"For the iron ore producers it has been an average time. No, not average, awful. Anglo bought the project for 5.5 billion Dollars from Eike Batista (the story calls him Brazilian billionaire Bike Batista, needs an update), sank/is sinking another 8.8 billion Dollars into the project and then saw it run around five years later than anticipated."

To market, to market to buy a fat pig. My word. I cannot believe that Marc Faber is still relevant in a world where people remember your last interview. Look, the truth is that everyone makes bad investments, to be perpetually bearish on the future is another thing altogether though. Just having a look at the plans from the conservatives in the UK, the plan to reduce taxation on middle income Britain is as a result of higher salaried teachers, policemen and many other middle income people in that country. When the 40 percent tax was first implemented on the people of Britain who earned (I think it is around 50 thousand pounds a year) there was only one in 15 people in that bracket. Now it is one in six and expected to be one in three at the current trajectory. Granted there has been inflation between now and 1988 when the tax bracket was first initiated, the fact that many more people earn more in the middle classes is lost on many.

Our mate, Samuel Arbesman (follow him on Twitter -> @arbesman) refers to these as Mesofacts. They happen so slowly over such a long period of time (relative) that the progress is lost on many people. The fact that handsets are readily available, their processing power is infinitely better than ever before and we are able to do more with them does not detract from the fact that WE WANT MORE! I can't tell why that post about small changing facts and how it impacts on us over time had such an impact on me, seeing it in action such as the advances that the smartphone market has made, or even motor vehicle market is astonishing over even half a decade.

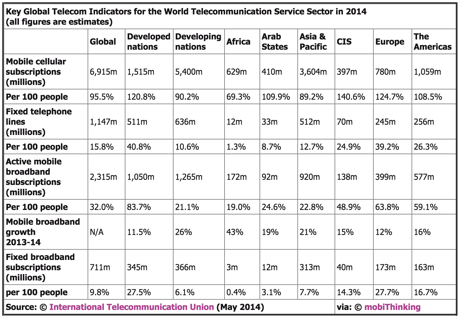

For example, only 4 percent of the human population used mobile handsets in 1997, 10 years later it was half, 50 percent. This table (scroll down the page) makes for interesting reading: Key Global Telecom Indicators for the World Telecommunication Service Sector in 2014. See the table which I have taken a screen grab from:

The opportunities across our very own continent relative to the rest of the world (in terms of growth) are clearly there to see for all. Notice how Africa has a total (according to this report) of 12 million fixed lines. Or 1.3 percent per 100 people. There are however 172 million active mobile broadband subscriptions, usage rates not too dissimilar to the emerging markets of Asia. What this tells you is that our continent is kind of unique, we skipped the fixed line generation and went completely mobile. You knew that already.

What it also tells you is that there are going to be many people with better and bigger handsets using more internet in years to come. The future certainly, at least from a demographics and statistics point of view tells you it is bright for mobile operators across our continent. Even though MTN have had some high profile problems in Ghana with Mobile Money -> 'Your monies are safe'- MTN assures Mobile Money users

And whilst we are on Mesofacts, back to the motor vehicle market. Michael (he sits opposite me here on the desk) points to an article that he read that suggested that efficiencies in the combustion engine has saved us over three million barrels of oil a day, over a mere 6 years. Since the oil price nearly topped out at 150 Dollars a barrel, in the first half of 2008. Now the oil price is struggling (for the bulls) to hold the 90 Dollar level. For consumers this is fabulous news. For the high cost oil producers this is not so good.

It is not just looking more than a little sad for oil producers. Equally for the iron ore producers it has been an average time. No, not average, awful. And believe it or not, Anglo American, according to this Reuters article (which I found via a Google alert from Creamer Engineering news) -> Anglo American gets operating permit for Brazil iron ore project. See that chaps? Bought it for 5.5 billion Dollars from Eike Batista (the story calls him Brazilian billionaire Bike Batista, needs an update), sank/is sinking another 8.8 billion Dollars into the project and then saw it run around five years later than anticipated.

For Anglo, with a current market capitalisation of 19 billion Pounds (nearly 31 billion Dollars), this represents nearly half of their market cap and has been a disaster. As you can see from the article, the company expects to be shipping around 26.5 million tons in 2016, following around 11 to 15 million tons next year. At the point where the iron ore price has taken a heavy hit. Wow, the perfect (very bad) storm for Anglo in this project. China shifting to consumption over breakneck building (still huge producers and builders) has had a marked impact on global miners. We continue to avoid Anglo and at current levels even think it is overvalued.

We forgot to mention Mr. Market, which took an absolute pounding again yesterday. Growth worries. Check this WSJ article -> ISM Manufacturing Index Slips From Previous Month. Still, a number around 56.6 represents solid growth, equities are not expensive at all. This is a hiccup, from time to time we expect these in equity markets, it always feels horrible when you are in the midst of it all. The long and the short of it is is that companies continue to make progress, those in growth sectors will continue to improve.

We continue to see headlines around Hong Kong, this is slightly different though. Democracy in my opinion is fabulous, even if you do not subscribe to the whole idea that each and every vote is the same. There comes a time in your life that you concede (mine came when I was 19, really late) that I was never going to make the Protea's cricket team. It should have been evident to me whilst at school I struggled to make serious headway, never a batsman nor a bowler (I thought I was brilliant at both!), the realisation came later. With a single vote, you are exactly the same. Archbishop Tutu's vote is the same as yours and mine, that is how democracy works. I think that it is great in the long run, negative (remember the Greek people throwing Molotov cocktails at the Police?) in the short term.

Things that we are reading, that we think you should be too

Two big growth themes, China and the internet - Zara Ceding China Web Control to Alibaba in Bid to Boost Growth

Always interesting to get stuff from the Berkshire Hathaway stable - 29 Brilliant Quotes From Charlie Munger, Warren Buffett's Right-Hand Man and 17 Facts About Warren Buffett And His Wealth That Will Blow Your Mind. The last few show what your return would be if you had invested in Berkshire at different periods.

This last article is more down the sci-fi alley but we like Elon Musk around here - Exodus - Elon Musk argues that we must put a million people on Mars if we are to ensure that humanity has a future. Focusing on where humanity is going helps you make better investment decisions.

Home again, home again, jiggety-jog. Lower here again, the selling stops at some stage. And then people will start to talk about finding value at lower levels. US employment data tomorrow will probably be one piece of data to allay fears of a slow down, I am anticipating that, to be perfectly honest. Then again, those of you who have been watching this for years will know that I am optimistic by nature.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment