To market to market to buy a fat pig. The 'Trump rally' seems to have come to an end thanks to the interest rate concerns; February was the first down month since Trump was elected. I can't say that I am a fan of the term 'Trump rally'. In my opinion, if Hilary had won markets would have also done well. Maybe markets would not have run as high, without the Republican the tax cut benefit, but higher none the less.

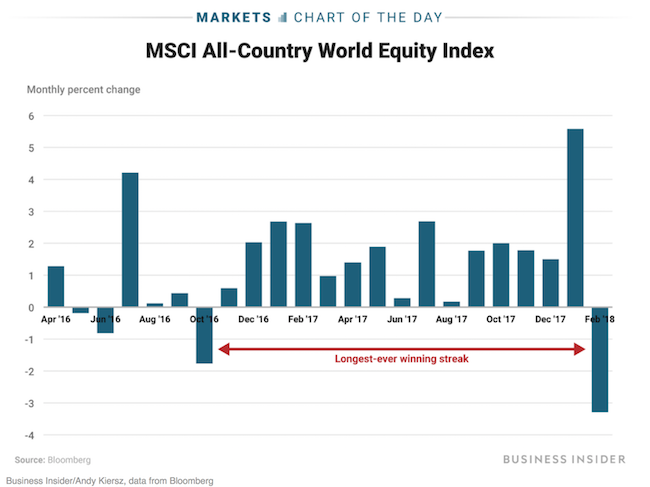

What makes this recent run of gains amazing is how long it lasted, without an interruption. Global markets went higher for 15 straight months, the longest streak ever! Since 2009, the market has been on the up. There have been a few hiccups along the way but many more up days than down days. The problem with that is we now have a generation of investors who think that markets only go up. We have seen high returns and low volatility (the calm waters of the last 15-months).

Found at Global stocks end a winning streak that's never been seen before

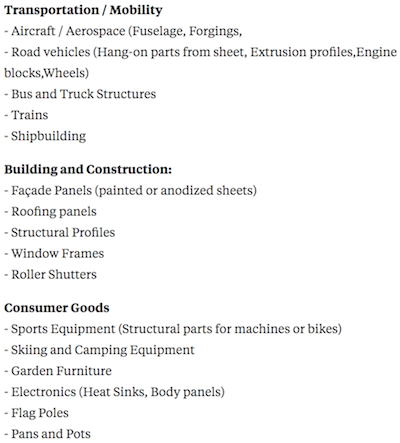

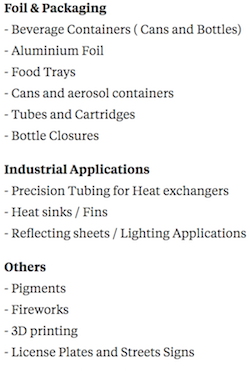

Market Scorecard. The US market wasn't sure which direction it wanted to go yesterday, bouncing between red and green for most of the morning. Then at around mid-day Trump announced that he was going to implement trade tariffs on steel and aluminium, pushing markets firmly into the red. The Dow ended up down 1.68%, the S&P 500 was down 1.33%, the Nasdaq was down 1.27%, and the All-share was down 0.69%. As Larry Summers said to Bloomberg yesterday, there are far more people in the US using steel and aluminium, than people who produce those metals.

If you live in the US and make use of any of the following products, you are about to pay more. Also, if you work in an industry that produces any of these products, your job security just dropped a few points.

Company Corner

Bright's Banter

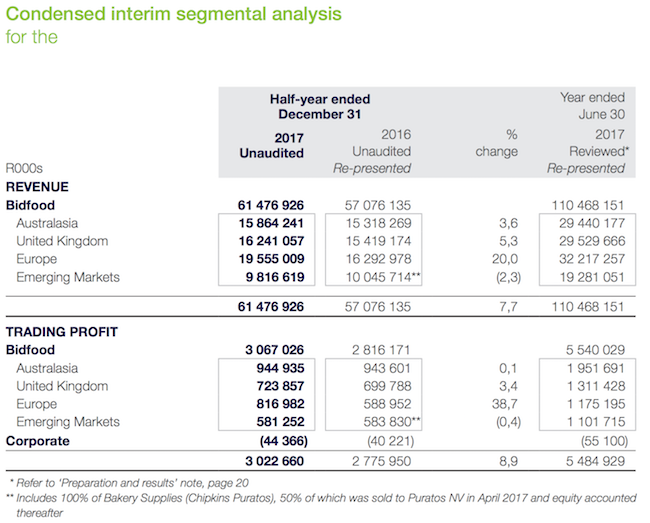

On the 21st of February I went to Bidcorp's results presentation which was held in the beautiful Standard Bank head office building in Rosebank. The company was reporting their half year results to the end of December 2017. Just a quick refresh, this business has diverse food service operation across 30 countries. 90% of Bidcorp's earnings continue to be offshore. Only 10% is earned locally, making it another useful Rand-hedge.

We've seen the Rand strengthen in recent times, so that's not helpful. Notwithstanding that headwind, the company reported total revenues of R61.4 billion, that's up 7.7% from the previous year. Headline earnings per share were up 8.6% to 640c and the company increased the interim dividend by 12% to 280c.

The segmental analysis below shows that the Australasian region continues to be largest contributor to both the top and bottom line. Food inflation was mixed and muted on average (never forget the 6-foot-tall man who drowned crossing the stream that was 5 feet deep on average). Wage inflation has been relentless across the board, management worry about that.

The company confirmed that they were reinvesting in their business and expanding capacity in Australia & New Zealand in order to fill territorial gaps and be closer to the consumer. In those two countries Bidcorp is expanding from one distribution centre each to about three to five smaller, more manageable urban facilities.

Trading in Europe was fantastic with revenues up 16.2% and trading profits up 32.9% in constant currencies with improving margins from 3.6% to 4.2%. Overall the businesses in Europe are making steady progress notwithstanding some avian flu outbreaks which led to a shortage in eggs and dairy products. The disruptions were temporary.

They business continued to make small bolt-on acquisitions as a way to enter new regions or to supplement existing capacity for broader reach. Emerging markets revenues were up 0.7%, trading profit was up 1.7% but the margins stood at 5.9%. The business entered the Vietnam market and Malaysia is starting to contribute. The Greater China region was also affected by the dairy and poultry situation.

The CEO Bernard Berson was asked if the likes of Uber Eats and Delivery Hero were eating their lunch? He explained that in order for a restaurant to deliver food directly to the customer, they still need Bidcorp for the ingredients. Ex-restaurant or ghost/shadow kitchens use platforms like Uber Eats to get the food to the customer but they need food ingredient suppliers. Bidcorp will benefitting from more eating out and more takeout food delivery. Sounds good! #KaChing.

I would argue that Bidcorp's edge is their complex infrastructure, and "routes to market". They have spent billions over the years to develop the infrastructure to reach their customers. Adding more customers to that system is easy and adds to margins. I don't want to get too excited here but management mentioned that they are using "big data analytics" to better understand their customers. They have all the data already! This tech spend makes good sense.

The food services industry remains fragmented with only a few big players spread across the globe. Bidcorp is a consolidator and sees more opportunities to grow. The company trades at a historic PE of 21 which is cheaper than its peers. Bidcorp believes that a low-debt balance sheet is a strong competitive advantage. For the moment, the strong Rand is a bonus when considering capital purchases.

Linkfest, lap it up

One thing, from Paul

Boston-based Harvard University has an endowment fund worth $37.1 billion. That's permanent capital that they have saved up, or received from alumni grants. The university uses the income that the fund generates to supplement student financial aid and develop its infrastructure and teaching programmes.

The management of that portfolio has always been the subject of much debate. In addition to conventional equities and bond holdings, the fund has huge bets on natural resources. It accumulated a $4 billion portfolio of Californian vineyards, Central American teak forests, a cotton farm in Australia, a eucalyptus plantation in Uruguay, and timberland in Romania.

The current endowment chief, Narv Narvekar, decided to write down the value of that natural resources portfolio last year by $1.1 billion, to $2.9 billion.

Over the past decade, Harvard's fund posted a 4.4 percent average annual return. That's worse than its university peers, and worse than a market-tracking index fund (60/40 equities/bonds) which would have earned an annual 6.4 percent. Vestact's all equity US portfolio generated average returns of around 10% per annum!

So much for the best brains at the world's top university. Read all about it here:

Harvard Blew $1 Billion in Bet on Tomatoes, Sugar, and Eucalyptus

This week on Blunders: Xi Jinping is now Chief for Life in China, Cape Town is Superdry, Egypt is awful and Snapchat has a Kylie Jenner problem - Blunders: Episode 90

Michael's Musings

As your smartphone becomes your most important possession, having access to the internet is something you can't live without. Here is how each South African network ranks in terms of coverage - The mobile network with the best coverage in South Africa.

When times get tough humans adapt to get stronger and more efficient - How this 78-year-old Cape Town company became one of the most water-efficient manufacturers of Coke in the world.

Home again, home again, jiggety-jog. As expected, our market is down this morning, in line with global markets. The most important thing on our screens today will be day two of the test between the Proteas and Australia; not much out today in terms of key market data.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment