To market to market to buy a fat pig. It was budget day yesterday, which made many people nervous. Back in the days of Trevor Manual, the anticipation was around how big your tax cut would be. The market reacted favourably to the budget, with the All-share swinging from red to green and our bonds dropping below 8% for the first time in three years (read 'before Nenegate'). The reason for the positive reaction from the equity and bond market is due to the government showing they are willing to do what needs to be done by raising VAT.

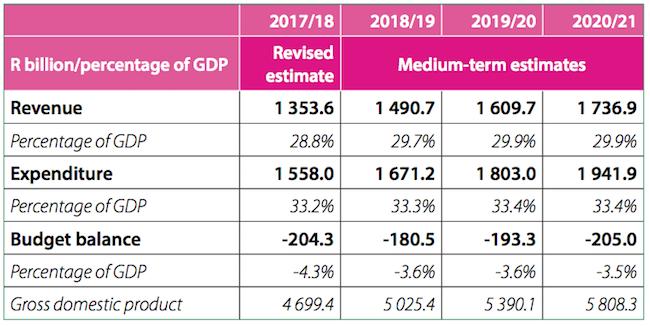

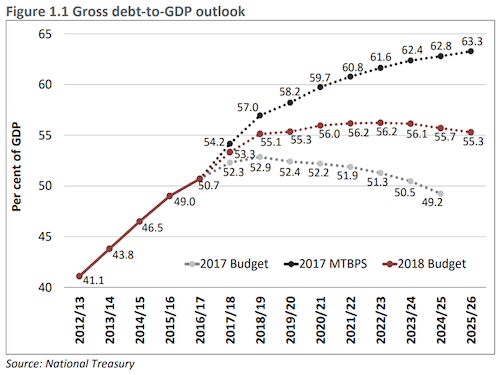

Step one has been completed, we have avoided a debt downgrade. There is very little room to raise taxes further. Going forward, the government needs to be more effective and SOE's need to send corrupt employees to prison. Let's not kid ourselves though, there is still a monster hole in our budget. We desperately need growth, to get back to a balanced budget and to bring our debt to GDP ratio under control.

A VAT increase means less money for both rich and poor. The reality however is if we did not have a VAT increase, we would as a nation be in an even worse position down the line. A debt downgrade and potential bailout from the IMF won't stimulate the economy. Zero economic growth hits the poor the hardest.

An unintended consequence of raising VAT or a tax on consumption, may be increased savings. There are studies that indicate taxing consumption, leads to less consumption and higher savings. As you can imagine though, trying to predict people's spending habits is fraught with assumptions.

Market Scorecard. It was a very mixed day for US markets yesterday. Things were going along swimmingly until the Fed minutes were released, then all fall down. The Fed noted that the US economy is in its best shape since the crisis. What the market heard was that there are going to be more interest rate hikes than currently assumed. The Dow was down 0.67%, the S&P 500 was down 0.55%, the Nasdaq was down 0.22%, and the All-share was up 1.17%.

Linkfest, lap it up

One thing, from Paul

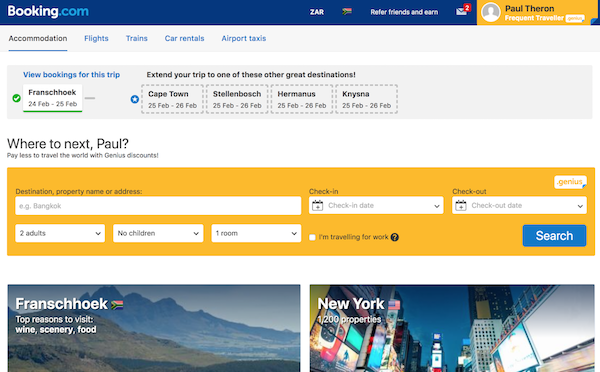

One of our core holdings in New York, Priceline, is changing its name to Booking Holdings. The company will begin trading under a new ticker symbol on the NASDAQ: BKNG from February 27. Remember that the group is made up of these six primary brands: Booking.com, priceline.com, KAYAK, agoda.com, Rentalcars.com and OpenTable.

The CEO Glenn Fogel said yesterday, "Over the last two decades, our business has expanded from just priceline.com, operating solely in the United States, into six primary brands with headquarters around the globe, operating in more than 220 countries and territories in over 40 languages, fulfilling one unified mission of helping people experience the world. Today, our largest brand is Booking.com, which has more than 1.5 million properties, averages over one million bookings per day and produces a significant majority of Booking Holdings' gross bookings and operating profit."

I approve of this kind of thing! Investors like simple names, simple business models and simple corporate structures. Some of my favourite companies have names made up of letters that you can count on both hands. Like Amazon, Netflix, Discovery, Google, Aspen, Naspers, etc. Oh, and Vestact too!

Michael's Musings

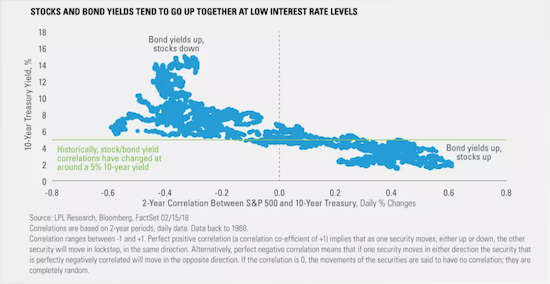

With all the concern about rising interest rates, what does history tell us about how markets react? It seems that when interest rates come off a low base, rising interest rates are coupled with higher stock returns. It is only when interest rates are above 5% that an increase in rates has a significant negative impact on the stock market. History is not the future, interesting numbers none the less - Are We Out of the Woods Yet?.

How can a disease that requires an inexpensive shot, be returning ? - The return of measles in Europe is "a tragedy we simply cannot accept"

Home again, home again, jiggety-jog. After the finish for US markets, it is no surprise that the Alsi is lower this morning. The prospect of higher interest rates from the Fed has also strengthened the Dollar, currently we are at $/R 11.66. Data out later today is GDP from the UK, the expectation is for YoY growth of 1.5%.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment