To market, to market to buy a fat pig. Tick, tock, the taper clock, tip toe the Fed draws near, sigh slow the markets says no. OK, that was so very, very poor from the point of view of rhyming. If I had a voice though I might be a rapper. I would feel uncomfortable in outsized pants, big vests, sneakers without laces and sideways caps, not to mention chains. Yip, I think that my rapping career has no chance. Perhaps I could be a sign language interpreter seeing as the quality is low and there seems a desperate need for it. Ouch, that is embarrassing, the FT and Bloomberg were running stories on the box and on their online platforms yesterday and this morning. Sucks, I hope for the sake of us all that this fellow is not a friend of a friend of a friend, if you know what I mean. He says that he is qualified, the interpreter, I have no way of knowing.

My eldest daughter and I learnt a sign alphabet, only to find that there are more alphabets! We learnt the BSL one, there is an American one too! I suspect that one has to learn both. You can sit there and shake your head and wonder how this happened, meanwhile in the economy that is supposed to throw us off the top of the pile as the biggest economy in Africa is having worse problems. Nigeria, according to the FT, along with a leaked letter or two: Mentor adds to Nigeria president's woes amid missing $50bn. Missing 525 billion Rand? Missing? Try Switzerland. There are problems and then there are problems, but we must always demand excellence. Starting with education. If I were to fix only one thing, that would be it. Everything else would then fall into place. You cannot steal or take away an education. All the great leaders of the world were measured. And remember, the more that you know, the more that you realise that you have so much to learn.

And that is what we try and do around here, learn something and empower the readers and clients. Knowledge is powerful. Back to markets and the Fed, tapering and the inevitable. And then the deal around the budget, long before any deadlines and likely to pass, getting closer. And then the news from the people that make the news? Nothing really. Because it is not close to a disaster. Good news does not capture the imagination in quite the same way that bad news does. Not everybody thinks that this is the best deal around, but a little more spending after the sequestration, and a very modest addition to US GDP is welcomed by both sides. Do not cheer all at once. The budget deal could pass through the House as early as today, and then be handed over to the Senate. Who knows, perhaps there will be a budget deal by Christmas. Now that would be a turn-up for the books (err... internet?), bearing in mind that there has been a lot of animosity in Washington DC lately. You will not be surprised that the idiom, turn-up for the books has to do with bookmakers and unexpected happenings.

Whilst we are on that subject, the folly of forecasting and the unexpected: Missed It By *This* Much. And that is why I have no view on where the market is going this year, the remainder of this year, all of next year. Why? Because when we speak to real people about investing their hard earned money, we explain that this relationship with investing your money should be the same, or not too dissimilar to owning a personal business. Because that is what you are doing, buying into an existing business at a specified price. It matters more what you buy at the beginning rather than the absolute timing. Quality trumps the Fed each and every time. Why would you want to be held to a forecast, when things can change so rapidly? But I guess that is part of the beat.

I recall that Johan Rupert choice observation, in amongst many choice ones, in which he beat up on the analyst community after a set of results. He said something along the lines that the people in the room are always critical of their business, but how many of them had been at the same institution for ten years. There were a few show of hands in amongst all of the masses there. He then pointed out that in their business, Richemont, they had been in business for years and years, doing the same thing. Trying to strive for perfection and make it happen for the folks that judge them over a longer period. That was a point well made, the folks that are critical of the business, the analyst community and the media want action quarter in and quarter out, but as Rupert explained, it takes many years to build and grow a business of that scale. And that is the point, that is why you own companies and not share prices.

It comes to that time of the year when we head for the hills and make our separate ways. I am away from next week, Paul is away and will return early January and Byron and Michael will be here through to the 20th, also returning in early January. But as ever, we will be in contact, the very best way to contact us all is on the email address (that this message is sent from). We will respond! For those of you that need to speak to us in person, you have our mobile numbers! If you desperately need them, email us again, we will hand out those numbers. There will be a message of how the year was and how you should expect to see the following few pan out, but you pretty much know our views.

Byron beats the streets. South African retail sales in the spotlight.

Yesterday we received retail sales numbers for October 2013. I must say, the Stats SA website is looking much better from when I last checked it out a few months ago. Well done. Back to the numbers we saw a 1.3% year on year increase for the month based on constant 2012 prices. Textiles, clothing and footwear grew 7.6%, hardware, paint and glass grew 3.3% and medicines, cosmetics and toiletries grew by 2%. Out of the laggards Food and beverages were down 1.5% while household furniture and appliances were down 6.1%. Ouch.

We also saw CPI numbers come out yesterday which showed a 5.3% increase for November compared to 5.5% compared to October. This was lower than expected and is taken as good news.

So what do these stats tell us? Firstly that 1.5% retail growth is not good enough with current inflation rates. Most of the growth is coming from price increases, not volume. It also tells us which sectors are struggling. People love clothes and love to look good. It makes you feel good and in relation to many other things, is not that expensive. You can never have enough clothes but certainly only need one dining room table. Clothes shopping is a hobby for a lot of people, a way to pass time. Buying furniture and food is a necessity.

Should we be worried? The short answer is no. People love to shop all over the world. The shopping malls are so full at the moment it is almost unbearable. Maybe they are not buying as much but they are there and they want to buy. The buying will pick up as soon as more income streams in. And it will, yes the economy is not growing as fast as it should be but it will pick up. These things have cycles and once the rand stabilises we should see our retail sector stabilising along with it.

Well managed companies in growing sectors will do well over the long run. The retailers we are invested in are fantastically run and world class. The economies they operate in are certainly going to grow in the long term. The sector is down 12.6% for the year. If you are not already invested, now is a good time to get in.

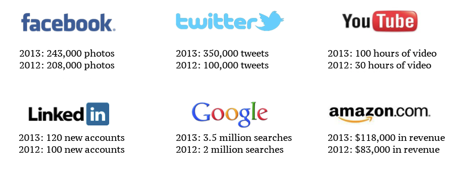

Home again, home again, jiggety-jog. Markets are taking some heat today, taper squash we can call it. All the way through to next week I am afraid, but we could go almost any way. I want to leave you with this amazing graphic that I saw online, via my old favourite professor, Mark J Perry, click on the graphic below to get a larger one. It basically is what happens on the internet every minute and how fast internet traffic continues to grow:

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment