To market, to market to buy a fat pig. Ukraine, the Crimea, agitating and the unnecessary loss of life. All rather strange to many, but if you are a Ukrainian or a Russian, it is a very emotive issue. I guess we just do not understand the centuries of history of living side by side and the trust issues (lack of) run very deep. The Russians think that the Russians who are in the Ukraine are "theirs" whilst the Ukrainians feel that the Ukraine is theirs. I think in the simplest terms, that is about right. To try and find a measured view, which factors on both sides and their theories on the world is just plain tough and almost impossible.

The Russians accuse the Western Press of being completely biased, the West sees the Russians as aggressors and just plain crazy, comparing the Russian invasion to the Sudetenland annexation by Nazi Germany in 1938. As far as the Germans were concerned, the German speakers in Czechoslovakia as it was then, were around one quarter of the entire population. All I can say is that I really do not understand the situation, but everyone certainly recognises the hostilities of both parties as being potentially very negative. Sigh, if only we could all start the sentence, on my planet earth, rather than in my country. Just this morning S&P have downgraded Russian debt to BBB- with a negative outlook. That is a single rung above junk.

As a consequence of the heightened tensions in the Crimean area and Eastern Ukraine, markets have sold off a little this morning. Yesterday the markets locally touched 49 thousand points and closed at a record high, 48,935 points on the Jozi all share. We came off the very best levels, which were around three thirty in the afternoon, driven by better than anticipated earnings out of the US, and some decent durable goods orders for the prior month, March of course. These positive numbers were somewhat offset by a worse than anticipated weekly jobless claims number. But as that market slipped a little, and stocks sold off in the US, the local market sold off from their best levels.

In the US stocks ended the session mixed, the NASDAQ the best of the bunch, up over half a percent boosted by the 8.2 percent move northwards by Apple inc, we wrote extensively about that yesterday. Apple now has a market cap of 489 billion Dollars, the company reaching that magic half a trillion Dollar mark over two years ago. Since then of course many things have happened. I am glad that the market is focused on earnings, which so far have beaten estimates by quite some margin. But yet a fair amount of negativity abounds, and that in a sense is good for longer dated investors. One definitely needs the naysayers to balance the levels. For every seller there is a buyer of course. Dumb comment, but if there were no sellers on a specific stock, that would indicate everyone thought the levels were woefully undervalued, or overvalued.

Not feeling the market glow yesterday was one of the Vestact firm recommended stocks, MTN, which reported subscriber numbers yesterday. The market liked the numbers like they liked flat and warm ginger beer. In other words not that much. The stock sank 3.76 percent to end the day at 20820 on 1.36 billion Rand worth of value! Yowsers. But to put that into perspective, it is around 35 percent more than usual. MTN trades nearly one billion Rand a day, which is strange when you think that the entire market cap is 389 billion Rand. At that sort of run rate, the entire market cap of MTN turns over in around 20 months worth of trading days, in my narrow minded long term view, that is completely nuts. We have clients who have owned this stock for around 11 years. And it is probably one of those companies that you could own for another decade, as African communication continues to evolve and grow in a data direction.

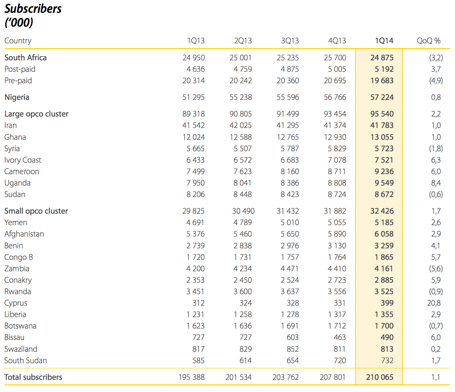

Did you see this chart of the day via the BusinessInsider which pointed to the Flurry Blog which indicated that we are turning into an addict of another kind? The mobile kind. Check it out -> The Rise of the Mobile Addict. Why is this relevant to this discussion about MTN? Well, quite simply, whilst their subscriber base growth was muted for the quarter to end March, data consumption continues to rise at a rapid rate. You can download the release here: MTN Group records 210,1 million subscribers, with that confirmation about data: "Data revenues bolster performance increasing 43,3% year-on-year (YoY)".

Concerns about two of their largest markets, South Africa where "subscriber numbers reduced by 824,768 bringing total subscribers to 24,9 million at the end of the quarter. This was largely due to the disconnection of 973 064 subscribers who had been showing activity but not generating revenue as per our 90 day RGS requirement." And then in Nigeria, where a one month ban of sales of sim cards saw a marginal growth in the subscriber base to 57.2 million, but market share slipped to 49.3 percent. In Iran and Ghana, subscriber growth was only 1 percent too, not helping the larger four of their markets. ARPU's slipped, we are still in the zone where call rates will continue to fall (here locally MTN have slashed call rates to send a clear message to Cell C), but data will continue to become a whole lot more dominant.

So here are the subscriber numbers for the quarter:

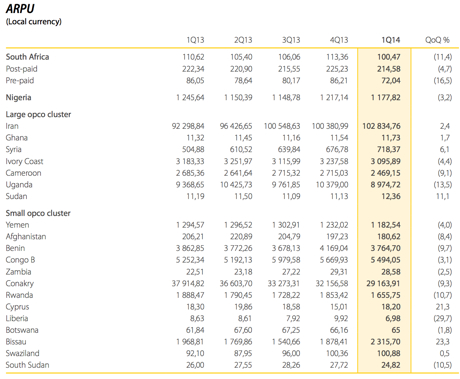

And then the ARPU numbers:

OK, so you see the trend. Lower and lower on the ARPU's as calls get cheaper. What we noticed yesterday too was that Cyprus being the only mature market of MTN was seeing increasing revenue per user. On a side note, the S&P ratings agency upped their credit rating of Cyprus, so in part this uptick must be associated with a stabilisation and recovery of the country. I am guessing out loud here, but the Cypriots are probably very grateful that they did not side with the Russians.

We are not worried about the overreaction. ARPU's are astonishingly low and the data revolution will take place alongside better priced handsets primed for web functionality. I remember everyone saying in 2011 (around then) that the mobile companies were mature here in South Africa. Short term and narrow thinking. We continue to accumulate what is a great business.

Visa. The card that supposedly takes you places and enables you to be in a cashless world, engaging through the best payment network in the world to debit your account, in your currency. Making it easy to perform the same transactions both inside of your borders and in other countries across the world. The direct translation from Latin for Charta Visa to English (according to Wiki) is "paper that has been seen", which makes sense why the business is called Visa. Nice. The company operates in over 200 countries and territories (36 million merchant locations) and according to the 2013 Annual report, the company has four defining characteristics:

1. We are a payments network.

2. We are a partner and enabler to those who have direct relationships with consumers, businesses, merchants, and now also those who can accelerate the electronification of payments.

3. Superior technology and innovation are critical to our success.

4. We strive to always be the best way to pay and be paid for everyone, everywhere.

As such, this company falls broadly into two investment themes for us, firstly consumer related activities and secondly technology. More upwardly mobile consumers able to spend more money in the consumer space. The company can process 47 thousand transaction messages a second. Everyone expects this payments system to work all of the time. Visa are trying to enable a cashless world, where checks and physical cash will be a thing of the past. The win will be for everyone, the consumer, the service provider and do not rule out the regulators, who would love to have an electronic record of every transaction for the purposes of taxable events. Visa is not a bank, they do not extend credit, they are a payments system enabling debit and credit card payments.

But you knew all of this already, let us take a look at the Visa Q2 2014 results, from last evening post the market -> Net Income of $1.6 Billion or $2.52 per Diluted Share. Revenue for the quarter was 3.2 billion Dollars, that is on 15.4 billion processed transactions, representing a 7 and 11 percent increase respectively over the corresponding quarters. Profits were 26 percent higher at 1.6 billion Dollars. On a per share basis they were 31 percent higher, as a result of the buybacks, 2.52 Dollars a share. That includes a tax benefit of over 200 million Dollars. Excluding that tax benefit, earnings per share translates to 2.2 Dollars per share.

The share repurchase program was 5 million shares bought above 217 Dollars a share, with three billion Dollars still available. Buy now, the share price is lower! That is approximately 2.8 percent of the shares in issue, not to be sneezed at. The dividend is 40 cents a quarter, so at 1.6 Dollars year, it is hardly a kings ransom. The outlook was a little muted, currency headwinds also saw lighter than anticipated revenue for the quarter. Revenue growth expectations were lowered by around 2 percent for the year, and that is exactly what led to a four percent sell off after hours, the stock is projected to open around 200 Dollars. Which mean that year to date it is around 5 percent down. Not good.

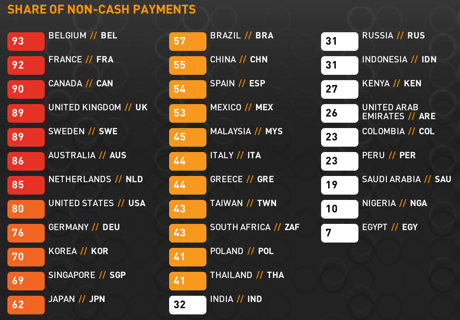

But the future of this company is really bright. The room for growth is huge. The company continues to invest and offer payment systems suited to specific environments. The purchase of South African business Fundamo (middle of 2011) has had Visa utilise that platform in Rwanda with mVisa. MasterCard have useful insight into the cash market, and why we should all be electronic:

"Today, around 85% of all retail payment transactions are done with cash, equat(ing) to 60% of retail transaction value." and "cash costs society as much as 1.5% of GDP"

And then all the places in the world where cash is still used:

Loads of opportunities for all payment companies globally, including Visa and their rival MasterCard. We continue to add to this company, using current weakness, and it remains a firm buy.

Byron's beats

Yesterday evening we received second quarter results from Starbucks which came in line with expectations. Comparable store sales were up 6%, revenues grew 9% to $3.9 billion and operating income increased 18% to $644 million. Margins increased nicely by 130 basis points to a healthy 16.6% which is a record for the second quarter. Earnings per share came in at $0.56 which is up 17%. Earnings for the full year are estimated to come in at $2.66 for 2014 and $3.17 for 2015. That puts the stock on a 2014 PE of 27. But as you can see earnings are expected to grow by 19% which puts the stock on PE to Growth ratio (PEG) of 1.42 which is reasonable. The closer to 1 the better.

The company is expecting big things. Here is what the highly publicised CEO Howard Schultz had to say about the quarter.

"Starbucks record operating performance in Q2 demonstrates that our focus on building a different kind of company - performance driven, through the lens of humanity - continues to drive profits and shareholder value. The innovation we are bringing to market through reinvention of our Teavana business and partnership with Oprah Winfrey, our reimagination of the Starbucks Experience through next-generation payment and loyalty programs and our continued investments in the over 200,000 Starbucks partners who wear the green apron every day continues to build equity in the Starbucks brand and strengthen our connection to customers in every market in which we operate."

In case you are wondering, Teavana is their tea business. They really are excitingly innovative and operate in a coffee world which is growing fast. Regionally the growth we have seen in sales is well represented in all their regions Although the US still represents the bulk of sales (72%). The America's grew sales by 6%, EMEA (Europe, Middle East and Africa) grew by 6% and Asia grew by 7%. Even in developed markets the uptake of good branded coffee is huge at the moment.

They are growing their food services focusing on both breakfast and lunch, they are diversifying into tea, juices and possibly Soda Stream and of course growing and innovating with their core coffee business. They are leveraging all of these activities off their amazing brand power plus their global expansion is still in its infancy, we continue to add to this one.

Michael's musings: The GOOG

Last week while South Africans were slowing things down in anticipation for the long weekend, Google released their results. We gave you the brief highlights from their release with the promise of a more detailed analysis this week.

For the first quarter of 2014 Google grew revenue by 19% (yoy) to $15.42 billion. The increased revenue though did not filter down to double digit earnings growth though, with EPS only growing by 1.7%. This was partly due to operating margins dropping to 32% from 34%, and then compounded by extra stock issued through Google's stock based compensation. The revenue figure is broken down with 68% of revenue generated from Googles own site, 22% generated through partner sites and then 10% generated from other activities like their Play store for Android devices.

As an advertising company it is expected that they generate 90% of their revenue from adverts, but it is the other 10% that gets me excited. Google are turning themselves into a diversified tech company, which is what you want to be seeing. In the tech world market dominators can quickly become irrelevant and end up on their knees, Blackberry/Apple in the recent past for example (Apple only in computers), so you want to see a tech company positioning themselves in more than one area. This is what Google are doing with a number of strategic acquisitions and their "Google X Labs".

Google X labs is a facility where they work on semi-secret projects with the goal to "improve technologies by a factor of 10, and to develop science fiction-sounding solutions". Some of the products being worked on is the Google glasses, their driverless cars, a contact lens to tell diabetics when their sugar levels are low and then a balloon that can be used to bring internet to rural parts of the globe instead of using satellites. Some very exciting projects!

Some of the more recent acquisitions have been Nest, which designs smart tech. It is still a small company but one of its founders was one of the main Apple designers under Jobs which means whatever is designed will have the tech from Google and the design from a master. Another company that they bought is a company called Deep Mind which is an Artificial Intelligence (AI) company. They are trying to teach computers to learn, which then should lead to them "thinking" for themselves.

The implications for search are that you will get a more intuitive response from Google when you are searching, instead of irrelevant information when you have a complex search. The one experiment that they did at Deep Mind was to show a computer Youtube videos of cats, and then when they were done they asked it to draw a cat. The computer came back with a very generic looking cat, very basic but the biggest part of learning is associating words with concepts.

Any one of these projects in the future has the potential to be a major revenue contributor and become core to our lives like Google search is to our lives today. For a tech company this is what you want to see and why I think that Google will remain relevant as a company for the foreseeable future.

Now back to the 90% part of their revenue. Their Cost Per Click (CPC), which is the money that Google gets for every click on an advert was down 9% and is the 9th straight quarter of negative growth. The reason for the dropping average CPC is due to the shift to mobile, advertisers are not willing to pay as much yet for a click on a mobile advertisement. Due to the shift toward mobile, Google's paid clicks are up 26%, which more than offsets the lower average price that they get for every click. As our mobile phones get more powerful and functional, the value of a mobile advert should converge with the value of an advert on other devices.

Only one-third of the world's population has access to the internet! As more and more people move onto the internet and as more and more people feel safe doing online purchases, so will Google list of willing advertisers grow. Google is in the position where they are a very long way off being a mature company and as such should see continued growth going forward.

Their current P/E is sitting at around 30, which is to be expected for a company with their growth potential. Interestingly in 2004 when their share price was $190, they had a PE in the mid 90s, sometimes companies have high PE's for a reason. Google is an exciting company with a growing customer base and as such they are one of my favourite US stocks!

Home again, home again, jiggety-jog. We are marginally lower here at midday. Russia, people are trying to see what their next steps are going to be, that should put a lid on things a little. But we continue to be optimistic, growth prospects are better, even though tensions still exist.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment