To market, to market to buy a fat pig. Carl Quintanilla, an American CNBC anchor said something yesterday that pricked my ears up, he said that the Dow Jones Industrial Average (the index) had never had four straight days of triple digit gains. This was relevant because in the prior three sessions that had happened, triple digit gains for the Dow. But last evening the record was not reached (the Dow ended down 26 points), even though jobless claims were at a 7 year low. And those numbers, falling below that 300 thousand weekly number for the first time since April 2006 put to the collective the tough question: "is good news bad news?"

I guess the fact that two states, who did not report the numbers properly (computer upgrades was the reason given) suggests the number was skewed. See here -> Jobless Claims Fall To A 7-Year Low.

But, the employment picture has been improving and that bodes well for the Fed stepping away from their bond buying program, announcing this next week no doubt. The Fed has wound down various programs before, perhaps not of this scale, but without disrupting the market. The whole idea that extra liquidity has somehow found its way into gold does quite seem plausible to me. People buy gold for historical reasons related to inflation, fear and as an alternative to currencies that the buyer (of gold) can't trust. Or so it is from where I sit, there must be many, many more reasons why people choose to buy gold as an asset class. So I shan't open Pandora's box. And we are all friends around here.

Regardless of what the Fed does next week, ordinary folks will buy iPhones, use a lot of data, buy food, use electricity and water, make use of healthcare services, fill up their motor vehicle, go to work, go back home and on and on. The world does not come to a standstill. There are many people involved in financial markets, but a lot more people outside of that. Money might make the world go around, but real people make up economies, not numbers.

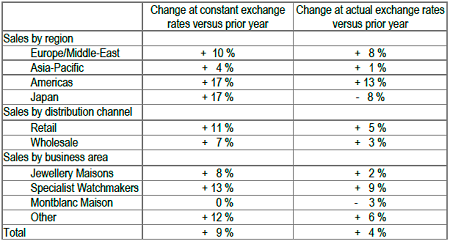

Richemont released a trading update that Mr. Market was not too happy with, expectations were missed. Just a bit, not by too much. The sales update (fairly short and sweet) can be downloaded here: RICHEMONT REPORTS FIVE MONTHS SALES AT ANNUAL GENERAL MEETING. Two surprises and I am going to use the table from the release to illustrate the point I want to make:

Check out the sales in the Americas and Japan, showing huge movements, whilst Asia-Pacific has been subdued, indicating that Chinese policy makers with their crack down on "gifting" is filtering through, as anticipated. That is the first point I want to make, sales in the developed world are starting to pick up strongly, whilst sales in the fastest growing (and now biggest) market of theirs, China, is starting to slow.

The second point I want to make is the Richemont sales in Euros, because whilst the company may be listed in Zurich, they report their numbers in the common European currency. The one shared from Athens to Dublin. In fact there are 17 official users inside of the Eurozone, 8 official users outside of the Eurozone (small places like the Vatican and Monaco) AND 3 unofficial users, including our neighbours to the North, Zimbabwe. Remember when the weakening Euro helped sales? Well..... it is different this time around, as they point: "At actual exchange rates, sales rose by 4 %, negatively impacted by the weakening of the US dollar and the yen against the euro."

What does this mean as a Richemont shareholder? Should you be spooked that sales are slowing? No, not really, because the business I suspect will continue to attract newer and more customers. Check this out: Where the World's Millionaires Live—in 1 Graph. These are from last years "wealth report" but I suspect that we will continue to see the wealth of the developing world continue to rise.

What is quite interesting from this Economist piece: Cities and their millionaires is that Frankfurt has more millionaires relative to the rest of the cities inhabitants. I bet you 20 years ago that list would not have included Moscow, Shanghai, Mexico City, Beijing or even Seoul, let along Hong Kong! The world is changing, there are more of us and we are getting richer. That bodes well for businesses (like Richemont) that sell timeless and desirable luxury goods.

Five years on this weekend is the anniversary of the demise of Lehman Brothers, the investment banking firm that was founded in 1850. And that declared bankruptcy in 2008, as of yet the complicated structure has not been unwound. See this FT article from last evening: Lawyers and accountants log $3bn payday in Lehman aftermath. That headline tells you a lot, the structure was and is so complex that the folks untangling it have reaped 3 billion Dollars thus far in trying to determine what belongs to who and how much. And as the article points out, the 3 billion (over five years of course) Dollars is less than the inflated profits that Lehman Brothers reported in 2005, 2.36 billion Dollars.

If you read the article further, you will see that not everyone ended up with zero, zilch, nil, in fact it turns out that some creditors have made a handsome return in Lehman's European business, which was the most complex of all. But the aftermath and fall out was massive. And all I have to add to this is that Hank Paulson, Ben Bernanke and others like Neel Kashkari along with the bumbling policy makers (too slow for the markets liking) and of course the financial institution heads all did their best to keep the ship afloat. They bailed water, they fixed large holes, they did everything to shore up confidence. And it worked.

Again, I make the point that there will and would be those types of people who are purists, and would have preferred to see the system take care of itself. Let the market sort out what was a markets mistake. Well, you could argue that policy makers themselves were asleep at the wheel. Ben Bernanke is one of the best students of the Great Depression, perhaps the best around. I remember exactly two years ago an interaction that I had with a reader of the letter. He was worried about the debt issues, which still exist. But my answer (13 September 2011) I think still holds true. I was talking about the state of government revenues:

What would happen if revenue collections improved?

And if government programs designed to normalise and keep confidence at a better level than they were back in those dark days of late 2008 had not been implemented?

Well, Ben Bernanke was a student of the great depression, this is what happened when normal market forces were allowed to decide what should and shouldn't happen:

An extract from this fairly well written piece Great Depression :

"In the United States, the Great Depression began in the summer of 1929. The downturn became markedly worse in late 1929 and continued until early 1933. Real output and prices fell precipitously. Between the peak and the trough of the downturn, industrial production in the United States declined 47 percent and real GDP fell 30 percent. The wholesale price index declined 33 percent (such declines in the price level are referred to as "deflation"). Although there is some debate about the reliability of the statistics, it is widely agreed that the unemployment rate exceeded 20 percent at its highest point."

There was zero policy response all through to 1932 whilst GDP contracted by one third, whilst the unemployment rate spiked to 25 percent.

Which one is the worse of the two evils, "kicking the can down the road" to when revenue collections improve (corporate America is more profitable than ever before) and the hiring starts. It will.

Or the option of just letting all the banks go that were not fit enough to survive, 40 percent of all banks in the US failed post the Great Depression. Not good.

So there you go. "Things" have improved. To the point that we are talking recovery in Europe. Right now, as we speak, the next bit of financial engineering that will lead us to the next hiccup and sell off in equity markets (and cause some bond holders enormous pain no doubt) is taking place. You can try and stop humans from chasing wealth and pushing boundaries by defining the parameters, but invariably humans at the coal face are too smart for the law makers. I guess that is why businesses employ revenue generators!

Michael's musings: A little birdy told me

Twitter announced that they have filed to go public. The announcement was fittingly done via a tweet:

So I guess we were told by a little birdy.

Twitter's financials have not been made public yet due to them filing under a new law called the Jumpstart Our Startups (JOBS) act, which allows them to keep their financials private until shortly before the sale. Last month GSV Capital Corp, a venture capital company who own part of Twitter, valued it at $10.5 billion with speculation by analysts for the listing value sitting higher at $15 billion, but that depends on assumptions about what the financials will show.

What we do know from the filing is that Twitter has revenue lower than $1 billion, due to the $1 billion revenue limitation for using the JOBS act. Current revenue levels are all speculation, but the estimation is that it sits at about $550 million and will grow to $1 billion for the 2015 year, putting the growth rate at about 35% annually. The revenue is generated from adverts being placed in between other tweets, of which there are 500 million tweets a day, with the record for the most tweets in a second being 142199, I found these facts on this Bloomberg video, it's a quick video with a couple other facts.

Listing will allow Twitter to raise funds to use for further growth, and probably more significantly in this case, it allows venture capital companies, who were early investors, to exit their positions in an easy manor and at a higher price due to the generally higher price that listed companies get given.

On the topic of big name IPO's, Hilton has also filed for an IPO. The company was taken private by Blackstone in 2007, where Blackstone bought Hilton for $26 billion. Hilton is now valued at around $30 billion and hope to raise $1.25 billion in the IPO, making it the largest lodging company IPO.

This week has seen big positive news for the economy, with Verizon having the biggest corporate bond sale in history (almost 3 times the next biggest) and today with the news of two high profile IPO’s. Long live the 'green shots'!

Home again, home again, jiggety-jog. It is here then, the Twitter IPO announced just half a decade after an old investment bank went bust. New technology versus old technology! New almost always wins. But at the start we are not winning today, Friday fatigue starting to set in.

Sasha Naryshkine and Michael Treherne

Follow Sasha on Twitter

011 022 5440

No comments:

Post a Comment