To market to market to buy a fat pig. It was another record-breaking day for US markets. Our broker in the US, sent us a mail over the weekend pointing out that it appears many of the more cautious money managers, who have been caught on the sidelines of this amazing bull run, are now wading in. Our view is to always be fully invested. As Paul said in his message on Friday, "To paraphrase Peter Lynch: 'always be fully invested. It's great to be caught with your pants up.' "

Market Scorecard. Locally, due to Naspers our market was red. The Dow was up 0.85%, the S&P 500 was up 1.18%, the Nasdaq was up 1.28%, and the All-share was down 0.14%.

Company Corner

Michael's Musings

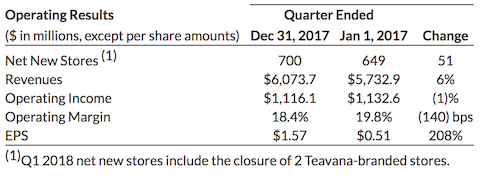

Last week Starbucks released its First Quarter numbers. Below, Paul goes into our thinking around owning them, so I will focus on the numbers. This was the first time that they had over $6 billion in revenue for a quarter, that is a monster number for a company that sells coffee! For comparison purposes, Woolworths' current market cap is R70 billion, Starbucks sold more in three months than the entire value of Woolworths.

Since this time last year, they opened 700 new stores (almost two new stores a day) globally bringing their footprint to 28 039 stores across 76 countries. Of those 700 new stores, 300 of them were in the China/Asia Pacific region.

The below table gives the best snapshot of where the company currently stands. The drop in margin is due to them selling more food; it is a more 'commodity' type product where margins are lower than coffee.

The key figure in the numbers for us was the 30% growth for China, specifically. As it stands, of the $6 billion in revenue, China is less than $1 billion, showing the amount of growth potential going forward.

Linkfest, lap it up

One thing, from Paul

This week on Blunders: Trumped in Davos, Chinese bank is in the Pudong, airport baggage handlers are evil, and things work differently in Saudi Arabia: Blunders - Episode 85

At any given moment, there are usually a few of Vestact's favoured stocks that are going through a tough time. That's how it goes. The tricky part of managing money is knowing when to sell out and run away, and when to hold on and be patient. A solid company in a good part of the economy will usually come right in time, so mostly we don't chicken out.

As an example, Starbucks has been trailing the field in US portfolios recently. The stock fell around 5% last night after quarterly earnings that showed less robust sales growth in the US than Wall Street had been anticipating. In general, coffee and food sales in the US have been a little sluggish. Not slowing, but not growing that fast either. Low single figures.

Kevin Johnson, the new CEO, said that holiday season drinks and merchandise did not resonate with our customers as planned. I'm not that surprised, having spent the festive season in the USA and seen the offers for Eggnog Lattes and Chestnut Praline Chai Teas. Er, no thanks!

In our view, the market is missing the real story here: China. Same-store sales in that mega-region rose 6%, and customers there mostly use mobile payment systems. Last month Starbucks launched its first overseas "Reserve Roastery", a flagship store combining gourmet coffees and a bakery in Shanghai. They plan to have 10,000 outlets in China within a decade, as many as there are in the US now. In that country, Starbucks is definitely seen as a premium, global, aspirational brand. I have visited some of the stores around Beijing, and noted that the stores were very well run, by young, energetic staff.

Here is an interview with Howard Schultz (former CEO, now Chairman and Reserve Roastery project leader) with more about the Chinese rollout: China brews bubbly future for Starbucks

Byron's Beats

Remember when Elon Musk tweeted that he would be able to solve Southern Australia's volatile energy issues within 100 days? Tesla ended up doing it in 60 days and gained some great PR.

But does that business model make money? This article explains how it does indeed make solid income. To simplify, the battery gathers energy at low prices when supply is flush. It then sells energy when supply is low at a much higher price. Sounds like a great business model. The utility side of the Tesla business is another reason to be excited.

Tesla Mega battery made about 650 000 euros in two days.

Bright's Banter

Nicholas N. Taleb has one simple message about Bitcoin. "It may fail but we now know how to do it". NNT makes some interesting points on why this cryptocurrency makes sense to someone who doesn't like to be part of "the system". "It fulfils the needs of the complex system, not because it is a cryptocurrency, but precisely because it has no owner, no authority that can decide on its fate. It is owned by the crowd, its users. And it has now a track record of several years, enough for it to be an animal in its own right."

Just because I like the guy and his writing doesn't mean I have to agree with him.

Bitcoin by Nicholas Nassim Taleb

I love Google analytics because you can see what people in your country are searching for at different times and you can even search by your region to see what kind of stuff people are searching for. Try it out, it's mighty fun!

Wikipedia has their own version of analytics and they just announced their most visited pages last year. The usual suspects, Bitcoin, Game of Thrones, Trump and Death feature on this list. What still amazes me is that Trump came out second with almost 30 million visits on his Wiki page and he was only second on the list after Death for 2017.

You will find more statistics at Statista

You will find more statistics at Statista

Home again, home again, jiggety-jog. We have a huge week ahead for the US market. The fed meet on Tuesday and Wednesday, and then all the tech titans report. Facebook on Wednesday, and on Thursday there is Visa, Google, Apple and Amazon. Are you as excited as we are? This morning, locally the index is flat, fluctuating between slight gains and small loses.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment