"Back to the tariffs conversation, it works on the "broken window fallacy". The broken window fallacy is where a teenager in a small backwards town, throws a stone through the window of the baker. The baker then has to call the glass guy to fix the window. The glass guy now because he has business goes to the taylor to get a new suite, the taylor then hires an assistant who happens to be the mayor's son. The mayor sits down, looks at the situation and decides that the rebellious teenager is now a hero because he created all these jobs and economic activity. ViVa breaking windows! ViVa!"

To market, to market to buy a fat pig. Another day and markets are still taking a beating. I think it would be safe to say that there is plenty blood of the resource bulls in the streets? It was Baron Rothschild who said "The time to buy is when there's blood in the streets.". Over the last 3 months, BHP Billiton is down 25%, Anglo is down 20%, Harmony is down 32% and Impala Plat is down 23%. Looking at a year to date number Kumba is down a whopping 46%! Not all of these companies are down because they are poor operators but mostly because they do not have control over the price of the product that they sell. I think it was Bill Miller who wouldn't invest in resource stocks because they were too cyclical. From where I sit at the moment his reasoning seems sound. If I had said not to buy resources a year ago when they were moving higher, you might have struggled to see the reasoning.

Not all stocks have done badly this year, two of our favourite stocks Aspen and Naspers are up 44% and 25% respectfully. Buying expensive, quality companies seems to have worked well this year but we are not in it for the short run. Where will these companies be in 5 to 10 years is the real question? So far the market as a whole is only up 4%, which is not even beating inflation! The forecasts for this year was for high single digit growth or a little over the 10% mark. New Year is a little under 3 weeks away so we still have time to get there!

An article in the Business Day caught my eye this morning, Exporters fear poultry duty may threaten US trade deal. The basics of the article are that South African exporters may stop receiving preferential rates of their goods exported to the US because the US don't like the "anti-dumping" tariffs imposed on their chicken exporters. For non-economic speakers, the term dumping is where a company/country sells goods at a loss, as to drive the competition out of the market and once they have no competition they sell their products at exorbitant prices. There are milder forms of dumping, if you have excess stock you then sell it for a loss on the logic that something is better than nothing.

I am not a fan of tariffs because it then forces us to pay more for something, then that extra money that we are spending on chicken could be spent on something else like clothes. I heard a "buy proudly South African" ad on the radio the other day, saying that we must buy locally produced goods because it is good for jobs. It sounds great in theory but misses the point that if we spend more on South African made goods we are spending less elsewhere. So basically spend more on this good to save jobs but then spend less elsewhere and cost jobs there. Don't mess with prices and we will spend money on the more efficient products by maximising what we produce as a country and maximise the number of jobs created. Look at the proudly South African campaign as a brand building campaign, a brand that you are now willing to pay more for, like Nike or Apple.

Back to the tariffs conversation, it works on the "broken window fallacy". The broken window fallacy is where a teenager in a small backwards town, throws a stone through the window of the baker. The baker then has to call the glass guy to fix the window. The glass guy now because he has business goes to the taylor to get a new suite, the taylor then hires an assistant who happens to be the mayor's son. The mayor sits down, looks at the situation and decides that the rebellious teenager is now a hero because he created all these jobs and economic activity. ViVa breaking windows! ViVa!

Wait! This situation does not sound right? The part of the storey that the mayor didn't take into account, mostly because he couldn't see it happen, was that the baker was going to call a builder to expand his bakery but couldn't because he had to replace the glass. The builder was then going to buy a suite from the Taylor and the Taylor would have hired the mayors son. The outcomes of both stories are similar, but the big difference is that in the first storey the world is poorer because it has one less pain of glass and it still has the smaller bakery. Im not a fan of tariffs and I am not a fan of getting preferential export treatments, a very black and white view for a complex colourful world.

Company corner snippets

Omnia have announced that they are buying back some of managements shares at a price of R210.69. The share price today is around R168 a share, so they are taking advantage of the 30 day VWAP. Management have created a great amount of share holder value over the last couple of years and the SENS announcement stresses this fact but I can't help feeling that management are getting one up on shareholders. It also looks like a clear sign from management that they don't think the share price is going anywhere for the next year!

An update from Gold Fields on one of their Australian mines, Appeal Lodged By Gold Fields Subsidiary In Native Title Proceedings. This will probably drag on for a while but I am not familiar with the Australian legal system and not sure how long appeal processes take. Gold Fields are in the green this morning, compared to the other gold miners who are down, so the market seems to be liking the news.

Things we are reading, we think that you should read them too

Big news from our favourite social media stock - Instagram is now bigger than Twitter. Add these 300 million Instagram users to the 600 million WhatsApp users and then the 1.3 billion Facebook users and you get to over 2 billion eyeballs that advertisers are willing to pay money to access. Many of the users probably double up across platforms, but each app has a different use, so more opportunities for advertisers.

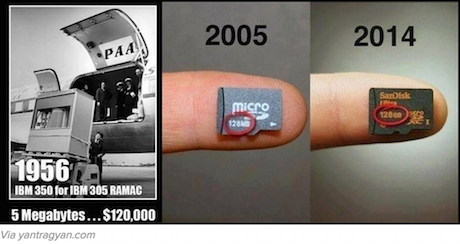

Looking back at the year that was - 22 Pictures That Prove That 2014 Is The Future. The rapid growth in computer processing power is something that I struggle to rap my head around, without computers many of the other modern innovations would not be around yet.

The reason that we don't like gold as an investment is because it doesn't innovate, create anything or take advantage of gaps in the market - Apple Co-Founder Traded His Shares for Gold. Why That Was a Horrible Investment, in 1 Chart

Some good news out of the parastatals stable - SAA launches Project Solaris

Knowledge is power, here are some big and free data bases that will allow you to gain knowledge - The free big data sources you should know. It is scary how much data we each put out there on a daily basis that people then analyse.

Then a controversial subject to end off - 2014 was a breakthrough year for marijuana. Regardless of where you sit on the debate, it looks like legal weed is here to stay and will probably be legal in more and more places. I don't see any investment grade companies in the sector yet.

Home again, home again, jiggety-jog. Mixed markets again today, with more stocks down than up so far. The Rand broke through the R11.60 level to the dollar for the first time since 2008 according to my graph. In other news the Ruble has fallen to all time lows. The low oil price at least offsets the weaker Rand, that is not the case for Russia. I suppose that this highlights the need to make hay while the sun is shining and to diversify your economy as much as possible. Enjoy the long weekend if you are taking Monday off!

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment