"...the equities markets is a mechanism for owning and indeed a claim on the earnings and more importantly the assets of a specific business. You should view it that way. One of my favourite Buffett quotes is that one in which he says that you should be willing to own a company on the basis that there was no mechanism to transact for up to five years. That sounds a little extreme, remembering that the people who make the price on a day to day basis (who have shorter time frames than you and I) provide us with the necessary liquidity."

To market, to market to buy a fat pig. Wow. I cannot remember two days like that in the US markets next to one another. The best of the year Wednesday was followed by the worst day of the year Thursday. Check out the two day graph:

The upshot of it all? The two days have realised losses of 0.36 percent, at the least the S&P 500. Yesterday was about as ruthless as it gets however, for equity markets that is. Not only was this the best and worst days wedged next to one another, there have been some big swings after a relatively calm time of it, bringing the most volatile time for the equity markets since 2011.

So what should you do as a holder of companies? Nothing. Or as I said earlier in the week, buy when nobody else is. The businesses that you own are just fine. Europe might be struggling through another tough patch (seems a little like the Pakistan cricket team, loads of talent, not much direction), the economy of Europe will be just fine. Recent Euro weakness as a result of Dollar strength (as well as patchy Chinese data) has led to much lower commodity prices.

Lower commodity prices are great news for all consumers globally. The ISCS (or International Council of Shopping Centers) expects a 4 percent uptick in US holiday shopping. Seasonal hiring at shopping centres is expected to increase by 7.3 percent, an extra 794 thousand jobs. People are feeling better about their prospects, by people I mean the US consumer. And seeing that it is still the biggest economy in the world and that economy is still largely consumer driven, we should be greeting this news.

That still does not detract from all the reasons being given as to why the markets have been really volatile. I suppose after a a period of prolonged upwards trend with very little volatility, which has been really bad for the trading types, it does not take much to spook anyone. The IMF report, Syria, ISIL, the Hong Kong "umbrella" demonstrations, Ebola and the associated scare, Russia-Ukraine (which has been forgotten), European deflation and stodgy growth, Fed rate tightening and reigning in their bond buying programs, there has been lots of canon fodder for the sellers.

For me however, the equities markets is a mechanism for owning and indeed a claim on the earnings and more importantly the assets of a specific business. You should view it that way. One of my favourite Buffett quotes is that one in which he says that you should be willing to own a company on the basis that there was no mechanism to transact for up to five years. That sounds a little extreme, remembering that the people who make the price on a day to day basis (who have shorter time frames than you and I) provide us with the necessary liquidity.

If we were all like Warren Buffett then there would be no liquidity and ironically the share prices would trade at a liquidity discount of sorts. I field many calls from anxious clients, who I think are worried about a similar scenario to late 2008 into early 2009. Equities markets were trounced back then, through that period we stuck to the tune of not selling, stay fully invested, the companies are quality ones. In this case we are shock absorbers on the very bumpy current path. We tell equity holders not to freak out, that is the worst thing to do, to sell in the midst of the hysteria.

In the end it matters what companies earn relative to their share price. Obviously the economy matters, in the US however job openings are above the pre crisis levels. What does that mean? It means that there are more jobs in the US markets that are available to people than there were since late 2007. If those job openings are filled, that would be positive for the economy and of course consumption. Why do I keep talking about the US market and how that matters? It is the driver for global markets, we keep telling you that our market does not represent our economy, it goes more in lock step with global markets. Keep calm, stay invested, today is going to be another day of selling.

You can file this away for the weekend, for further reading, Carl Icahn and his two business partners have written a long and extended open letter in his capacity as a shareholder to Tim Cook and the Apple board: Sale: Apple Shares at Half Price. His price target for Apple is 203.23 Dollars. Oh. That means, in his mind, that the stock is dirt cheap and the board must definitely push for a stronger buyback program.

He makes some interesting assumptions about unit sales, suggesting that by 2017 there could be 242.5 million phones sold per annum, 95 million iPads, and even Apple Watch sales of 72.5 million units (including the straps). And an Apple TV (a new product from Icahn himself!!) run rate of 25 million per annum. iPod sales are nearly dead by then, according to the Icahn measures, 1.6 million per annum. Perhaps discontinued by then, who knows.

Icahn points out his returns, perhaps looking to attract fund inflows with this open letter, they have been exceptionally impressive, why not look to give yourself a punt. He makes a very interesting point about his Apple stake: "At today's price, Apple is one of the best investments we have ever seen from a risk reward perspective, and the size of our position is a testament to this. This investment represents the largest position in our investment history, reflecting the strength of the convictions we have expressed in this letter."

Wow. Two things, as time goes on and Icahn gathers more assets it is always likely that there is going to be a bigger and bigger investments, so that part I think is not as relevant. The fact however that he feels this is a real conviction buy, that is slightly different. I believe he is right here. I believe that Apple presents one of the best investments, however the replacement cycle of handsets (and all electronics) is so quick, that you have to watch these closer than most.

The comparison that Icahn draws between a Mercedes (Apple) and a Volkswagen (Android) is that the price differential on a contract overt time is not as much as the motor vehicles. Check:

"The choice between them is analogous to the choice between a Volkswagen over a Mercedes at the same price, and unlike a Mercedes, the $649 cost of an iPhone 6 is affordable for the mass market, equating to just $20 per month over a two year period (including a $170 estimated resale value of the phone at the end of two years, excluding financing and taxes). We see the iPhone remaining unaffected by the "junk", as you called it, sold at lower price points, but we also see it dominating the entire class of premium Android smartphones, such as Samsung's Galaxy phones."

I find it quite interesting that Icahn thinks 649 Dollars is affordable for the mass market, clearly rich people, yes, not so much the rest of the world. When he says you, he is talking to Tim Cook, the Apple CEO. All in all it makes for good reading, it is really long and well thought through, obviously Icahn is talking his own book and has bias, I do prefer that though, when someone actually has something to lose.

Michael's musings: Small things add up

Sasha and I were talking about the power that the middle class have. We started talking about it because of Jack Ma's (founder of Alibaba) comment "Jack Ma: If you're still poor at 35, you deserve it!". The basics of what he was saying I think is that when you reach the age of 35, your parent's legacy (if they were poor) should no longer be an excuse for where you are in life.

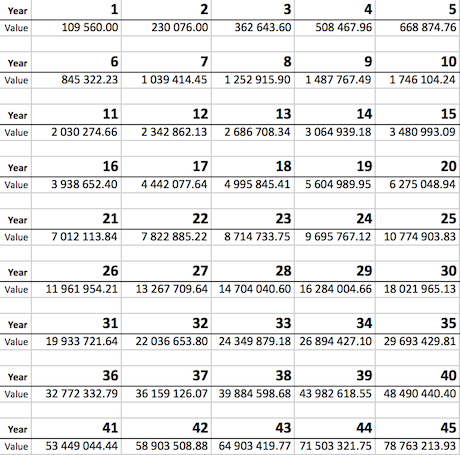

We decided to look at things from a different perspective and looked at the impact of investing instead of consuming. So here is a VERY rough calculation we did: how much money would you have if you invested R8 300 a month and it grew at 10% a year (we assumed that there is no inflation to make the calculation cleaner). Here are our results:

The first thing to note is that after 30 years you could have around 18 million in todays money, given that most people reading this will live to around 90, 30 years is not that long of a time. The second point to note is that our monthly investment amount did not increase over the years, so you don't need a high flying job to be wealthy over the long run.

Taking the calculation one step further, assume that you buy a new Golf 7 Gti today for R 400,000, you finance it over 5 years and your monthly repayments are R 8 300. After 5 years you would be left with a car that is yours and is worth around R250 000, compare that to the R 680,000 that you could have had if you had invested the money. Your opportunity cost of buying the car works out to a huge R430 000!

There are many assumptions in our calculations but it does give a ballpark figure of where you could be in the future. It also highlights the power that the middle income has to consume or create wealth.

Things that we are reading, that we think you should be too

Lower food prices are great for consumers - World food prices fall to 15-year low. It will also allow a company like Tiger Brands to get their margins back to historical levels.

More from Elon Musk and more of what the future of motoring will look like - My lap of terror in the Tesla D and a cool video of Elon Musk - Tesla: Exotic features and go-fast model

Another twist in the tussle between tobacco companies and governments - E-cigarette adverts (with people smoking) will be on TV in weeks

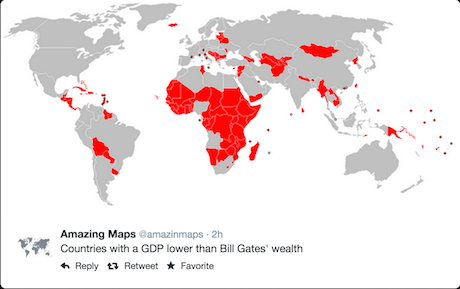

Then lastly an image putting Africa's potential in perspective -

Home again, home again, jiggety-jog. Ooops. We are getting hammered again here today, the market has given up (locally in Rand terms) around 10 percent from the highs. I think that this is a big opportunity. Stand by for the short term levelling off of equity markets.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment