To market to market to buy a fat pig. Chatting with many clients, most people hate buying at all-time highs. The feeling is that a correction is coming or at the very least, you have already missed the opportunity. Their proposed solution, keep your gunpowder dry and sit on cash. Ready to deploy at a moments notice, during the next correction.

Kicking off this year, markets went into correction territory; "A stock market correction is when prices fall 10 percent from the 52-week high". If you were on the sidelines, sounds like a perfect time to buy right? What happens in reality though, is that when the market is down 10%, it looks certain that the market will drop further in the coming days. Then a few days later, when things have settled and the market is only down 8%, you promise yourself that you will buy when the market gets back to being down 10%.

Yes, you guessed it. While you were worrying about how far the market will fall, the market dropped and then recovered all without you deploying a single cent. We have seen it many times, where clients have cash on hand to buy the dips, but when it comes time to buy the dip nothing happens. This Tweet from Byron sums things up nicely.

Its far easier to accept that you can't predict where the market will go tomorrow; just buy when you have long-term capital available. As the market adage goes, "It is time in the market, not timing the market".

Market Scorecard. The market didn't like what Jerome Powell had to say to Congress yesterday. The Dow was down 1.16%, the S&P 500 was down 1.27%, the Nasdaq was down 1.23%, and the All-share was up 0.27%. Unless US markets have a rip-roaring day this afternoon, February will be the first down month in 13-months! It has been good to be an equity investor.

Linkfest, lap it up

One thing, from Paul

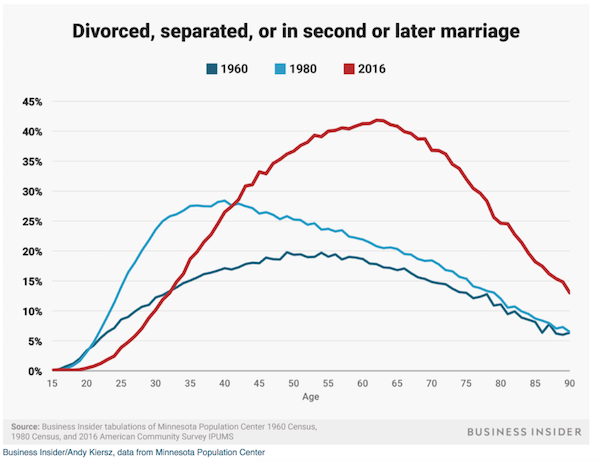

I've heard that getting divorced can be really bad for your finances? That makes sense, since usually a couple's savings are split and immovable assets have to be sold in a hurry. Setting up two new homes can be really expensive.

The problem is, marriages seem to be ending sooner. Here's a chart which shows the percentage of people who are divorced, separated or in a second or later marriage in America in 1960, 1980 and 2016. In other words, these are people who are probably trailing a number of financial "ex-dependents". That number now peaks at over 40% of the total population.

Here is a link to the the article which contains that graph:

Here's when you're probably getting divorced

Byron's Beats

Imagine the billions of photos, videos, songs and files that get stored on Apple devices. These days, not even 256GB phones can handle all this content. Then this needs to get backed-up onto a computer which duplicates the storage requirements. Step in Apple iCloud. I cannot even comprehend the amount of storage capacity iCloud requires.

I was always under the assumption that iCloud was done in-house. Apple has the capital available. But this CNBC article titled Apple confirms it uses Google's cloud for iCloud suggests that Google has secured a massive cloud storage deal with Apple. The details in the article are a little "cloudy" because these businesses tend to be secretive about their deals with each other. They are supposed to be fierce rivals after all. It seems that Amazon Web Services and Microsoft's Azure used to be the cloud providers, but Google has replaced Azure over the last two years. AWS still seems to be involved.

I recently spoke about Google's cloud business as the next big thing for the business. This is certainly a step in the right direction.

Michael's Musings

Eddy Elfenbein has a great piece this morning in his blog post called, Crossing Wall Street. He speaks about how market guru's make forecasts that they can not be held accountable for. At the start of each year there are a set of people who get wheeled in-front of the cameras to talk about all the reasons the market is going to do badly. Their claim to fame is calling the 2008 crash. As the saying goes, even a broken clock is right twice a day - "A 40% Chance"

Home again, home again, jiggety-jog. Following the path set by the West, our market is down this morning. Added to that, the idea of interest rates rising this year has resulted in a stronger Dollar, currently at $/R 11.74. International data out later today is EU CPI and then US GDP.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment