To market to market to buy a fat pig. An hour before the US market opened, we had as one analyst put it "The most highly anticipated inflation number for the last 10-years". The expectation was for inflation of 1.7%; it came in at 1.8%. Confirming market fears, inflation is coming and so are interest rate hikes. Futures immediately dropped over 1%.

You will then be surprised to hear that yesterday was the fourth straight day of gains for US markets. Why the gain then? At the same time as the inflation number release, US retail sales came out; Retail Sales in U.S. Decline After December Revised Down. Huh? The biggest part of the US economy went backwards and stocks went up?

As you might have guessed, it has to do with interest rates again. Weak retail sales today, means that demand push inflation dissipates tomorrow, and the concern of increasing inflation is gone. So there you have it, bad data is 'good' data again. Until it isn't, but you will only find that out after the fact.

Market Scorecard. Our market spent the day in the green, until 15:30 when the US inflation data sent global markets crashing. Luckily with only minutes left of trading our market managed to squeak into the green again. The Dow was up 1.03, the S&P 500 was up 1.34%, the Nasdaq was up 1.86%, and the All-share was up 0.33%.

Company Corner

Michael's Musings

Last week one of our smaller holdings, Cerner released their FY numbers. They are the guys that are trying to remove all the paperwork you have to fill in every time you visit a medical professional. The goal is to create a network where you complete your information once, then from there, all doctors have access to it. Saving trees and saving you time. More importantly though, having the data in digital format, lowers the risk of bad handwriting leading to wrong diagnosis or the wrong procedure being done.

Built on to that is Cerner's management system, where hospitals can then use the information to easily see revenue and expense figures. It also allows them to see what operations are in the pipeline, meaning accurate forecasts can be made. Probably the most exciting part of the business is where they unleash AI onto the data. The clever algorithms take the data fed to it from all your medical tests, and at some stage in the future from your smartwatch too, and issue early warning signals around potential health issues.

Due to the time required and the capital-intensive nature of revamping a hospital group's computer systems, Cerner has a 'book' similar to that of construction company. For the 4Q, they had a record number of bookings, $2.3 billion, up 62% YoY. Over the last year, their revenue came in at $5.1 billion up 7% YoY. From that revenue they made a profit of $867 million.

Cerner ticks all the boxes, it is a technology company in the medical space. It is also defensive because once a hospital chooses Cerner, it is not easy to move to a competitor. Thanks to those characteristics, it trades on an 'expensive' 24 times earnings. Management expects earnings to grow by 11% over the next year so the multiple isn't going to unwind in a hurry. With many things in life, you get what you pay for. Paying up for Cerner is one of those things in our opinion.

Byron's Beats

When Aspen released their full year results last year, the second half of the year was much better than the first half. Stephen Saad, at the results, mentioned that he expected this momentum to continue into the financial year 2018.

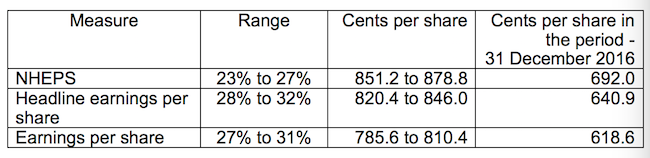

This morning we received a trading update which indicated as such. Here are the numbers.

This is all the info we have access to but let's delve a little deeper into each 6 month number over the last 18 months. To be consistent let's look at the normalised headline earnings per share (NHEPS). Last year this time the company made 692c for 6 months. For the full year they made 1463c which means they made 771c in the second half. This trading update suggests they have made 860c (middle ground) which shows an 11.5% improvement on the second half of last year.

The first half of last year was off a low base but the growth off a very solid second half base still looks strong. The market has reacted very positively to the news, the share is up 6%. The detailed numbers will come out on the 8th of March, more details then.

Linkfest, lap it up

One thing, from Paul

Finally, Zuma is gone! Under his leadership South Africa slipped very badly. He says that he doesn't know what he did wrong? Well, apart from anything else, the country faces a dire fiscal crisis, thanks to his bungling.

His involvement in the gross mismanagement of public enterprises is well known, and the debts of a looted and bankrupt Eskom will doubtless be added soon to the sovereign debt mountain.

The ANC leadership crisis had already derailed the State of the Nation Address, and the postponement of the Budget Speech was next.

The Moody's Baa3 rating is the only thing keeping our bonds debt in the Citi World Government Bond Index, given that the grades from S&P Global Ratings and Fitch Ratings are already below investment grade.

The rules of the index require that a borrower can no longer be included once it's rated junk by all three rating companies. Moody's deadline is 23 February. They are probably waiting to see if the Government has the guts to do what must be done: raise the VAT rate from 14% to 16%.

Bright's Banter

My favourite academic Prof. Scott Galloway has been singing this song of breaking up big tech i.e. Apple, Amazon, Google/Alphabet, Facebook and Microsoft. Here's his reasoning on why we should build em and break em up!

Apple's smart speaker, the HomePod is now available for purchase, the sales went live this past Friday and the reviews are flying in! Apparently its a great quality speaker but is not in the same league as the competition when it comes to being "smart".

I think the problem is not the speaker, but Siri. Siri's had the first mover advantage but never really grew from there. On the other hand Alexa just lapped Siri on her amazing ability to learn.

The graph below shows how these speakers (Google, Amazon Echo, HomePod etc.) perform head to head.

You will find more infographics at Statista

You will find more infographics at Statista

Home again, home again, jiggety-jog. The Rand is stronger this morning, trading at $/R11.68. No, not because we no longer have a president but because of the US inflation data. We know who our future president will be, the question that the market will be asking is who will be delivering the budget speech next week Wednesday? With the Chinese New Year, Chinese markets are closed today and tomorrow, and Hong Kong had a half day of trading today. After a busy news data day yesterday, there is nothing major out today.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment