"In 40 years, if you had stuck your money into the S&P 500 tracker it would have returned 2297 percent, the Dow 30 has under performed, with a return of "only" 2031 percent. It confirmed my bias to the S&P 500, the collective market decides, rather than a bunch of chaps, as to what is the best method."

To market, to market to buy a fat pig. Financials roared ahead in the local markets, there was a recovery across the seas and far away with the US markets up comfortably on the session. It has been a strange old tale of the divergence of the Dow Jones Industrial Average, Year-to-date performance on the blue chip 30 index is a negative 0.04 percent. What? That is right, the blue chip index, the top 30 industrial stocks picked by the folks that founded the index (and they still choose what is in and out), size and scale has nothing to do with it.

The broader market, the S&P 500 is a market capitalisation index, the bigger in size, the more chance of being near the top of the table of the index. So far, that index, the S&P 500 is up 4.9 percent year to date. As far as I remember this is one of the biggest divergences that I have seen. In 40 years, if you had stuck your money into the S&P 500 tracker it would have returned 2297 percent, the Dow 30 has under performed, with a return of "only" 2031 percent. It confirmed my bias to the S&P 500, the collective market decides, rather than a bunch of chaps, as to what is the best method. Do not ever battle with the collective, you will lose. Not always, because human nature rewards the outliers that are disruptors and changers, normally always for the better.

The top ten constituents of the S&P 500 represent 17.5 percent of the total market cap of the S&P 500 (which has 501 constituents). They are names that you know well, in order of market cap, Apple, Exxon Mobil, Microsoft, JNJ, GE, Chevron, Wells fargo, Berkshire Hathaway B, JP Morgan Chase and lastly Procter & Gamble.

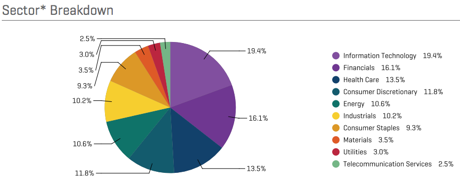

What is quite interesting is the way that the index has changed over the years, there is more a healthcare and technology feel to corporate America (as per the divisionalising or segmentation of business activities to indices) now, trumping energy, industrials and even consumer discretionary. Financials still are massive, that goes without question. Check it out, download last month's fact sheet on the S&P 500, and then check this pie chart:

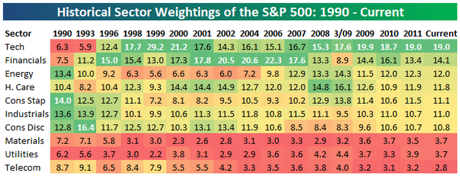

Technology. I found a piece by Bespoke Investments titled S&P 500 Historical Sector Weightings which although it is old, it serves perfectly well for the purposes of this conversation. Technology as a percentage of the S&P 500, as per the table in the article was a whopping 29.2 percent of the index in 1999. Wow. From 6.3 percent in 1990. Now? As per the pie chart above from S&P it is only 19.4 percent. It is the biggest constituent.

The recent moves in healthcare are telling, it is becoming more and more important. It now represents 13.5 percent weighting in the S&P 500. When the going is tough for the market, it rises, obviously we know that healthcare spend is emotive, somehow citizens are hardwired to this idea that someone else must always pay, where the money comes from, that part is seemingly irrelevant in the conversation. Nothing is for free, ever. Perhaps air, as in The Lorax tale however, someone is working on that. I guess you could argue that government levy taxes on emissions, so air is not free.

Just for interest sakes if you did not click on the bespoke piece, here is the table that shows the ebbs and flows of the makeup of the S&P 500 over the 20 odd year period, starting in 1990 and going forwards to 2012, you can see the makeup currently with the pie chart above, at the start of the conversation.

The other major move over 25 years is how telecoms weighting in the S&P 500 has significantly reduced from 9.1 percent in 1993 to a mere 2.5 percent now. Obviously technology has had everything to do with that, what counts as normal communication in 2014 is vastly different from 1993. Industrials and materials have become less important as the US has moved towards the information age. Energy has made a massive comeback by value in the S&P 500 with fracking in the US being so important.

The key to investing over the next two decades is to try and predict whether or not healthcare is going to continue to be dominant and whether or not you should allocate more of your own value to what is a fast growing sector. We believe that this is the case. We like technology, not all of it, be more specific about the companies and not generalise about a sector that is better than the other. You can like sectors (thumbs up), in the end you own companies that are masters of their destiny and you hope outperform their peers.

Michael's musings: Up, Down and Flat

Caterpillar recently had their second quarter results which were largely in line with analyst estimates. The one statement used by Caterpillar which is a quick summary of the results is "Higher profits on lower sales". Sales compared to the same period last year are down 3% and profits are up 8% from $1.45 a share to $1.57 a share.

Saying profits are up though is a bit deceptive because operating profits are down 5%. The gain in EPS is due to there being 30 million less shares to share the profits among and also favourable income through currency hedging (which they made a loss on last time). Having said that as a shareholder the shares that you own have benefited from the share buybacks, which the company has indicated they will spend a further $2.5 billion on further buybacks.

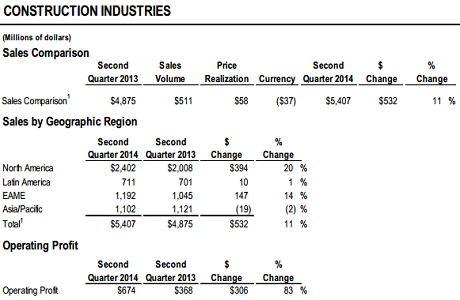

Caterpillar has 3 main divisions which brought in $14.62 billion in revenue. The biggest and most important division is their construction industries division which contributed $5.4 billion to the revenue number, up 11% with a huge increase in operating profit of 83%. The increased profits are from increased sales prices and lower manufacturing costs, both positives. Below is an image of the division's breakdown, with a very positive 20% growth in sales in North America. The construction industry would be a leading indicator of future growth in North America, so a positive sign for other stocks.

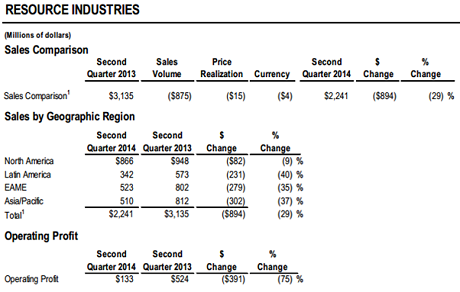

The next sector that had a very big impact on the company is their resource division whose revenue dropped 29% from $3.3 billion to $2.2 billion, with the more worrying drop of 75% in its operating profit. Part of the big drop in the operating profits was due to them not having a once off income from a settlement last year. The below image of how the division did in the different parts of the globe, paints an ugly picture.

The last division is their Energy and Transportation division which had a decline in revenues of 2% to $5.175 billion but had an increase in operating profits of 6%. Both these figures are relatively flat and the profit number which is arguably the more important figure moved in the right direction.

Giving their outlook for the rest of the year Caterpillar see developing markets to continue to grow but "developing economies will remain challenged". The bigger concern and it has been seen in the current quarters figures is their forecast for mining, "we expect mining companies will continue to be cautious about resuming equipment investments, and we expect mining capital expenditures in 2014 to be below 2013". Going forward the company lowered their median sales forecast figure by $1 billion but increased their median EPS forecast figure from $5.55 to $5.75 per share.

The results are very volatile, with one division having a large increase in profits and the other a large decrease. Going forward I don't think that there will be fireworks from the stock and will probably be under pressure until the mining industry opens their wallets for capital spends. As Byron said in the last piece on CAT, we approach with caution.

Home again, home again, jiggety-jog. Mr. Market is having a better time of it this morning, compared to last week which was not the best week for equities. We are around half a percent better. The headlines that I read is that somehow the earlier than anticipated rate hike means that the market is on for x or y or z. What the Fed does matters little for your portfolio. What companies do is more important and I presume that when deciding what businesses do and where, this factors in interest rates, it is not the only decision. Rates are what they are, if your investment philosophy or thesis is to agonise over what to do next as a result of the Fed, then I think you are doing it all wrong.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment