To market to market to buy a fat pig. I (Michael) am reading Thinking, Fast and Slow by Daniel Kahneman. I have been since December; a recent reading test told me that I read at the speed of a high school student, a few words a minute slower than the global average. Kahneman is a Nobel prize winner, for his work on behaviour economics (cognitive biases). Basically his work proved that people are irrational and economists need to come up with better models for how the world works.

One of the experiments spoken about in the book is how unhappiness can derive from comparing. Researchers took two chimps, in separate cages. First, they gave each one a cucumber and then observed. Both Chimps ate the cucumber and were content. Then the researchers gave one chimp a banana and the other chimp a cucumber again. As you can imagine, one of the chimps was happier than the other. The chimp with the cucumber went as far as throwing the cucumber at the other chimp.

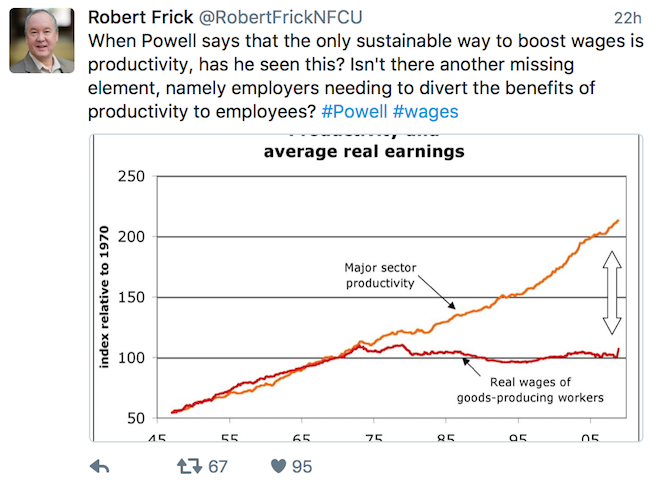

It is amazing what happens when we feel that we are being treated unfairly. What the experiment demonstrates is that unfairness and unhappiness is relative. If the second chimp never saw the first chimp with the banana, there wouldn't have been a problem. Imagine if the first chimp got wilted spinach instead of the banana? Apply this to a very emotive subject, income inequality; has social media made the problem seem worse than it is? The graph below is one of the arguments presented for the rich getting richer and the middle class going sideways.

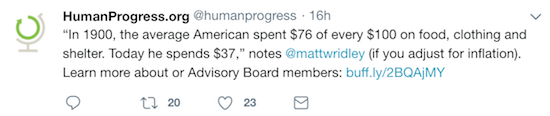

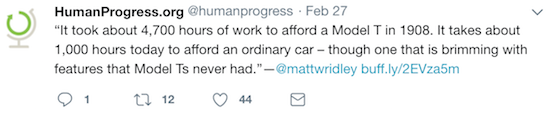

My argument is that focusing on real wages is the wrong metric. Surely what is more important is what you can do with what you earn? If your salary doesn't go up in real terms, but thanks to technology things get cheaper, that is progress? These below tweets show how far we have come in the last 100 years.

I agree that there is no point in having a society build tremendous wealth that only benefits a few, but at the same time, things probably aren't as bad as the media would have you believe?

Market Scorecard. Tuesday's tough time continued on Wednesday. The Dow was down 1.50%, the S&P 500 was down 1.11%, the Nasdaq was down 0.78%, and the All-share was down 1.19%.

Company Corner

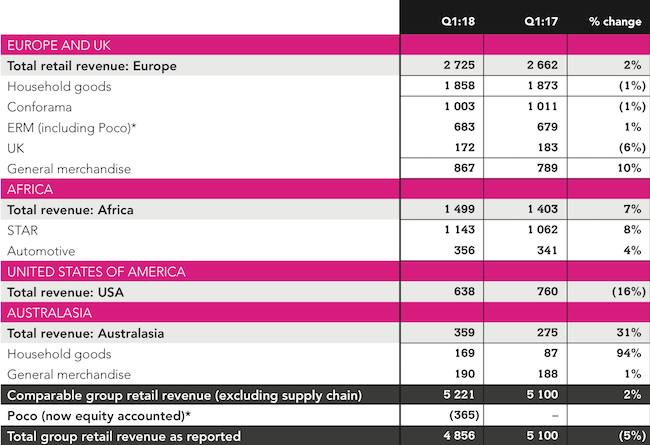

Yesterday after the market closed, Steinhoff released its Quarterly update, for the three months ending 31 December. Meaning the post-implosion period only accounts for three weeks of these numbers. The first thing I looked for was an update of when PWC would release their findings.

"It is not possible at this stage to provide any definitive timing for conclusion of the PwC investigation, but the company will provide regular updates on any material developments and clarity on timing as soon as possible"

Here is a look at their top line performance.

As you can see, Mattress Firm (US operation) is hurting while they are in the process of revamping the business. Here is what management had to say:

"During the quarter under review, 99 stores were closed, while eight stores were opened. Management aims to close approximately 175 stores and open 75 new stores"

"Furthermore, management has identified that the change in major supplier has resulted in gaps in the product range that are being urgently addressed."

"Mattress Firm's like-for-like sales being down by 10% for the period under review, largely driven by lower average unit selling prices. Like-for-like unit sales for the group declined by 3%."

It all still looks rather ugly. To make matters worse, German media and Moneyweb are reporting that incriminating emails between Jooste and senior management have been uncovered (#SteinhoffLeaks Part 1: 'Some big mistakes'). If you are still holding the share, the end to this sh*t show doesn't look to be any closer.

Linkfest, lap it up

One thing, from Paul

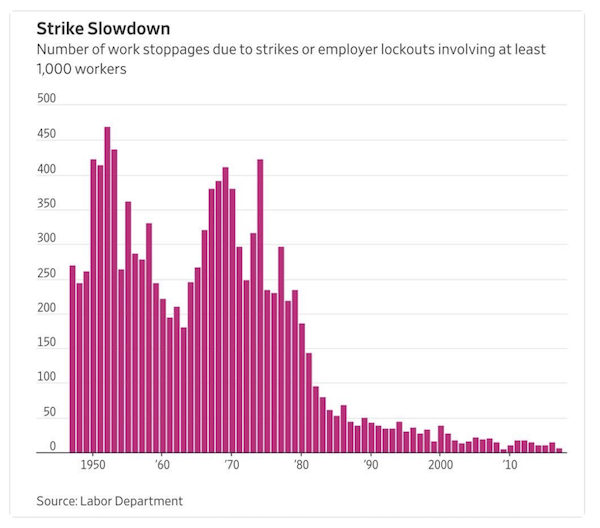

Strikes by organised labour are on the decline (in developed countries at least). The collapse of unions in the private sector is the principal reason. Globalisation of manufacturing and services is also a factor, as enormous companies with worldwide operations simply adjust to avoid work stoppages.

This trend seems true of South Africa too? We have high levels of unemployment, which further strengthens the hand of companies. Trade unions only really have much traction in the state sector, where their employer is a pushover?

Here is a link to the article (might require a WSJ subscription) which contains that graph:

Why Workers Are Striking Less Than Ever

Michael's Musings

If you are on Twitter you need to follow Wandile Sihlobo. His blog post from yesterday has a look at the unused land which can be used for agriculture, the low hanging fruit for land redistribution - These Provinces Have Unused Land Suitable For Agriculture.

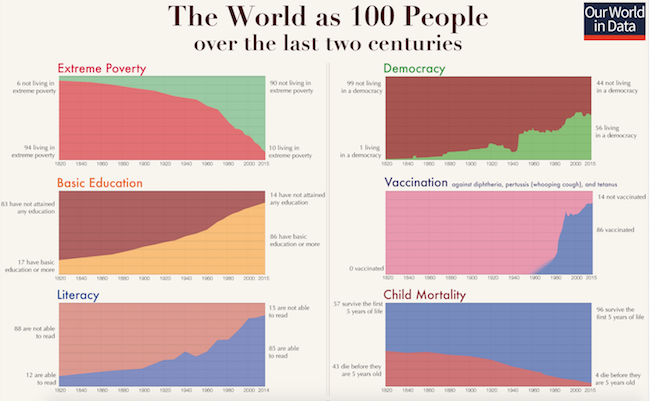

Todays chart from Visual Capitalist fits perfectly with what I wrote above - These 6 Charts Show How the World is Improving.

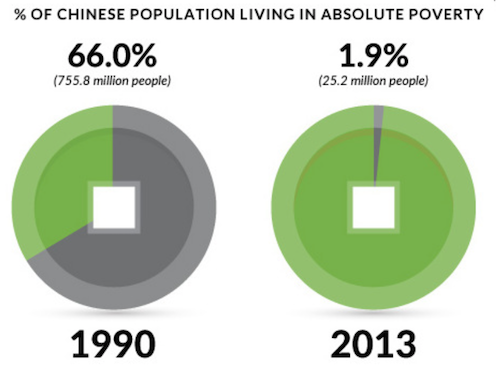

The mind still boggles a bit, when you think about how much China has changed over the last 30-years. It shows what can be accomplished when the government is focused on the people and not their own benefits.

Vestact in the Media

This an interesting question to think about. Michael gets a nice mention when talking about the impact of our currency on the stock market - Does South Africa really need a stronger rand?.

Home again, home again, jiggety-jog. Our market is slightly down on the open. A strong Dollar means the Rand is heading back to the $/R 12.00 level. Local data today, we have manufacturing PMI and vehicle sales numbers; how big will the impact of the renewed optimism be?

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment