To market, to market to buy a fat pig. Ukraine and the Crimean crisis seems so far away now. Hey. I forgot to divulge that not only was my great grandmother born in the Ukraine, but my grandmother (my mother's mother) was born in Sevastopol, the capital of Crimea. So that makes me an expert on both the Crimean region as well as the Ukraine. Lucky for them, they left swiftly around the time of the Russian revolution for greener pastures. They ended up in Algeria and then France, with my mother's family living in Paris. So I guess that makes me an expert on France then, right? Wrong.......

In Jozi yesterday equity markets closed at a record high. Did they? Yes. 48105 points to be exact, the intraday high was 48263. What is in a number though? There are many laggards and many new entrants into the upper echelons of the market capitalisation ranking tables. When the commodity stocks were roaring back in May of 2008, there was no listing of British American Tobacco back then, although arguably it was "there" inside of Richemont and Remgro. No Glencore Xstrata back then. Sasol was NOT bigger than Anglo American by market capitalisation. Yes. This is true now, if only by a whisker, Sasol in Rands is a bigger business than Anglo American. Naspers was not a half a trillion Rand company, by market cap. And Richemont was around one sixth of the price it is now, when it unbundled the cigarette business.

But yet, we only have twenty companies with a market capitalisation in excess of 100 billion Rand, Steinhoff the last on that list in twentieth place, with a market cap of 113 billion Rand. Likely to get bigger, right? More Steinhoff shares going to be issued for acquiring JD Group. Just last evening Steinhoff announced that it had received more acceptances for their offer to JD Group shareholders, and once the swap had been settled, they would own 83.9 percent of the furniture business. Guess who is the uncle now? Sorry, I am not an expert on company law, but read a guide from Bowman Gilfillan (so I must be an expert, right?) which suggests the following: "the compulsory acquisition of minority shareholdings when an offerer acquires 90% of the shares in the target." Watch closely.

Talking of unbundling, the talk that BHP Billiton could let go of their "weaker" performing businesses and focus on the core sent the price in London up 0.35 percent. Oh dear, that is nothing. The two ADR's (BHP and BBL) performed a whole lot better, BBL was up 1.85 percent, whilst BHP was up 2.05 percent in a rising market in New York. This morning the stock in Sydney is up 0.86 percent. Locally the stock added 1.76 percent. As in the old days when the sun never set on the British Empire (all their "territories" on a world map were in pinkish), the sun never really sets on the BHP Billiton share price.

I suspect that a slimmer and more profitable business would be appealing for the majority of shareholders. Bigger is not necessarily better. Talking of bigger, another announcement from BHP Billiton this morning, this time from their coal division: BHP BILLITON DISCUSSES THE GLOBAL OUTLOOK FOR COAL AT CEDA. Interesting, still very committed to their coal businesses. I have seen several broker reports upgrading the outlook for the company, and suggesting that this is a positive.

To some it may come as a surprise, to others it is expected. The resignation of Dr. Jonathan James Louw as the CEO of Adcock Ingram was announced after market, the good doctor will go "pursue other interests". Which is code for I am not sure what. Think about life in the corporate world and have another go somewhere else. I have no doubt that he will pop up somewhere else, he is only in his mid forties.

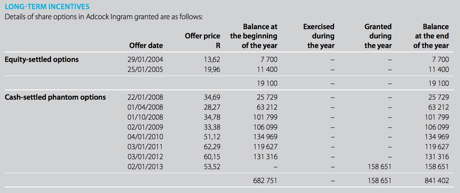

According to the 2013 Annual report, there were only 2 directors who held a total of 48,450 shares in the business, that represented a negligible amount that did not even register on the 201,128,009 shares in issue. In the two years as per the annual report (where directors remuneration is dangled in the open), Louw made good money, over 8 million Rand. He had however exercised options, the gains on those were 9.3 million Rand. Good work if you can get it. At the end of 2013 Louw held a mere 39300 shares. Loads of options though. But that is the deal. Check out the extent of those share options:

Phew. As well remunerated as one is in the corporate world, the shares and specifically options are the "best" part. Provided of course that the share price does well. Over the last three years the stock has gone sideways. Since they unbundled from Tiger Brands in August of 2008, the stock is up 71 percent. Measure that against the All Share index which is up marginally more than Adcock over the same time frame. But most of that outperformance of the all share index, against Adcock has been in recent times when the share price, post the PIC and Bidvest consortium (with CIH) having control of the business now, has fallen. The Chileans are gone. Poor chaps had a serious earthquake overnight, that is not that great.

So Bidvest essentially get what they want, a new management team with a new vision for the business. The new CEO will be announced in due course. I think that the only reason why I pointed out that he, Louw, had very few shares now, is a) it is not much of a issue in terms of an overhang to an already weak share price, but more importantly b) as a shareholder of any public company, you would want to have your interests aligned with the management.

I would want all the businesses that I won to definitely have management in knee deep in the business, as an equity holder. Management cannot control the share price, most certainly not, but they can control how well the business operates. And if their interests are aligned with yours, then you are in for a better ride. Not always, a lot depends on the business itself of course (you cannot give the best management team in the world a rubbish business to run), but as a shareholder it feels better when interests are aligned, and shares are options are not viewed as remuneration. I think Bidvest think this too, hence the resignation of the CEO.

Lynx, I'm reading this, you should too

These come around every month, the AIR FREIGHT MARKET ANALYSIS. The Middle East Freight market growing like crazy, but that is because Emirates, Etihad and Qatar are growing like crazy. They are collectively know as the MEB3, the Middle East big 3. What is quite interesting is that South Africa was weak, but the African numbers are volatile. Good to see that this is moving in the right direction.

The payment is nothing, really, but the principle is everything. So that is why when dealing with a payment of around 5000 Dollars you would not expect it to set off an international mud slinging match. But it depends if an American bank (JP Morgan) is being asked to pay a Russian bank that is on the "no-no" list. It happened, check it out: Russian threat to retaliate over JPMorgan block. File that in the drawer of unintended consequences to your actions.

Its jobs Friday. Not today, but rather this Friday coming. Today is the ADP report, the private payrolls. But, according to the Business Insider People Are Thinking The Jobs Report Might Be Really Big. More positive data for the markets, which in the US overnight saw the S&P 500 trading at an all time intraday high.

Home again, home again, jiggety-jog. Markets are higher again here. A new record high. Things must be really bad out there.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment