To market, to market to buy a fat pig. It was a big day for the local equity markets, dampened a little at the end by valuation concerns for specific patches of the market. The high flyers. The companies that the market and all the participants chose to target were naturally the companies that had enjoyed higher valuations relative to the rest of the market. The whole Icarus argument, the closer you fly to the sun with your wax wings, the more chance of your wax wings melting. Hey, talking Greek mythology, did you see that the Greeks managed to raise 3 billion Euros in a five year issuance for a mere 4.95 percent yesterday? Yes/No?

Check -> Greece Triumphs in Bond Odyssey. Whilst it only represents one percent of Greece's outstanding debt, with strong demand too. Many more people lining up in a low interest rate environment to buy Euro denominated debt at nearly five percent. And for all the Euro detractors out there, where are you now?

Ok, back to the tech sell off. Biotech, which technically speaking is medicine and science and technology all interwoven into one has been dealt the heaviest hand sell off. Michael Catt, England's former rugby full back (WC 1995 Semi Final) only knows what pain the sector and their respective shareholders have felt. Phew, that was an epic run over. IBB, which is the NASDAQ Biotechnology index, and which includes big names like Amgen, Celgene, Biogen and Gilead, was crushed over 5.6 percent last evening. Over the last month it is down nearly 15 percent. Over three months the index is down 7 percent.

Over the last twelve months the index is down up nearly 39 percent. Amgen trades on a 17 multiple, Celgene on a more lofty 41 times, Biogen trades on 36 times earnings, whilst Gilead trades on 36 times as well!! Big Pharma comparisons see GSK on a 14 multiple, Pfizer at 18.5 times whilst JnJ trades on a 20 multiple. These are all historic. Amgen (as the biggest index constituent of the Biotech index) is on an even keel relative to the "big pharma" stocks.

Gilead however, as well as Celgene, Biogen and Amgen are developing newer more exciting therapies and as such have been growing faster, slightly better margins and enjoying and attracting money from the investment community as a result of not having old legacy therapies. As such the investment community, the broader community that includes all and sundry with different time frames (yesterday's message, remember?) have juiced up expectations of these companies. However (and but of course) Celgene trades on a CY estimate of 19 times and a 2015 multiple of 14.5. Amgen trades on a current year expectation of 14.5 times earnings. Biogen trades on a lofty 25 times current year, but a more reasonable 14 times next year.

So quite quickly you can see two things here, one and possibly most importantly for the price, the earnings expectations are VERY lofty and the prices have been primed for perfection. An earnings stumble here would be a disaster. Secondly, and perhaps why these companies and their sector finds itself in a different space is the fact that they have real growing earnings and businesses alongside lofty priced shares. It is different, back then the stocks were rated highly and the earnings were non existent. That is why I think that it matters this time around.

Moving onto the much trickier technology sector, and because that is very broad it includes the likes of LinkedIn (call it your CV online, replacing the traditional methods slowly), Tesla which is a motor vehicle manufacturer, Amazon.com which is an online retailer priced as a growth tech stock, as well as the likes of Facebook and Twitter. LinkedIn trades on a historical multiple of 777, Current year (CY) it is 104 and 2015 earnings should see the PE shrink to (a still lofty) 60 times. Tesla. It made a loss. But is going to make a profit, at least that is what the analyst community thinks. So the suggestion is that the company will trade on a CY PE of 126 times at the current price and a 62 times earnings multiple next year. Ford trades on a current multiple of 9 times, for a little perspective. But Ford is not trying to change the world (it already has), well at least from where I sit.

Amazon.com is building a huge network and disrupting retail as everyone knows it. That requires all necessary resources to be sucked out of the business, and as such the company trades on a 542 multiple. CY the analyst community reckon that the company is going to "make" 1.95 Dollars worth of earnings, which translates to a 171 multiple. And forward to next year, 81.5 times. Holy smokes, still incredibly expensive for a retailer masquerading as a tech company, but essentially they are a big mixture of both. Facebook trades on a 90 times earnings, 45 times CY earnings and 33.6 times next years earnings. Twitter makes a loss. Twitter is expected to make only two cents a share this year and 22 cents next year, which means that at current levels they still trade on a 2015 multiple of 193 times. Yowsers. But, as Dick Costolo, the CEO said, once you get Twitter, you cannot be without it.

As you can however see with all these businesses mentioned, lofty expectations have been built in. On the other hand, businesses like IBM have a 2015 forward multiple (on earnings expectations of 19.87 Dollars of earnings per share) trade on a 9.7 times earnings. However, in the eyes of many an investor, IBM is at the wrong end of the market, but admittedly catching up quickly and shedding legacy businesses. Apple, an exciting company in my book, trades on a 13 times historical multiple with a 12.26 current year expected earnings multiple, with 2015 lower at 11.26 times. But as you can see, earnings for both of these businesses are not growing at the same pace. Or, let me rephrase, not expected to grow at the same pace.

This is a reset. There are always resets. We just saw a miss from JP Morgan, with their mortgage business and trading business under pressure, first quarter revenue shrank by 8 percent when compared to 2013 Q1. Earnings were lower and missed estimates by as much as 8 odd percent. What that does represent however, the JP Morgan numbers aside, is that we have started one of our favourite seasons. Earnings season, for the quarter past. Next week includes the likes of Citigroup on Monday, Johnson & Johnson, Coca-Cola, Yahoo and Intel on Tuesday, AMEX, Google and IMB on Wednesday, with Du Pont, Goldman and GE (pushed a day forward) on Thursday.

Friday, well, take that off fellows and revert the next week. Exciting times and a great look again into the real reason why we own shares, the associated companies that report numbers, and transpose that against their share prices. And then perhaps as a collective we can see what level overall the markets should be at. It will be interesting to see in the commentary whether or not "things" are improving across several territories. GE, IBM, even Intel will have global commentary. Google will always be refreshing. Fun times!

Byron beats the streets:

Yesterday we received Chinese trade data which as you can imagine is an important number to look at because it tells us export and import numbers for the country. Basically what the global demand is for Chinese products and what kind of appetite Chinese consumers have for global products. The number was disappointing, exports dropped 6.6% and imports dropped 11.3%. Before you panic, this number is terribly volatile and could just as easily be up 10% next month.

There have also been some worries about the validity of this number, not because the government are tampering with it but because companies were lying on invoices to sneak money into the country. Apparently this took place heavily during this time last year which artificially inflated the comparable number. So I guess this normalisation is a good thing because the money laundering is being phased out.

This brings me to my next point. Ignore these numbers. Rather look at a more smoothed out number for the whole year (so far this year, Chinese exports are up 4% excluding Hong Kong). But more importantly look at company earnings, they are the ones who are operating on the ground floor and because China has become so influential, will talk about demand from China specially.

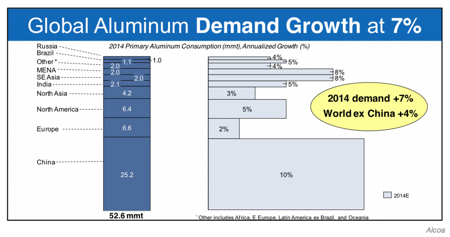

For example look at Alcoa, the biggest Aluminium producer in the world who released results 2 days ago. Here is a page hacked from their presentation.

As you can see, China's demand growth is growing at 10% and is accountable for nearly 50% of demand. In fact China is so significant for growth they give you the figure without China just for perspective. Alcoa sparks the start of the US earnings season and we will be monitoring it very closely over the next few weeks. That is where I will be getting my information from.

Home again, home again, jiggety-jog. Mr. Market has sold off again. Stocks swinging wildly one way or another. Stay the course, hold the quality. Always.

Sasha Naryshkine, Byron Lotter and Michael Treherne

No comments:

Post a Comment