To market, to market to buy a fat pig. Over in the US market participants were wrestling with the idea that the US could be preparing themselves for a strike on Syria, both the Senate and House now get to vote. And seemingly there is support on both sides of the political spectrum. There was a Gideon Rachman FT article that I tweeted yesterday in which he suggested that the world needed the Americans as the police of the world, because I can't see any other nation wanting that job for the moment. Not the Chinese. Nope. They might just veto any military action, but they are not as vocal as the Russians who will continue to supply the Assad regime with weapons. So if an American strike does come, this will be another test of American weapons against Russian weapons. That has happened a lot over the 60 years, just not so much recently.

The repercussions of such a strike for a war weary public in America and also regional political muscling in the Middle East are not known. Perhaps that would have been more (or less) eloquently put by Donald Rumsfeld. But as equity investors we cannot know what the short term anxieties about these events hold in the medium term, we must continue to invest and buy good businesses that will deliver above inflation returns to the owners of the business, the stock holders. So if there is an opportunity, then you should act. Always be adding. US markets struggled to build momentum after a day off and a futures market that had pointed higher on encouraging PMI data across the globe, but after all was said and done, the day ended with a modest upswing. We wait for more information on where to next from US politicians!

Discovery released results for their full year to end June 2013 yesterday, the stock rallied 3.2 percent to close at 8700 off the day highs of 8830, but pleasing after the drubbing that the stock took post the trading statement. You will remember that we covered the poorly worded trading update last week: Discovery trading update spooks market. A little birdie told me that CEO Adrian Gore was out of the country on business, and he was less than pleased. Yesterday however he put his best foot forward, the guy really looks good for someone who turns fifty next year, even though there is a little greying at the edges, that is a sign of age, which means more experience. Right? Right!

This company is an innovative one, a disrupter in their markets where the company is not the leader is what Gore said during the presentation. Which I watched from the comfort of my own desk, thanks to DStv and channel 412 for broadcasting. He made a good point about a medical insurance company, you should in theory NOT like the business, because you always feel like you do not get full freight value.

In other words, when you pay a lot for your medical insurance, you somehow don't feel like they are "there" when you need them, but somehow you feel like other people get too many benefits. Let us face it, we live in a country where if you are able to afford private healthcare, you are lucky. And their members have grown as more middle income people share the view that medical insurance and quality healthcare is non negotiable. For me at a personal level that is exactly the case.

And then there is the innovative part, the fact that the company is streaks ahead of their peers in terms of product offering and pushing the boundaries technologically speaking. At one stage during the presentation, Gore tried to replicate an easily done test using an application on an iPhone to test a fellows blood sugar. It did not quite go according to plan, but we all got the idea.

I said here in the office that the Vitality premium paid as members was an amazing product, you pay the company to let them know how healthy or unhealthy you are. As such they can adjust their risk profile for a specific individual based on their food consumption and exercise regime. But the onus is on you to make sure that you pull your weight, both figuratively and literally.

That is all rather *nice* knowing that Discovery knows enough about your health to make sure that they can offer you life and short term insurance knowing more about what you are eating, and how you are driving, but what about the numbers? Firstly, the business now operates in 5 different geographies, South Africa, the United Kingdom, the US, Mainland China and more recently Singapore. 2.76 million lives are now covered by Discovery Health here in South Africa, I thought I needed to throw that in. 20 years ago that number was basically nothing. Zero. The Vitality program has 5.5 million folks across all their geographies. Here is a slide from their presentation (which you too can download -> Annual results presentation) which shows the geographies in which they operate and the company structure:

Normalised headline earnings grew 20 percent to 2.787 billion Rand, dividends for the full year grew by the same amount to 124.5 cents per share. Embedded value was up 18 percent to 35.7 billion Rand, or translating to 64.48 ZAR a share. Basic earnings per share fell to 372.2 cents per share. With a share price at 87 ZAR that seems rather stretched on an out and out valuations basis, but remember that we are taking into account some complex actuarial calculations. I guess some other important metrics are that their cash generated from operations increased 45 percent to 2 billion ZAR.

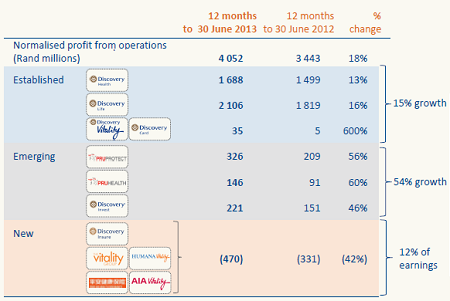

I guess in part why the company commands a premium to their peers is their presence in the market and the ability to disrupt set industries and do it well. Their invest and insurance entrance to what was considered a fairly saturated market has been cross sold really well. That said, the two main business that generate all the profits are their local health and life insurance businesses. Check out slide 15:

I am confident in this management team. After all, Adrian Gore is only 49 and still has great ambitions for this business. It is an innovative growth business in a sector that people are starting to tackle lifestyle choices with greater gusto. Even the best old investor in the world, Warren Buffett suggests that your health is the asset that you should look after the most. In the medium term this bodes well for Discovery's life business, the healthier they can keep their members, the better for claims later. And members are incentivized with discounts as well as cash back on healthy foods and life premiums. And something that Discovery does well is cross sell across their product lines. Their investment retail products are not cheap (and by extension good for the company) and they are making good inroads into the short term insurance market.

Adrian Gore holds over 9 percent of this business. 53,769,883 shares as per the 2012 annual report. 4,677,979,821 Rand as per the closing price last evening, or 4.677 billion ZAR. I have been told by people who know him well that it is not about the money for him, and that sits well with me. It is about the thrill of changing society and business. We still continue to add to the stock, this is still a good growth company with a fine and compelling product. In markets both developed and developing that are embracing change.

FirstRand released a trading update yesterday that is a little consuming, but at least the company guides you towards the metric that they think is the most important. Diluted normalised EPS, for what that is worth. Diluted normalised earnings per share are expected to be 19 to 21 percent better than the full year number this time last year of 225.8 cents. Quick math tells you to expect 270 cents per share, which is marginally better than what Mr. Market was anticipating. A dividend of around 130 cents for the full year is anticipated.

The company still commands a premium to their peers, in terms of their stock valuation, and that is because of their innovative approach in which they are gaining market share. We will see in six days time, results are anticipated on the 10th of September. The stock is still around 7 percent off their highs reached in late January, but comfortably off their June lows of 26 and a half. Currently trading at around 30 and a half ZAR.

Michael's musings has a look at a business that came back from the dead, one that if you know well you are older than you think. Here goes: Kodak without moments:

Kodak are back but have left their moments in the past. A leaner Kodak emerged from bankruptcy yesterday, having sold their camera, film and photo businesses which they were known for. In January 2012, Kodak filed for chapter 11 bankruptcy protection due to the weighty matter of liabilities of $6.75 billion and assets of $ 5.1 billion. The result of the bankruptcy is a restructured business, a new set of equity holders and debt holders having a haircut. Kodak managed to cut about $4.1 billion in debt with unsecured creditors receiving between 4 and 5 cents on the dollar (Ouch, this is closer to a clean shave than a haircut), and shareholders were left empty handed.

The new company is going to be a high-tech printing company, which will have three core operations; functional printing, packaging and graphic communications. The functional printing business will be targeted at competing with current ink jet printers, where the Kodak printer will have a higher resolution and a lower cost per page.

Kodak is also in the development phase of a cheaper touch screen for smartphones and tablets. Kodak plans to use their printing technology to lay out super-thin metals, which will make the screens cheaper, more effective and give screens the ability to be flexible and foldable.

Kodak's last division is packaging, where they are hoping to use printing to create smart packaging. The packaging would have sensors that will give consumers information, which could for instance tell consumers that the product has been out of the fridge for too long.

It is still too early to tell if the restructuring will work; for the company that was founded in 1880 and who were part of many memories (Kodak moments) for decades, I hope that it does work.

Home again, home again, jiggety-jog. Markets are lower here to begin with, the late selloff in the US was done when we were thinking about bed time and not deep in thought at our desks. US futures are pointing to a flat opening that side of the Atlantic, in case you were not aware, this week is the monthly jobs data week. And that generates an enormous amount of excitement, although expectations are pretty lukewarm for this number, somewhere in the region of 170 thousand jobs were supposedly added last month. August, the happy time in the Northern Hemisphere. September is a very happy time here, we can think about that first dip in the pool again, someone told me that they went already on Spring day, tough crowd!

Sasha Naryshkine and Michael Treherne

Follow Sasha on Twitter

011 022 5440

No comments:

Post a Comment