer:

To me it is simple, a Facebook re-rating over the last 8 trading sessions must have a lot to do with it. Plus LinkedIn. The "quality" internet assets have been rerated.

Since the 25th of June Tencent is up a whopping 33.3 percent! Over the last month alone Tencent is up 20.23 percent in Hong Kong.

On a simple NAV basis that has added 51.15 billion ZAR (570bn HKD @ 308.4 on the 25th of June to 685.98bn HKD @ 370.8 on the 5 August = 115.4 bn HKD difference * 1.2697 (exchange rate) = 146.57bn ZAR * 34.9% stake = 51.15bn ZAR)

Pretty easy to understand, methinks!!

25 June, Naspers = 688 ZAR, today (5 August) = 815 ZAR. Shares in issue = 415 million shares. 127 ZAR*415 million = 52.7 billion ZAR.

Sounds about right!!!

The market I guess was working properly there. And Facebook, if you had not noticed had been through their listing price of last May. In early September the stock traded as low as 17.55. Just under a year ago there is someone who is looking at the price at 39.19 and asking themselves, why oh why did I sell that one? Because at the time there were anxieties over whether the company could monetize mobile. And yes, by the time the company reports their next quarter you might see advertising through their mobile channels at nearly half of all revenues. The company trades on a forward multiple of 80. That is crazy. But that shrinks quickly over the coming years as the business starts to be more and more profitable.

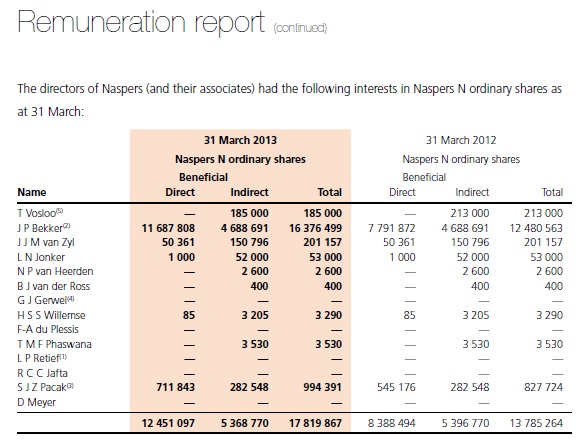

But back to the other issue at heart here too, the remuneration of Koos Bekker in Naspers N stock. I was asked about that too, and equally I am going to share my answer with you:

In the annual report (page 117) it says:

"The chief executive, Mr J P Bekker, does not earn any remuneration from the group. In particular no salary, bonus, car scheme, medical or pension contributions of any nature are payable. No other remuneration is paid to the executive directors. Remuneration is earned for services rendered in connection with the carrying on of the affairs of the business in the company. Interests in group share-based incentive schemes are set out below."

Also, it makes it clear:

"Mr J P Bekker has an indirect 25% interest in Wheatfields 221 Proprietary Limited, which controls 168 605 Naspers Beleggings (RF) Beperk ordinary shares, 16 860 500 Keeromstraat 30 Beleggings (RF) Beperk ordinary shares and 133 350 Naspers A shares."

But I guess you are referring to the shares payment arrangement, the 3.9 million shares that are to be paid in the years three, four and five of his current contract:

He agreed, the board agreed and shareholders no doubt ratified the payments in shares. When the share price was much lower, that stake was worth a whole lot less.

Total shares in issue are around 415.8 million shares, he is effectively a 4 percent shareholder. Good to have the chiefs own holdings aligned with yours, it is not altogether his fault that the stock price has gone bananas and through the roof. That is no doubt why he structured the deal that way!!

Not sure what to think further.........

As shareholders we are glad that he has his interests aligned with our own. Shareholders must remember that in large part it was and is his visionary thinking that made them a fortune, so far of course.

Byron beats the streets

This morning we received a sales update for the fourth quarter from Cashbuild. If you have been following my updates on this company you will know that is has been a tough year for Cashbuild and I was getting concerned that sales were actually going to decrease. Well a stronger fourth quarter has prevented that, let's look at the numbers in more detail.

On a comparable basis (last year compromised 53 weeks) full year revenues grew 3%. This is very much thanks to a strong fourth quarter which grew revenues by 8%. South Africa which compromises 88% of sales was the main driver with 8% growth in the last quarter.

The company which is usually quite conservative had a busy period operationally.

"Four new stores were opened during the fourth quarter, resulting in the number of stores trading at the end of the financial year to be 200. Two stores were relocated and seven stores refurbished during the fourth quarter. A total of nine new stores were opened during the financial year with 21 refurbishments and six relocations being completed."

So from the nine new stores opened this year, four were opened in the last quarter. This of course had an impact on sales but same store revenues still grew 5% in the quarter.

There are a number of factors which have affected sales. The company is mostly geared towards the lower LSM income brackets who have struggled, thanks mostly to a weaker rand. Weaker rand equals higher inflation, which has a knock on impact for the poor. We have also seen a big pull back in unsecured loans. Cashbuild do cash sales so when clients don't have the money to improve their homes they turn to the unsecured lenders. Lastly, there has been a big increase in competition from independent operators who, so I am told, do not adhere to many forced costs that face a big corporate (like taxes). This has affected margins.

None the less I am glad we have seen an uptick in sales and hopefully this is a continuing trend going into the first quarter of their next financial year. As for this year's numbers I wouldn't expect too much earnings growth but the share price is not expecting that. This is a long term hold and it is times like these when you should be accumulating such a well run business that have so often found themselves in a sweet spot among South African consumers. More details when the results come out, probably mid September.

Home again, home again, jiggety-jog. The Mars Rover landing celebrated it first anniversary yesterday. That is pretty awesome to think as a species that we put a craft on that planet and it manages to transmit pictures back to us. Longer than we initially thought, I use the "we" as a collective, because humans sent that craft there. You can add this to the list when people tell you that this market "feels" like 1984 or 1996 or whatever. Ask them how many Mars Rovers were sending pictures back then and see what they have to say. None of course. If you still think, so what is the big deal, then watch this YouTube clip: Challenges of Getting to Mars: Curiosity's Seven Minutes of Terror. YouTube of course was not around then either, the video sharing service has only been around since 2005!!

Cullen Roche quotes one of his favourites extensively in this piece titled What if Everything Goes Right for Once? That favourite is Jan Hatzius, the well respected Goldman Sachs chief economist. Who is a lot more optimistic about the future than most, and we sit squarely in his camp. Italian GDP this morning was still a negative read, but it was less bad than anticipated. 8 negative quarters is the longest on record and a clear indication of what austerity has done. But we are calling it, green shoots!

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment