Bales and Nokia sales

"Can Microsoft do it? The short answer is yes, I think that they can do it. Is it going to be easy? No. To topple Apple and Samsung off the pedestal that is hundreds of rungs up the ladder, it is going to take hard work. And determination. For Microsoft it is around 3 percent of their market capitalisation, but for Nokia shareholders it might feel like throwing in the towel on a terrible chapter in the company's recent history."

To market, to market to buy a fat pig. We had the US markets closed for their labor day celebrations, in which the majority of labour actually worked. And forget overtime folks, the US has the least progressive overtime pay in all developed countries, as far as I could tell. In the local market it was all fireworks, as the financials and resources led the charge. Reason? Well for starters the pleasing PMI numbers across the globe, even the local number was something to cheer, boosted the resource companies. MTN's shareprice was under pressure, perhaps partly to do with the Syrian hangover, but possibly and more likely to do with a Nigerian political splintering of current president's Goodluck Jonathan's alliance.

Check it out: Nigeria's ruling party splinters in threat to President Goodluck Jonathan. Not exactly good to have political instability in your biggest market, but the flip side of that might be saying that this is democracy at work, and that is a good thing. Uncertainty however does little to ease the nerves. And make no mistake MTN is not for the faint hearted, but envisage the countries that they operate in continuing to grow their GDP at above global rates and as such the citizens becoming richer.

It has happened and continues to happen in large part. That will continue to translate to higher mobile usage, but remember that call rates are going to come under pressure. Data is the next big jump. Imagine a world without Skype, Facebook, Twitter, Instagram and Whatsapp at your fingertips. Oh, that was just over five years ago! Talking of old numbers the English Premier League Clubs last evening had done a record 813.08 million Dollars worth of business by 22 hundred hours. More on this later, Michael will compare the pay of the biggest transfer to the despised bankers. Yes, who is really worth what?

What the .....? Well, it was something that I suppose we were expecting all along, in the wee hours of the morning here it was announced that Microsoft would be buying most of Nokia's cell phone business. Stephen Elop, an Microsoft guy who went to run Nokia, is now seen as the replacement for Steve Ballmer, who announced his retirement days ago. All good I guess for Microsoft shareholders, the companies suggested that they had been working on this deal for a while now.

Nokia is a shadow of its former self. What does that expression actually mean? Some shadows late in the afternoon can be quite long. The stock is down 84 percent in five years as the company lost handset dominance to a wave of newer smart phones that left the Finnish company ..... well, finished?

The announcement from the Microsoft investor relations website lays iyt all out for us, so we can think less and read more: Microsoft to acquire Nokia's devices & services business, license Nokia's patents and mapping services. Price tag? EUR 5.44 billion in cash. "EUR 3.79 billion to purchase substantially all of Nokia's Devices & Services business, and EUR 1.65 billion to license Nokia's patents"

Microsoft shareholders (I mean the company) get another 32 thousand mouths to feed, 4700 folks in Finland and 18300 employees "directly involved in manufacturing, assembly and packaging of products worldwide." Nokia might have lost dominance over the last 5 years, but the company still managed to sell 53.7 million phones in the last quarter. But as this sort of recent graph from a lovely piece from Visionmobile's blog titled The Apple and Samsung Profit Recipe shows it is actually not about the volumes and absolute numbers, but rather the profitability of the products that you sell.

Consumers are drawn to a wonderful product, and don't get me wrong, price point is very important, but the most expensive products are usually the best from a consumer experience point of view. But this is telling, the profits of smartphones belong to two companies, Samsung and Apple. Check what Nokia used to be and what it was, not so long ago.

Can Microsoft do it? The short answer is yes, I think that they can do it. Is it going to be easy? No. To topple Apple and Samsung off the pedestal that is hundreds of rungs up the ladder, it is going to take hard work. And determination. For Microsoft it is around 3 percent of their market capitalisation, but for Nokia shareholders it might feel like throwing in the towel on a terrible chapter in the company's recent history. Mind you, Nokia used to chop down trees and produce paper, this is probably just another chapter.

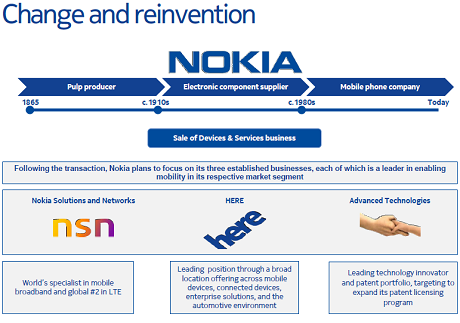

That is the question that I have not really seen asked, what now for Nokia shareholders, post the transaction. Well, luckily for us the investor relations people made us a slideshow to show us exactly what Nokia are going to do. Download the presentation and then scroll to slide 11 titled: Change and reinvention. I have taken the liberty of grabbing the slide to show you, put your glasses on:

Here, NSN and Advanced Technologies. That is what is left of Nokia. That is all I guess folks, good luck to Microsoft!

Michael's musings discusses the topic of underpaid CEO's.

- The last day has been filled with how mind boggling Gareth Bale's salary is. In Rand terms it amounts to (based on Rand/Pound of 15.94) R4.7 million a week, R680 000 a day or R 248 million a year. The highest paid CEO of a locally listed company was Whitey Basson of Shoprite who earned R40 million, or in percentage terms, 16% of Bale's salary.

Looking at this from an international point of view, Bale's salary is not as stratospheric as it first appears. Bale's salary of $24 million a year, will put him in the league of the average pay for CEO's of fortune 500 companies, where the someone like Jamie Dimon, the CEO of JP Morgan earned $18.7 million.

A measure that is used to see if CEO pay is too excessive is the 'CEO to average worker' ratio. How the ratio works is to take the CEO's full package and compare it to the average worker's salary. To do this for a soccer club is a bit more difficult, so I made a couple of conservative assumptions. Given my assumptions Bale's income is 390 times more than the average salary of a worker compared to the ratio for Fortune 500 companies is 204.

In summary all these salaries are determined by a free market, meaning that someone thinks that they are worth what they are paid. On a more worrying note, we can see that South African CEO's are under paid, and as it is strike season, they could consider going on strike themselves.

Home again, home again, jiggety-jog. The US is back online today, at 15:30 local time. Enjoy that open whilst it still lasts folks. I checked and was thrilled to see that the 3rd of November is the date that the US end their daylight savings, which means that from then on until the 9th of March, the US markets will open at 16:30 local time. That stinks for us, and is the worst thing about summer time here. British "summer time" ends on the last Sunday in October, so we still all have time. There are deals aplenty, and sizeable ones starting to happen after the Northern Hemisphere summer. The deal making activity would NOT happen without a level of confidence in the global economy. Sure there might be some bad patches here and there, but on balance "things" are looking up.

Think about this for a second, it was a tweet that I sent out this morning, I had to do a double take just to make sure that my math was indeed correct: "Microsoft/Nokia. That is 54 and a half Gareth Bales! Or less than 5 full football teams at that price. Nuts." 5.45 billion Euros for the Microsoft and Nokia deal on the handsets, if the top five teams in order of finishing in the English Premier League had a starting XI (forget the reserves) the same price tag as Bale, the two would be the same. Just the folks who take the field, forget the clubs themselves. Oh, and Nokia is up 40 percent this morning. But it is still a million miles away from the all time high, currently 4 Euros plus. The all time high? Nearly 28 Euros back in late October 2007. Still down 85 percent after the big move today.

Sasha Naryshkine and Michael Treherne

Follow Sasha on Twitter

011 022 5440

No comments:

Post a Comment