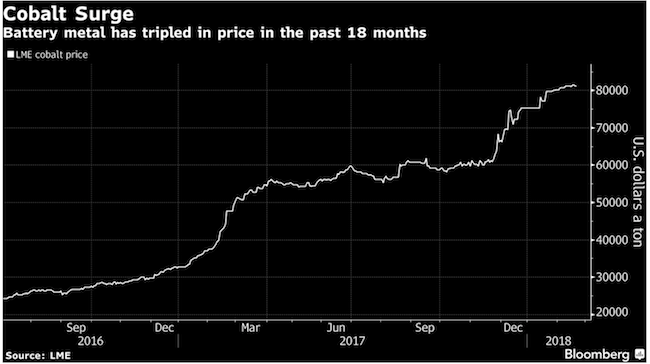

To market to market to buy a fat pig. Last week Paul spoke about the rise of Lithium, this week we will talk about the sister metal Cobalt. Like Lithium, it is a key component of the modern battery, and as a result has also seen its price sky rocket.

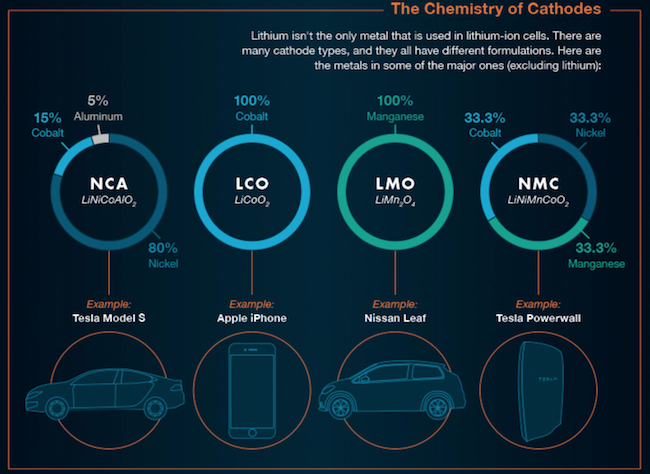

As the infographic below shows, cobalt is an important raw material in the iPhone battery. If Apple wants to continue selling 200 million phones a year, they need to make sure they can get enough of the metal. Here is their solution - Apple in Talks to Buy Cobalt Directly From Miners.

One of our readers last week pointed out that the commodity industry has a way of balancing itself out. At the moment demand out strips supply, and the expected growth in battery powered technology is enormous. If the Cobalt price continues to rise there are a couple scenarios to consider. The most likely scenario is that the global mining houses double down on their efforts to find more of the metal and find clever ways to bring down the price of mining it. Just like with oil and the frackers, high oil prices forced business to go in search of new reserves and new ways to extract it.

Another scenario is where the high prices of cobalt forces the use of an alternate metal. Then lastly, there have been over a billion iPhones sold, recycling the materials in those phones becomes more feasible as commodity prices go higher. The beauty of the free market at work. You will probably find that the future will be composed of a bit of all three scenarios; that goes for all the metals used in batteries.

Market Scorecard. The US markets had a good day on Friday, with a big rally going into the close. The Dow was up 1.39%, the S&P 500 was up 1.60%, the Nasdaq was up 1.77%, and the All-share was up 0.96%.

Company Corner

Spur has been in the news for all the wrong reasons recently. Given how important entrepreneurs are to job creation, I feel that we need to pay tribute to those people who start and grow businesses - Spur Corporation Limited - Retirement Of Spur Founder And Executive Chairman.

"Mr Ambor (76) founded Spur when he opened the first restaurant in Newlands, Cape Town, in 1967 and has served as executive chairman of the board since the company's listing on the JSE in 1986."

Wow!

Linkfest, lap it up

One thing, from Paul

This week on Blunders: KFC runs out of chicken, Iberian ham prices run wild, MiWay agent calls Zulu king and disaster strikes in Hulene (Maputo) - Blunders - Episode 89

Michael's Musings

The days of Diesel engines may be numbered, a German court is ruling on the legality of driving diesel cars in the cities - German court delays ruling on diesel ban to next week. In South Africa, the big impact will be felt in the platinum price. Here is a piece from last year talking about the subject - Will The Death Of Diesel Ruin Platinum?.

Bright's Banter

In my last piece on Facebook I said the following "Facebook is going back to first principles by revamping the News Feed and prioritising posts from friends and family over advertised viral videos/content from publishers with an agenda. This will help avoid hurtful content (aka "fake news") that goes viral from time to time and dilutes the user experience. Most importantly, it'll help curb the invisible hands that have been swaying election results all over the world by perpetuating fake news on the platform. This move could see Facebook's advertising revenue growth slow in the interim, but it'll boost the company's growth long-term, as advertisers/brands will value and trust the platform more, and engagement will be more meaningful for users.

This sounds all good and well but advertisers are now skeptical of the average time spent by people on Facebook. According to a report by a crowd called Shareaholic, traffic on the Facebook platform is starting to decrease at a fast pace in the second half of 2017. This will not directly link to a fall in ad sales for the company because advertisers are still keen to have the attention of the +2 billion Monthly Active Users. To be honest Facebook and Google still own over 80% of all ad revenues worldwide. The infographic shows the decrease of Facebook traffic compared to other social media platforms.

You will find more infographics at Statista

You will find more infographics at Statista

Home again, home again, jiggety-jog.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment