To market to market to buy a fat pig. Today Granny Janet Yellen chairs her last FOMC meeting. Leading into the meeting, the US 10-year yield broke 2.73% for the first time since 2014 as investors start to contemplate a few rate raises for the year. Despite the spike in bond yields, market participants don't expected a rate raise tomorrow night. The key focus will be on the tone the Fed uses.

The impact on stocks is two fold. Firstly, higher interest rates means it costs more for companies to borrow for future expansion. Secondly, a higher interest rate means a bigger discount is applied to future company profits, resulting in generally lower share prices. The key here though is the speed of interest rate changes. With slow changes, which is expected, the market can take in its stride, with limited noticeable impact on share prices.

Market Scorecard. Markets globally yesterday spent the day in the red, I've heard the words 'Profit taking' mentioned. In truth, on an average day there are many reasons for market moves. We like to come up with simple reasons for daily moves because it gives us a greater feeling of control. Does it matter if our after the fact reason for the market move is correct or not? The Dow was down 0.67%, the S&P 500 was down 0.67%, the Nasdaq was down 0.52%, and the All-share was down 1.28%. Locally, banks and life insurers were crushed, being down 4.5% and 3.3% respectively.

Company Corner

Yesterday, Aspen released a SENS announcement saying that an unsolicited offer for their Nutritionals division, has prompted them to do a strategic review of the business (Aspen - Strategic Review). One of the options being explored is the "introduction of a strategic partner that could unlock appropriate value".

What that probably means is that they are thinking of selling part of the business to a company that can positively contribute to growing the nutritional business. It would also mean a nice upfront cash boost for Aspen, which they can put toward reducing the debt pile everyone was talking about earlier this month. We will probably get some more information at the company's interim results on the 8th March.

Linkfest, lap it up

One thing, from Paul

How important is a superstar CEO? Can one make a case for owning a company just because it has a hero at the helm? Should we blindly back entrepreneurs who start, build and then run great companies?

In my experience, when a company does really well, the media puts the chief on a pedestal. When a company falls on hard times, the converse happens. The boss guy must be an idiot!

Here at Vestact we are inclined to pick great businesses operating in promising parts of the economy, and to assume that they will be run by good people over time.

Highly visible CEOs who are fully engaged are great, but there is always a risk of them retiring or falling ill and leaving abruptly? Jeff Bezos, Elon Musk, Johann Rupert, Stephen Saad and Adrian Gore are amazing, but without them at the helm what will happen? Warren Buffett has done an amazing job at Berkshire Hathaway, but he is 87 years old and will be winding down soon.

Losing an inspirational leader can be tough and dent a company's rating, but usually shareholders should just be patient and wait for new management to come to the fore. Apple has been a good case in point. When Steve Jobs died, the naysayers moaned that the company "was no longer able to innovate". Since then its gone from strength to strength under Tim Cook.

I was thinking about this topic overnight, because one of our recommended companies JP Morgan, announced that its CEO Jamie Dimon would stay on for another five years.

Dimon is one of the most respected corporate CEOs in the world of business. Extending his contract is like Leo Messi announcing that he's going to stay on at FC Barcelona for the next five seasons!

He has been CEO since 2005. He's charismatic and opinionated, and is sometimes mentioned as a possible US presidential candidate. He's a pro-business centrist who once described himself as "barely a Democrat".

The succession plan at JP Morgan was clarified yesterday too. Daniel Pinto and Gordon Smith, currently the heads of the corporate and investment bank and its consumer bank have been elevated to the role of co-chief operating officers.

Byron's Beats

I know I harp on a bit about Nvidia but the avenues for this business are so wide and exciting that I have to share them. This TechCrunch article talks about how the oil and gas industry can benefit from AI (Artificial Intelligence). Anticipating new drill spots, dealing with seismic activity and avoiding malfunctions from wear and tear are all potential value adds.

I suppose anything and everything that requires image processing could essentially use a GPU chip (which is what NVIDIA make). In simple terms, it gives smart devices eyes. And that is a pretty powerful tool!

Nvidia and GE's Baker Hughes team on AI for oil and gas.

Michael's Musings

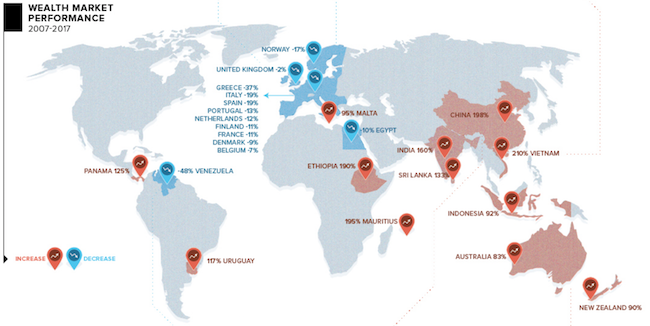

When thinking of years gone by and history, 2007 doesn't feel that far away. Since then however, countries like China have tripled in size, Australia has almost doubled in size, and closer to home, Ethiopia has also tripled in size - Visualizing a Global Shift in Wealth Over 10 Years.

Like many things in life, the more you pay for something, the better it is? - 'Expensive' placebos work better than 'cheap' ones, study finds

Vestact in the Media

Byron chatted to Business Day about Aspen's nutritionals division - Aspen Pharmacare seeks new formula for its global nutritionals business.

Home again, home again, jiggety-jog. It is another red start to our trading day. The only significant data out today is from the EU, at mid-day our time they release their latest GDP read, lets hope it doesn't disappoint like the US last week. Then on the company front, Stryker reports their 4Q and FY numbers this evening. Then lets not forget the US SONA tonight, I'm sure social media is going to love it! It is going to be yuuuuuge!

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment