"30% of sales is spent on advertising and promotion expenses! I am sure a fair sum of that goes to people like Scarlett Johansson and Blake Lively. Gross profit margins of 71% also shows you that these products are cheap to make but expensive to tell you how well they work."

To market, to market to buy a fat pig. Yesterday was a tough old day to be long the equities market. It was far easier to be long the VIX. VIX is volatility on the S&P 500, that was up a whopping 27.16 percent on the day. You could have bought that instrument a month ago around and be up 60 percent. Equally it can go nowhere and down 30 percent on a single day too. My instincts (I have no market secret sauce, nor do I have spider sense) tell me that it is too hard to try and call markets in the very short term. Like Tiger Woods and Rory McIlroy, there are champions at the top of their respective fields of expertise.

Going to a course, paying 500 Dollars (or Rand equivalent) in order to strike it lucky is not too dissimilar to getting an hour lessons from the club pro and expecting to swing like the Big Easy is possibly the correct analogy. With all due respect to the club pro and the person delivering the seminar on trading (pointing to fancy graphs and trends), becoming a specialist after a lesson or two, your chances are almost zero. I see people walking into training seminars being taught by people who themselves supposedly have the key, how does that all stack up? There is no quick way to trade and make money, even the best of the best spend years and years doing it.

The best way to make money is to buy quality and stay the course for as long as you can, reinvest the dividends, ignore the noisy. It is however much harder to tell people to do that, the allure of a quick buck and the warm fuzzy feeling one gets when you make a solid quick 20 percent is addictive. The people that do have home runs fail to tell you about the strikeouts. Investing is like test cricket, trading is like T20 or baseball, if I could use that analogy.

So what upset Mr. Market and caused the bottom to fall out a little, well 2 percent is a lot for many people, here goes a short list:

1) Ukraine and Russia, heightened sanctions and the repercussions, the "situation" has hardly improved.

2) Gaza, whilst there is a ceasefire, the "situation" is still tense.

3) Central banks and their next moves, the ECB is in a tight spot, the US economic outlook has improved and therefore interest rate hikes are being talked about.

4) Argentina default, did they or didn't they, technically yes, but as you can see from this FT article it is still very fluid: Hopes remain of deal on Argentine debt

5) Perhaps the strangest reason of all, the one that I saw the Business Insider trumpeted: Traders Are Blaming Thursday's Big Sell-Off On 1 Stat. Inflation. The dreaded inflation.

So what do you do as an ordinary person? You have no control over macro economic events and even less over geopolitical events. In fact you have in the bigger picture, no control over these events. What you do have control over is the companies you own, what they are up to, what consumer patterns to follow, which geographies to invest in (sometimes through the very companies you own), you get my point. It is more important to worry about that, rather than the Rand, or the price of X or Y or Z. File the noise in the ignore category.

Sometimes it is the sectors that you avoid that is equally as important as the sectors that you invest in. Yesterday I missed the opportunity to say which industry would you rather be invested in (this is one of Paul's favourites) cell phones or cigarettes? Quite clearly the statistics have shown that cell phones are actually more addictive than cigarettes, there are various sets of research that show that people check their smartphones over 100 times a day on average. Clearly that is more addictive than cigarettes and remembering that you can check your mobile almost anywhere, it is becoming harder to light up wherever you want.

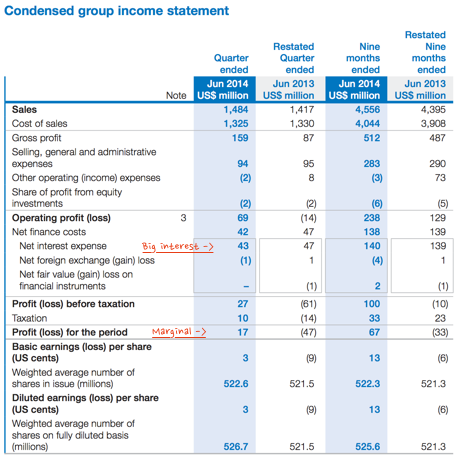

Where am I going with this? Another industry that we are not too in amid on is the paper industry and more especially the fine coated paper industry. That would make a business like Sappi as an investment, not the best around. To illustrate a little further let me use some of the numbers that they (Sappi) released yesterday. From their 3rd Quarter 2014 Financial Results Presentation. First, the numbers (by way of a screen grab) and the one that stand out for me are the monstrous debt and subsequent interest bill, as well as marginal profitability. Earnings themselves have been patchy.

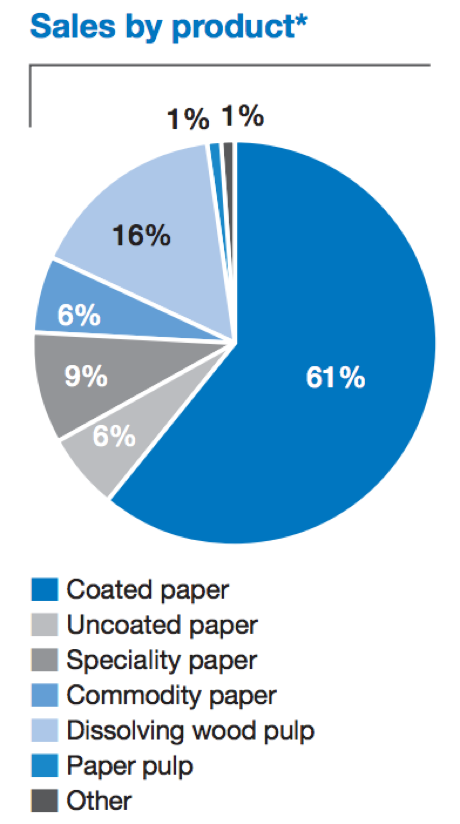

Here however is another two sets of graphics that tells me this company is not a buy, firstly the products that Sappi sell

61 percent of their sales are coated paper. And then below 66 percent of their products are sold in the USA and Europe.

I do not mean to beat up on a business, especially on the 102nd birthday anniversary of Milton Friedman. All I am saying is that whilst Sappi adjust towards cellulose (to compete against cotton in the textiles industry) their core product, paper for reading material in their core markets is going to continually look weak.

Last I checked schools and industry were moving towards paperless societies and storing documents in the cloud was far easier than storing them physically in a file. Last evening paging through a large Atlas (that is now a display piece) I was telling my eldest how much easier it is than when my dad used to tell me to go look it up in the dictionary or the encyclopaedia set. I checked on OLX, you can buy a complete set of Popular Mechanics encyclopaedia set for 500 Rand, or roughly one month worth of internet.

There are industries that are growth industries because more people are bound to use their products in the coming years and there are industries that are seeing lower sales and have razor thin margins as a result of too much capacity. Sappi falls into the latter and as a result is a sell. Coupled with a NAV of 222 US cents and creaking debt of 2.286 billion Dollars, or 24.52 billion rand. This is relative to a share price of 40.69 or 379 US cents and a market cap of 22 billion Rand. Too much debt, not getting smaller (they might give themselves breathing space by refinancing), it is going to be too hard. Avoid.

Byron's beats: L'Oreal H2 2014

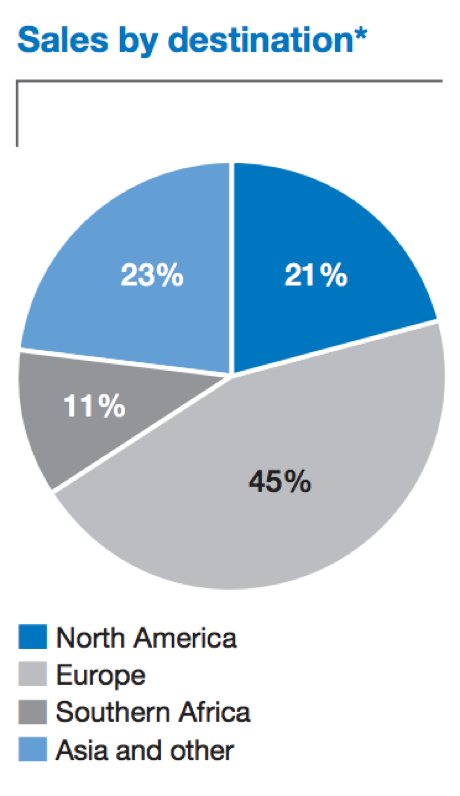

Yesterday evening we received first half results from L'Oreal. Overall like for like sales grew by 3.8% but due to currency fluctuations sales reported in Euros were down 1.7%. They have been hit by a double edged sword with the Euro strengthening amongst developed market currencies but at the same time many developing market currencies have weakened. For a company reporting in Euros this is of course not a good situation and explains why the share price has been flat for the better part of a year.

To kill many birds with one stone lets take a look at a table which lays out sales by operational division and Geography.

Here you can see all the currency effects, especially in the U.S and emerging markets. Wow this company is well diversified geographically. There is still huge growth potential in these regions though, especially in Asia and Africa.

Divisionally L'Oreal Luxe grew very nicely. That includes their top end makeup and perfume brands. Think Richemont and LVMH, the top end brands are very defensive and are soaring in this current environment. Active cosmetics which includes expensive suncreams and anti blemish products also did really well but is one of the smaller divisions. Professional products which includes products used at hairdressers and salons had a tough period thanks to slow growth in the U.S. Maybe it was the bad weather? I'd expect this division to pick up as that economy soars. Consumer products were solid but not exceptional as we have seen from competitors such as Johnson & Johnson and P&G.

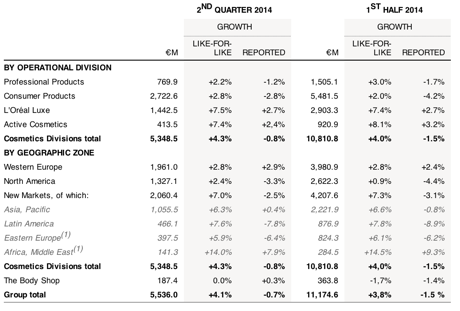

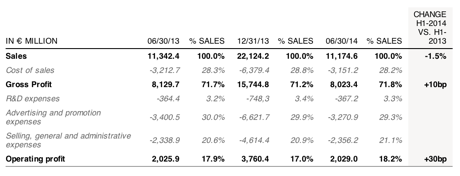

What absolutely fascinated me about this business was the margins and where money is allocated within the business. See the table below. 30% of sales is spent on advertising and promotion expenses! I am sure a fair sum of that goes to people like Scarlett Johansson and Blake Lively. Gross profit margins of 71% also shows you that these products are cheap to make but expensive to tell you how well they work.

Earnings for the year are expected to come in at 5.49 Euro which is enhanced by the big share buy back they have done with Nestle. We covered the details of that transaction in February in a piece titled Nestle make their intentions clear. The stock trades at 126 Euro or 23 times this years earnings which sounds about right for a business of this size growing like for like sales at such a fast pace. Any Euro currency weakness would also boost the share.

We continue to be attracted to the theme that L'Oreal are at forefront of, aspirations of new consumers. In fact Sasha tweeted a fascinating article the other day titled The "Next 15" will drive 80% of emerging market growth by 2025. Here is an extract. "McKinsey suggests that through mass urbanization there will be 60 megacities, double that of today, accounting for a quarter of global GDP. To target these areas of growth, luxury brands must adjust strategies to include cities that may not yet be on their radar to ensure that they have a presence as new markets begin to flourish."

I guess that is what 30% of sales in marketing will be geared towards, targeting that new market. We are still very happy to be adding to this stock, especially considering the current share price weakness.

Michael's musings: The everything store does not have profit

Last week it was Amazon.com's turn to in the earnings season to release their results. I am busy reading the book about Jeff Bezos and Amazon, so the team here decided to leave the report for me now that I am back from the Cape.

First things first, Amazon made a loss of $126 million for the second quarter of this year. A disappointing number but not a huge surprise because of all the money they are ploughing into technology, new distribution centres and other items designed to improve the customer experience. The guidance for the next quarter is even worse, as they are forecasting a loss of between $410 - $810 million, with $410 million of the loss coming from stock options and the writing down intangible assets. Personally I think that it is going to be a couple of years before we see a meaningful profit number from Amazon. I think that Jeff is going to increase his R&D and Capex spends as revenues grow.

The revenue number is by no means small or growing slowly, up 23% to $19.34 billion for the quarter. As one analyst said, it is quite a feat to make a loss on revenues around $20 billion. Next quarter revenues are expected to grow by 26% to between $19.7 billion to $21.5 billion! Breaking the revenue down into regions North America is $12 billion and the rest of the world is only $7.3 billion. To give you a comparison figure Walmart in their last quarter had revenues of $115 billion! When it comes to online sales though Walmart only had $10 billion for the last financial year, which is around half the figure that Amazon had for this quarter.

The large revenue number generates a large operating cash flow of $5.33 billion up around $800 million from the same time last year. This is the number that I think matters in Amazon's case because the bulk of the cash flow was put back into building a bigger Amazon with $4.288 billion going to property, equipment and web + software development. If and this is a big IF, Amazon do not spend this cash on building the company, the PE ratio would sit around the 27 mark. Which considering that they are growing revenues in the mid 20's, that looks cheap!

Given that profit is currently not very high (or negative) on the goals list for the management at Amazon what does their debt look like to fund the lose making company? It is not very high, sitting at the $4 billion mark, which is very small considering the operating cash flow number.

What is at the top of the Amazon goal list though, the customer! This is what will and does differentiate them from other online retailers. Being customer focused has made Amazon a very easy site to use and created a very loyal customer base. All the investment in infrastructure and R&D is to improve the customer experience by making the choice available bigger, easier to access, cheaper and quick to be delivered. More customers means better prices from suppliers for Amazon, meaning cheaper products leading to more customers.

Going forward online retail is only going to grow and Amazon will be the company leading the way. This is a stock that I would be buying for the long run, a buy and forget story, because I think it could be a bumpy ride, with small swings between profit and loss for the foreseeable future. Once the reinvestment of cash stops or slows down, I would expect to see Amazon towering above the competition and having a meaningful earnings number to justify the lofty valuation.

Home again, home again, jiggety-jog. Markets were down there, down here and everywhere. A big drop overnight on Wall Street, the biggest number today is undoubtably the non-farm payrolls number. In the meantime, happy birthday Milton Friedman. My favourite most pithy piece from the great man:

The world runs on individuals pursuing their separate interests. The great achievements of civilization have not come from government bureaus. Einstein didn't construct his theory under order from a bureaucrat. Henry Ford didn't revolutionize the automobile industry that way. In the only cases in which the masses have escaped from the kind of grinding poverty you're talking about, the only cases in recorded history, are where they have had capitalism and largely free trade.

If you want to know where the masses are worse off, worst off, it's exactly in the kinds of societies that depart from that. So that the record of history is absolutely crystal clear, that there is no alternative way so far discovered of improving the lot of the ordinary people that can hold a candle to the productive activities that are unleashed by the free-enterprise system.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment