To market to market to buy a fat pig. If you do any form of long-term investing, Warren Buffett is the man you aim to emulate. As such there are two big 'Buffett' events investors look forward to, the first is the annual Berkshire AGM and the second is Buffett's annual letter to shareholders. The man has an amazing ability to make complex matters sound simple! Here is an awesome example of his way with words and concepts.

"That last requirement proved a barrier to virtually all deals we reviewed in 2017, as prices for decent, but far from spectacular, businesses hit an all-time high. Indeed, price seemed almost irrelevant to an army of optimistic purchasers.

Why the purchasing frenzy? In part, it's because the CEO job self-selects for "can-do" types. If Wall Street analysts or board members urge that brand of CEO to consider possible acquisitions, it's a bit like telling your ripening teenager to be sure to have a normal sex life."

I came across this WSJ article on Friday, Investors' Zeal to Buy Stocks With Debt Leaves Markets Vulnerable, which ties in rather well with another point Buffett made. Using debt, backed by the stocks (margin) is a sure fire way to blow up at some point. Someone who comes to mind, is Christo Wiese, he used margin to increase the size of his Steinhoff holding. The result is that he was a forced seller, locking in huge losses (not to mention the losses to the banks!).

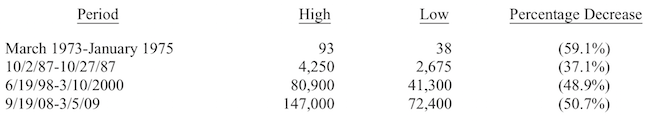

Anyone would agree that buying Berkshire 50-years ago would have been an inspired purchase, one that would set you up for stress-free retirement. If you used debt to buy them, you probably would have sold them in the early 70's. The below table shows the four biggest pullbacks in the Berkshire share price over the last 51-years. Note that even great investments over the long-term can lose half its value in the short term.

"This table offers the strongest argument I can muster against ever using borrowed money to own stocks. There is simply no telling how far stocks can fall in a short period. Even if your borrowings are small and your positions aren't immediately threatened by the plunging market, your mind may well become rattled by scary headlines and breathless commentary. And an unsettled mind will not make good decisions."

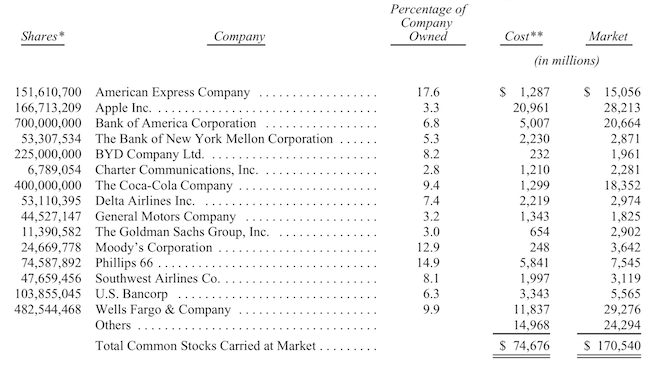

Lastly, here is a breakdown of their top stock holdings. Note how big their Apple position is, not bad considering that they only started buying it during 2016. Buffett was asked when he is going to buy an iPhone. His reply was along the lines of, for as long as he doesn't own one, the market is not saturated; there is scope to sell more phones.

One thing, from Paul

Our most important local stock holding, by far, is Naspers. Its our largest holding in almost all JSE portfolios. In our view, it should be trading at twice the share price that it is today. The aggregate value of its various Internet and media assets far exceeds its current value on the market.

So it's pleasing when we see other market participants who hold the same view. London-based Goldman Sachs analyst Lisa Yang had this to say about Naspers in a short note issued overnight (I have lightly edited her comments, and spelled out abbreviations, to improve the readability):

In our view, Naspers' recent underperformance was mainly driven by technicals and currency moves, overshadowing several positive developments surrounding fundamentals, transparency and improvements in the political and macro environment in South Africa. With the stock down 15% relative to JSE All Share Index over the past three months and its net asset value discount back to 41% (near all-time highs), we see a compelling entry point and reiterate our Buy rating (on our conviction list).

We believe local selling pressure has largely played out and Naspers should benefit from an increase in foreign inflows into South Africa.

While currency moves may be a further headwind for the stock, we note a lack of relationship historically. Additionally, a stronger Rand would benefit Naspers' Pay TV division, (22% of 2018 earnings, >100% excluding Tencent and Mail.ru).

Disclosure and transparency have improved, and we also see management optionality to navigate technical headwinds through increasing the liquidity of their depositary receipt listing in New York, or a full dual listing.

Fundamentals are showing a positive inflection as demonstrated by interim (6 month) results, and we expect further improvement and potential corporate action to crystallise the value of the private assets. Overall, our sum of the parts-based 12-month price target changes by around 10% to R4,198, mainly due to currency issues.

Naspers is currently trading at around R3,300 per share, so this target of Yang's at Goldman Sachs is almost 30% higher. Consider buying some more here! Of course, the trick with successful investing is to own stocks before everyone else starts liking them.

Market Scorecard. Green on the screen all around. The Dow was up 1.58%, the S&P 500 was up 1.18%, the Nasdaq was up 1.15%, and the All-share was up 0.26%. Looking at the list of companies at 12-month highs, it is packed with retailers and banks. Pointing firmly to local consumer and business confidence. The cabinet re-shuffle last night, was a bit of a mixed bag. Reputable people are in the key positions though, which should boost confidence further. In time, the list of ministers will shrink as departments are removed, which will probably see some questionable appointments removed? The one thing that the re-shuffle shows though is that change takes time. It also means that this song will make a comeback - Stomach in Chest out.

Linkfest, lap it up

Byron's Beats

I have always enjoyed reading Business Insider USA. They have a unique style which keeps things interesting. It may not always be deep analysis but they do manage to find facts and stories which demand my attention.

Business Insider SA is now up and running. Subscribe to their newsletter or follow them on twitter. You will enjoy their articles. Like this one about our new (and returned) finance minister, Nhlanhla Nene.

He farms cabbages and sold life policies - 8 things you didn't know about Nhlanhla Nene.

Bright's Banter

Amazon A Monopoly Or Nah?

The latest sector that Amazon has put in jail? The shipping sector! Amazon announced it was getting into delivery of goods. Immediately, the share prices of UPS and FedEx tanked five percent on opening bell or around $8 billion in market capitalisation, continuing a pattern of cascading stock prices within hours of Amazon announcing interest in any given sector.

Analysts claim the threat is overblown, pointing to UPS and FedEx's complex infrastructure. Amazon accounts for approximately just five percent of total revenue and pointing to all the CapEx expenses of about $5 billion each for FedEx and UPS in the most recent year. Last year after seeing Amazon lease delivery jets and buying tractor trailers, my colleagues alluded to the fact that Amazon might be planning on taking some of the delivery burden in-house and maybe taking over the sector once they understand it's ins and outs.

However, Amazon's Spokeswoman Kelly Cheeseman said "Our own delivery efforts are needed to supplement that capacity rather than replace it" referring to the surge in holiday demand and basically brushing off any speculation of Amazon becoming a full-time player in the delivery sector. Well it would appear that FedEx and UPS should get ready to be supplemented. It doesn't matter what the reality is — the perception that Amazon will win is a self-fulfilling prophecy as they will begin choking access to the mother's milk of business: capital.

FedEx and UPS, regardless of the reality, will lose a big chunk of their value as analysts begin to sharpen their pencils and look at a new gangster in the town of shipping: Amazon!

Below is an article which is the total opposite of my argument.

Here's why Amazon isn't a monopoly

Vestact in the Media

Bright chats to SAFM about Sasol's 6-month numbers yesterday - Sasol's liquid fuels volume down.

Home again, home again, jiggety-jog. Asian markets started well in the green but have since slipped into the red, Tencent is down 0.7%. On the data front, it is a rather quiet day. New Fed Chair, Jerome Powell, will appear before congress later. Given how Fed sentiment has been driving markets this year, I'm sure every word he says will be scrutinised.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment