To market to market to buy a fat pig. Yesterday Stats SA released our labour stats for the last quarter in 2017. The headline number compared to last year is marginally worse, but compared to last quarter it is one percentage point better at 26.7%. It is never nice reading that we have 5.9 million unemployed people and a further 2.5 million people who are classified as discouraged work seekers but not unemployed. To be classified as unemployed you have to have looked for a job recently.

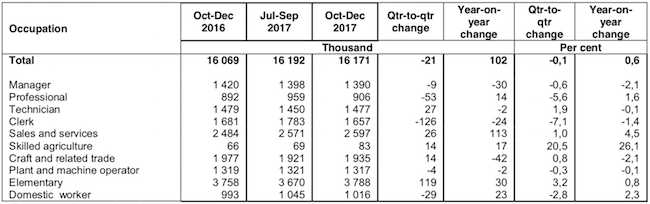

In total there are 16.2 million South African's employed, which includes Stats SA's estimate of 2.8 million people in our informal sector. Here is how they are employed:

The stat I enjoyed the most was that over the last year, employment in Gauteng dropped by 121 000, but employment in the Western Cape was up by 106 000. What! Does that reflect people were leaving the city of gold for the mountain and no water?

Market Scorecard. Yesterday was another day when US markets were both red and green at some stage, to a lesser extreme though. The Dow was up 0.16%, the S&P 500 was up 0.26%, the Nasdaq was up 0.45%, and the All-share was up 1.78%.Our market had a strong day, which included a surge during the home stretch. MTN was up 3.2%, Tiger Brands was up 3.5% and Naspers was up 2.9%.

Linkfest, lap it up

One thing, from Paul

I'm a big fan of holding steady and carrying on doing what works. This is definitely a good idea in markets, where over-reacting to the latest headline is generally a bad idea.

So I enjoyed this snippet in a blog post I read recently. An analysis of football goalies facing penalty kicks revealed that they dive to the right or the left 94% of the time. They guess correctly 40% of the time and save about a quarter of the correct guesses. It turns out that if the goalkeepers didn't move at all their chances of saving the penalty increase from 13% to 33%.

So they pick a strategy which looks good, and feels right, because "at least I'm doing something", but that strategy ensures they have a lower success rate. Apparently this is called "action bias" by behavioural experts.

Byron's Beats

Much is spoken about Amazon Web Services but Google Cloud does not get nearly as much airtime. According to estimates AWS revenues are about four times that of Google Cloud which is the third biggest cloud services provider. AWS is the biggest and Microsoft's Azure is a close second.

According to reports however, Google Cloud is the largest driver of increased headcount at the parent company, Alphabet. They also have established partnerships with big names such as Salesforce, SAP, Dell and Cisco.

Because the Google search business is so profitable, the potential of the cloud business sits in the cloudy shadows. This should not be underestimated. Cloud services are still coming off a low base and are essential creators of efficiencies for businesses all over the world. Not to mention the explosion of AI. Google has the brand strength (a lot of trust is required) and the capital to turn this into their second big trick pony.

Michael's Musings

Iceland is a great country to host crypto-mining operations. The electricity is cheap and is mostly clean, and the weather outside is cold, reducing the need for cooling - Iceland will use more electricity mining bitcoins than powering its homes in 2018.

5G will be a game changer for consumers, it is 100 times faster than current 4G technology! At this rate, fibre is going to be obsolete by the time it is fully rolled out - 5G Is Making Its Global Debut at Olympics, and It's Wicked Fast.

Home again, home again, jiggety-jog. Politically, the changing of the guard seems to have reached its climax today. The JSE is also in the green this morning, which is good to see after a rough few weeks for equities. At 13:00 today, we will get the retail figure read for South Africa. Remember our last read shot the lights out thanks to South Africans embracing Black Friday.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment