"Somewhere around 5.5 on the scale is equivalent (for the inner physicist in you) to 11 Terajoules of energy. Tera is one trillion! The Japanese earthquake in 2011 which measured 9 on the Richter scale and had a devastating impact (with the subsequent tsunami) measured 2 Exajoules, or 2 quintillion joules. Quintillion has 18 zeros, trillion has 12. 1,000,000,000,000,000,000 (Exa) vs 1,000,000,000,000 (Tera)."

To market, to market to buy a fat pig. Whoa, it is not often that we get to talk about a seismic event here in South Africa, yesterday was an exception with a tremor felt across these parts, the origin according to the USGS website was 6km east of Orkney. Yes, there is a detailed map and location, 10km deep apparently and magnitude 5.3 on the Richter scale.

According to the Wikipedia entry on the Richter scale, these moderate events occur worldwide around 1000 to 1500 times a year, so three to four a day globally. The most serious, the 8.0 to 8.9 occur once a year, 9 and above every one to five decades. Major earthquakes, the ones in magnitude 7.0 to 7.9 on the Richter scale occur 10 to 20 times a year and have a devastating impact.

Somewhere around 5.5 on the scale is equivalent (for the inner physicist in you) to 11 Terajoules of energy. Tera is one trillion! The Japanese earthquake in 2011 which measured 9 on the Richter scale and had a devastating impact (with the subsequent tsunami) measured 2 Exajoules, or 2 quintillion joules. Quintillion has 18 zeros, trillion has 12. 1,000,000,000,000,000,000 (Exa) vs 1,000,000,000,000 (Tera). You don't need to be exceptionally challenged with numbers to be bamboozled by the size of those two numbers, the perspective is all that I wanted to show you, I hope I nailed it. My late physics teacher would be proud of me with that calculation, provided I nailed it!

Earthquakes and tremors aside, the local market ended marginally higher settling off the best levels of the day however. US markets recorded a sell off in the middle of the session, the S&P 500 down around one percent by the end of the session, that has led to the lower open here on this side. The Russians are ready to impose sanctions of their own on the Europeans, including no fly zones. We can see how that will all work out.

Fox dropped their bid for Time Warner, after hours Fox was up 6.8 percent, Time Warner was down a whopping 10.55 percent. Well done to the board of Time Warner for refusing to engage with the Fox guys, really, well done. Staying with media for a second, I saw that Gannet had decided to split their business in two, the newspaper companies (which includes USA Today) will be separate from the rest of the business.

Newspapers in their physical format are on borrowed time, the people who advertise are telling you that. This year mobile advertising overtook newspaper advertising revenues in the UK, I would have thought it would have happened earlier. Predictions to 2017 suggest that total advertising revenues in print publications (newspapers and magazines) will be in the mid teens in the UK, I am sure that all developed markets will be the same. We continue to avoid all of these businesses as investments.

Alrighty, we finally get a chance to write up about the Zimmer results, which were released over ten days ago. As our holding time frames are for as long as possible, as long as nothing structurally changes, the timing of the reports is not necessarily mission critical. The mission is to stay long and strong!

For those of you not familiar with Zimmer, as per their website the company "designs, develops, manufactures and markets orthopaedic reconstructive, spinal and trauma devices, dental implants, and related surgical products." It sounds a little like the six million dollar man (Steve Austin) or the bionic woman, if you know what I am talking about there then you are more mature than the rest of society, some respect please!!

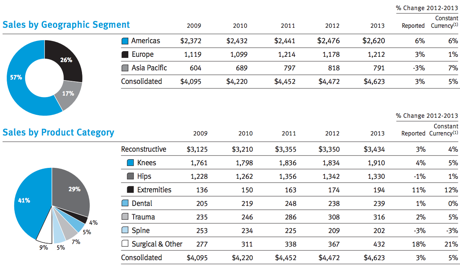

The company has been around since 1927, is headquartered in Warsaw Indiana, not Warsaw Poland. Their products undoubtably are for people with excess funds to spend on their health requirements, and you can definitely see that in their geographic sales segments. North America and Europe account for around 83 percent of sales, at least as per the graphic below, which is taken from their 2013 annual report that you can of course download at Recent News Releases and Information segment on their website. 44 percent of the 17 percent of sales is Japan, so over 90 percent of their sales are in developed countries, cementing the notion that this company's customers are mostly rich people.

Below the geographical breakdown, in the segment titled sales by product type (graphic above) you can see that knees and hips are undoubtably their biggest sellers. Why would that be the case? As we live longer in developed societies and by we I mean the royal we (all humans), our bodies need to keep pace with the wears and tears of life. A new lease on life for folks with new knees and new hips enables them to live more comfortably without the associated lack of mobility or pain.

I suppose that you need to understand a little anatomy in order to understand their products! Aside from knees and hips, there are dental products (implants), trauma products which stabilise broken or damaged bones, specialised spinal division (it looks incredible) with surgical equipment that helps all their businesses, blood and waste management, bone cement (yes really) and wound site management.

In North America, their biggest market by sales, the market is very competitive with DePuy Synthes (owned by JNJ, a Vestact recommended stock), Stryker (another Vestact recommended stock), Biomet and UK business Smith & Nephew (being courted by the aforementioned Stryker and even Medtronic is suggested to be in the mix). In Europe the market is more fragmented with smaller operators, companies like Waldemar and KG and Mathys, as well as the earlier mentioned US and UK companies. It is a tough market that is proceeding in terms of technological advances at a breakneck speed.

The company is however losing market share, or at least that is the perception. The stock is not expensive at 16 times forward, growth rates have been reigned in with management guiding lower to 6 to 6.1 Dollars worth of earnings (ten cents lower than previous guidance). Year to date the stock is up just over five and a half percent, the year high is around 8 Dollars from where the stock currently trades (98.36 Dollars last evening). The yield is a paltry 0.9 percent, most of the companies mentioned earlier have average yields, JNJ is the exception as they have two other huge businesses attached to their products and devices one.

At these levels the company is not a sell, but I would not be buying any either. I think that the thesis remains intact, there will be more elective and necessary surgery as the population ages in their core markets. There will also be more middle to upper middle income people in the coming decades using their products, I am very bullish on the prospects for the sector. Stryker would be my preferred buy, if you own JNJ their division as a standalone is currently the biggest in the world, the collective devices and diagnostics business. As most folks have the stock at a much lower level, it is a hold at these levels.

Byron's beats: Curro 2014 interim results

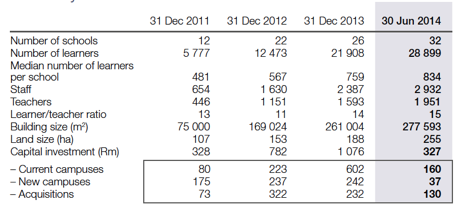

Yesterday we received 6 month results for the period ending 30 June 2014 from Curro, the biggest for profit private school education provider in South Africa. The presentation has lots of very informative tables so bear with all the figures being thrown at you. First lets look at the progress made as far as schools and learners are concerned.

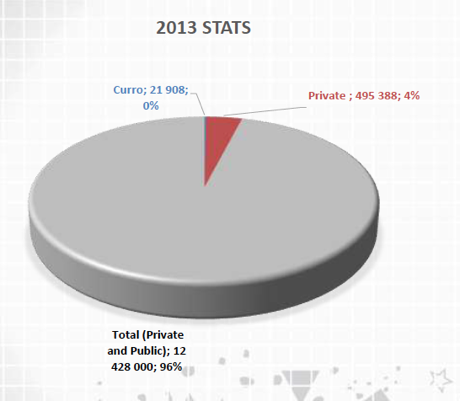

As you can see the ramp up of students has been aggressive in a small space of time. If that concerns you take a look at the pie chart below showing how much more room there is to grow. Curro are still a very small fish in a very large pond.

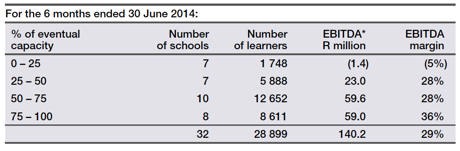

Ok lets delve into the numbers. Revenues increased 54% from R315 million to R487 million. EBITDA increased by 89% to R96 million which equated to headline earnings of R27 million. This equated to earnings per share of 9 cents with no dividend declared. As you can imagine predictability of earnings going forward is very difficult. Trading at R26.30 the multiple is huge but don't forget that this company has only recently become profitable. Talking about profitability this table was very interesting. It shows the kind of margins Curro receive at certain capacity levels. Incredibly at anything above 25% Curro are in the green pretty handsomely.

The future looks bright for Curro but as you can see the market already knows that. The share is priced for heavy growth. I wouldn't let that deter you though. There are still so many positives to take from this model. One of the those is the relationship they have with 57.5% shareholder PSG. I read in a Moneyweb article yesterday that the experts from PSG are actually the ones who are out their looking for expansion opportunities while CEO Dr Chris van der Merwe runs the day to day operations of the current business. That sounds like a fantastic relationship to me.

As you may remember they did a rights issue a few months back where they managed to raise R589 million. This wasn't their first capital raising through the market and won't be their last in my opinion. In 2014 they plan on investing R1.5 billion alone, that is nearly 20% of their market cap. By 2020 they plan on owning 80 schools (32 right now) but I honestly believe they will match this target before then. I like the theme, I like the management structure and I think the stock is a good investment. Not for the fainted hearted though, the ride is going to be interesting.

Home again, home again, jiggety-jog. Yowsers, ABIL have reported another awful set of numbers, the CEO has resigned, it all looks completely awful and feels not too dissimilar to a Metorex type situation, rights issues, on their knees and feeling the heat. More on that tomorrow.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment