To market to market to buy a fat pig. Local markets continued to take a breather after the absolute scorcher on Wednesday. SA inc, which was leading the pack last week was hardest hit on Friday. But all in all it was a great week for markets and a great week for SA. All topped off by an inspiring SONA.

US markets had another great start as the "massive correction" of February 2018 slowly fades away into memory. I would say that the volatility will still be around, especially relating to news about inflation.

The good start unfortunately faded away as news about Russian interference in the US elections reared it's ugly head again. Trump went on another Twitter rage about the issue. Interesting times indeed!

Market Scorecard. Both the Dow and the S&P 500 had five straight days of gains last week, not bad considering the volatility at the moment. The Dow closed up 0.08%, the S&P 500 closed up 0.04%, the Nasdaq was down 0.23%, and the All-share was down 0.69%.

Linkfest, lap it up

One thing, from Paul

Investors who like physical commodities are often excited when demand seems to exceed supply, prices are rising. Tulips! Whale oil! Platinum! Crude oil! Lithium! Easy money to be made!

Well, this article by Bloomberg correspondent David Fickling (based in Australia) takes a different view. His argument is that commodity markets never really stay in deficit for very long. Suppliers find ways of bringing more of what's needed on line. Consumers find ways of using the stuff more efficiently, and recycling where possible. If they don't, production innovations are sought to bypass the commodity altogether.

To be specific, he says that the current fixation with shortages of lithium for electric batteries is unlikely to last, so speculators loading up on lithium stocks might not make the quick fortunes that they hope for? Its not as if these elements are really rare, in the earth's crust.

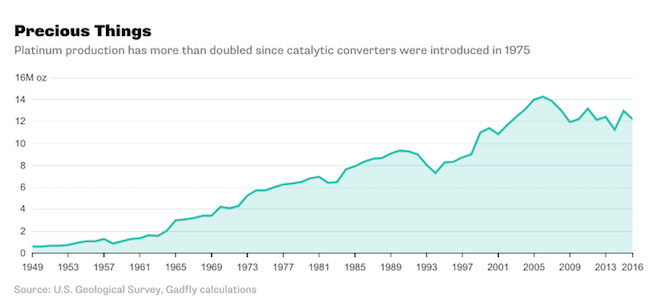

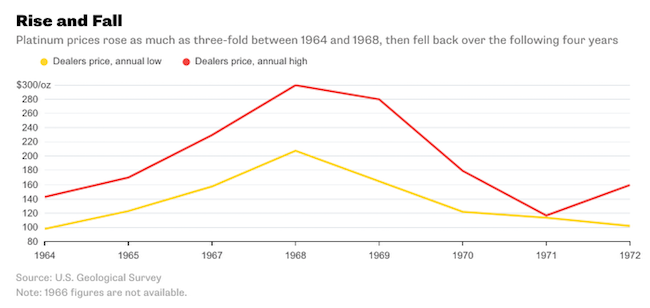

Fickling uses the example of Platinum in the mid 1970s. Demand for catalytic converters was going through the roof, and all of the supply was trapped in apartheid South Africa and the Soviet Union. Prices spiked. Over time though, supply rose and prices calmed down. You can see this in the next two charts:

Here is a link to the article: Platinum's Lesson for Lithium-Ion Batteries

Michael's Musings

I really enjoy watching the Olympics, the skill levels of the athletes is amazing. These robots are at the cutting edge of robotic technology, they still have a far way to go though to reach the impressive feats of olympians - Robots skiing reminds us how far away the apocalypse is.

For anyone who has done a forex payment recently, you will know that the bank you used made a tidy profit. The reason for the crazy transfer fees is because to send currency you need to use the SWIFT system. Blockchain (the system behind crypto currencies) is trying to change the monopoly financial institutions have - Saudi Arabia's central bank signs blockchain deal with Ripple. Having a central bank involved is pretty big.

Vestact in the Media

Byron gets a mention in CNN Money, talking about the renewed optimism in South Africa - Is now the time to invest in South Africa?.

Home again, home again, jiggety-jog. Our market followed the negative tone going into the close of the US market, we are down around 0.5% this morning. It is a very quiet day on the data front, both the US and China have public holidays today.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment