To market to market to buy a fat pig. As we get closer to the budget speech, the two key questions being asked at the moment are, "Who will deliver the speech?" and "Will VAT be raised?". Twitter is convinced that we will have a new Finance Minister. Our current debt to GDP ratio is over 50%. If we like it or not. the people who are lending us money need to feel secure in who is appointed to oversee the coffers.

VAT is a far more touchy subject than who will be finance minister. When change hurts your back pocket, people pay attention. It seems that there is very little alternative than to raise VAT in tomorrows budget speech though. I get grumpy about having to pay extra tax due to corruption and the billions spent on blue light brigades. The low-security, morning runs taken by the new president is hopefully a sign of how things will change. Reading this article, Cosatu warns against VAT hikes, austerity measures ahead of Budget, Cosatu has some good points about government cleaning up its own act instead of burdening the people with extra taxes. Housecleaning takes time though, time we don't have.

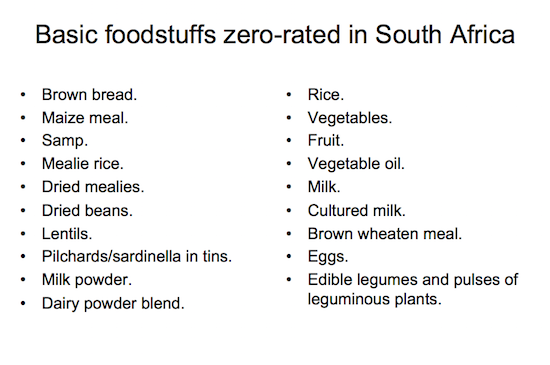

In terms of the fairest way to increase tax collections, in my opinion VAT is the answer. It is targeted on consumption and you can't avoid it by lying to the tax man. The following slide from treasury shows which items are VAT zero-rated, they are the necessities needed for survival. Items that are VAT exempt include, transport and education.

"Cosatu will not support any attempt by government to balance budget shortfalls and deficits upon the backs of struggling workers. Workers are not the ones who have looted Eskom, SAA and the state."

As a country, workers, management and the unemployed, we elected the people who were responsible for Eskom, SAA and the state. As such, surely we all carry the responsibility and burden when those leaders loot?

Market Scorecard. It was a very subdued day yesterday due to the US being closed for presidents day and the Chinese market being closed for their new year. The All-share was down 0.71% on the day

Linkfest, lap it up

One thing, from Paul

Did you miss the Blunders last week? I get disappointed if we can't get at least 1,000 views within five days and we are currently on 922. Go and watch it now!

This week: Jacob Zuma OUT; Valentines Day in India; Iceland runs short of electricity due to Bitcoin mining; and Kruger National Park lions eat poacher - Blunders - Episode 88

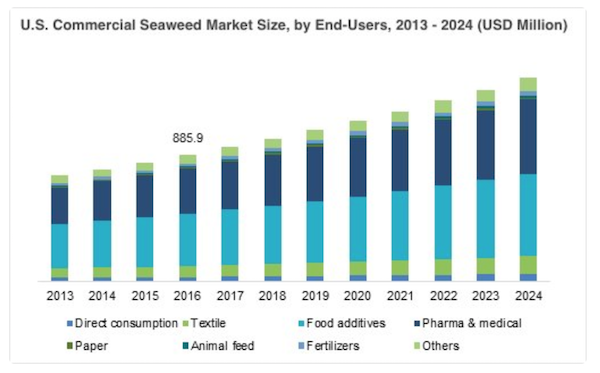

According to a research firm called Global Market Insights, the worldwide seaweed industry will surpass $87 billion by 2024. I hardly knew that it existed?

The major uses are food and beverages, fertilisers in agriculture, cosmetics and pharmaceuticals. There are also applications in the manufacturing of biofuels, biomass and wastewater management.

Significant global companies in the industry are Aquatic Chemicals, Seasol International, Indigrow Ltd., Algea AS, Yan Cheng, Pacific Harvest, Chase Organics GB Ltd., Mara Seaweed, Acadian Seaplants Ltd. and CP Kelco.

Here is a link to the report, if this seems interesting? - https://www.gminsights.com/industry-analysis/seaweed-extracts-market

Michael's Musings

Ask most people, what was the first financial bubble, and they will more than likely tell you 'Tulip Mania' - Tulip mania: the classic story of a Dutch financial bubble is mostly wrong.

"I was able to identify only 37 people who spent more than 300 guilders on bulbs, around the yearly wage of a master craftsman. Many tulips were far cheaper."

Bright's Banter

Carl Icahn has been very sceptical about investment products that buy and track the markets mindlessly and he's dead certain that it's the next bubble, as he explains in his short movie here titled Danger Ahead. Basically the gist of the story is that BlackRock is gonna cause the next market meltdown. Larry Fink (CEO of BlackRock) is the one driving the markets to the edge of the hill and the bus is gonna hit a "BlackRock" and that will be the end. It is worth noting that the video is from 2015.

Below is his most recent comments on index trackers and it seems like his mind is set with a determined resolution!

Carl Icahn Says There's A Dangerous Bubble In The Hottest Investment Product On The Market.

Home again, home again, jiggety-jog. Locally, we are down this morning. On a data front, there is very little out today. As South African's all eyes will be on parliament today. Discovery came out with their six-month numbers this morning, they look solid and are in line with what the market was expecting. Their results will be broadcast from their new head office in Sandton this morning. Exciting times!

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment