To market to market to buy a fat pig. Activist short sellers are something that we are not used to in South Africa. In a market like the US, it is commonplace thanks to all the capital looking for a home, and the large number of listed companies.

Just to make sure that we are on the same page, a short seller is someone who profits from share prices dropping. Here is the 101 on how the mechanics work. A short seller will identify a stock (Company X) that they think is overvalued, they will then approach long-term holders like ETF providers or pension funds and ask to borrow some stock of Company X. In exchange for the stock, they pay the pension fund or ETF provider a small fee. Once the short seller has the stock, they then sell it, hoping that when they repurchase it in the future the stock price has dropped.

We do have short sellers in South Africa; generally it is part of what is called a long/short strategy. For example, a hedge fund might go long Shoprite and short Pick n Pay, based on the assumption that Pick n Pay is overvalued for the sector. Activist short selling is a completely different beast though. Activist short sellers go after companies where they feel the company has something systematically wrong with it. Due to the limited number of stocks on the JSE, and the general high regard we hold for our business leaders, activist short selling hasn't been a feature on the JSE.

With the Steinhoff saga and Viceroy going after Capitec, the age of big short sellers has arrived. Toward the end of last week, the Resilient group of companies came into the spotlight again, this time from local company 36ONE. You might remember that they were rumoured to have been the target of the Viceroy report before Capitec. Moneyweb have a nice breakdown of the allegations - What is the Resilient stable accused of?.

People sometimes bemoan short sellers because they profit off of other people's loss. The argument can be made that due to short sellers the share price of defunct companies won't rise as high, meaning that when it comes crashing down to earth it doesn't fall that far. Short sellers take the same risks as ordinary buyers, normally more risk. They have a role to play in keeping management honest and helping prevent bubbles from forming.

Market Scorecard. Friday epitomised the market over the last week. It first started up over one percent, then dropped to be down over two percent then bounced to be up over two percent and finally closed up one percent. The Dow was up 1.38%, the S&P 500 was up 1.49%, the Nasdaq was up 1.44%, and the All-share was down 1.29%.

One thing, from Paul

Stephen Pinker is a Professor of Psychology at Harvard University. He wrote a book in 2011 called "The Better Angels of Our Nature" where he made the case that violence in human societies has steadily declined with time.

He is out with a new book now called "Enlightenment Now: The Case for Reason, Science, Humanism and Progress". This weekend the Wall Street Journal ran an excerpt from the book in a longish article. It's well worth a read:

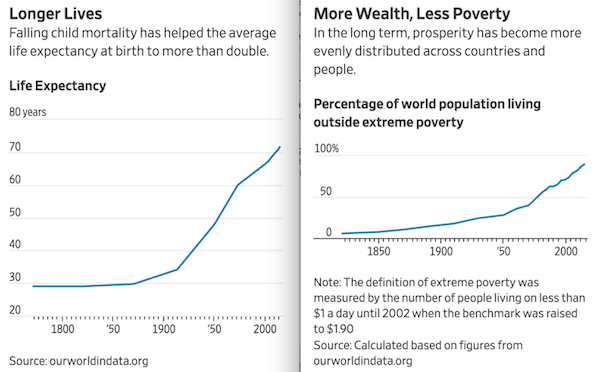

Pinker notes that through most of human history a newborn was expected to live around 30 years. Now its 71 years globally, and 81 in the developed world.

Poverty is also declining rapidly, a point that deserves more attention (despite the ongoing fixation with income and wealth inequality). Progress has been relentless, and it's not farfetched to suggested that it will be eradicated altogether in the years ahead.

Pinkers' key point: "To what do we owe this progress? The Enlightenment is working. Our ancestors replaced dogma, tradition and authority with reason, debate and institutions of truth-seeking. They replaced superstition and magic with science. And they shifted their values from the glory of the tribe, nation, race, class or faith toward universal human flourishing."

Of course, its to be expected that major global corporations would do well against this backdrop.

Michael's Musings

It is the week of love. Valentine's day is on Wednesday, have you bought something yet? The below infographic shows what the average spend is! - Valentine's Day 2018 - The Cost Of Love

You will find more infographics at Statista

You will find more infographics at Statista

Home again, home again, jiggety-jog. The question of who will lead South Africa should be put to rest by the end of today? We will have to wait and see. It is a rather quiet day on the data front, both locally and internationally. Out of the gate, our market is up, Naspers is back into the R3 000's and the Rand is below $/R12.00 again.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment