"I have nothing else to say other than just wow, the favour that capitalism has done for the global consumer trumps all ideology from less democratic nations. Get my drift? How long of course this lower oil price lasts is not exactly clear. Everyone is expecting the price to settle, my very best guess is that it will settle soon and then drift a little higher. If you wondered who to thank for lower oil prices, thank capitalism."

To market, to market to buy a fat pig. It suddenly dawned on me that the oil price tumbling down not only was the obvious transfer of wealth from countries that might not have the best records of democracy to consumers all around the world, rather the amazing unleashing of free enterprise operating in fewer rules that caused the price of oil to fall heavily. Think about that for a little while. It was only as a direct result of better technology on a smaller and more competitive scale in the US that allowed the "frackers" to do what consumers wish for, make energy cheaper through unleashing capitalism. I am going to read this book during the holidays: The Frackers: The Outrageous Inside Story of the New Billionaire Wildcatters.

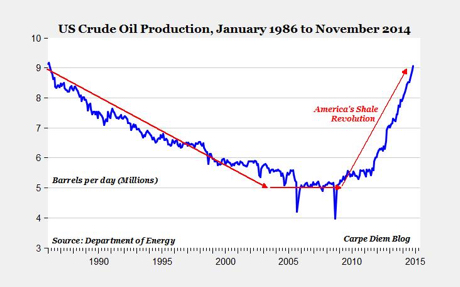

This graph is really everything you need to know, I had the same one, similar really, the other day, from the same source AEI, the blog is "manned" by Prof. Mark J Perry and this graph comes from his Thursday morning links:

That is simply jaw dropping, that scream higher from 5.5 million to above 9 million barrels a day in US daily crude production, in a mere three years. It was looking like one way traffic in 2005, as the book review on Amazon (above) says: "Things looked grim for American energy in 2006, but a handful of wildcatters were determined to tap massive deposits of oil and gas that giants like Exxon and Chevron had ignored. They risked everything on a new process called fracking. Within a few years, they solved America's dependence on imported energy, triggered a global environmental controversy, and made and lost astonishing fortunes."

I have nothing else to say other than just wow, the favour that capitalism has done for the global consumer trumps all ideology from less democratic nations. Get my drift? How long of course this lower oil price lasts is not exactly clear. Everyone is expecting the price to settle, my very best guess is that it will settle soon and then drift a little higher. If you wondered who to thank for lower oil prices, thank capitalism.

Two other things worth noting here today. First, the ECB at their meeting yesterday basically suggested that they were primed and ready for stimulus of some sort. Check out the FT article (subscription only) Euro rallies after ECB keeps powder dry, which suggests that they (the ECB) are going to increase their balance sheet by 1 trillion Euros in order to boost inflation. Obviously the falling energy prices are bad news as far as the threats of deflation is concerned, the collective economies of Europe will be just fine in the end, as far as I can tell, they will turn out stronger than before. Growth has been revised lower and looks almost Japanese like. These are rich people, they will have the right decisions at the end of the day for their people. So whilst there is still some jostling amongst the ECB, the French asking for more and the Germans not exactly keen on the whole idea. We will see.

And then the other thing which is of utmost importance for investors traders are the non farm payrolls for the month of November. Consensus is around 225 thousand, the employment rate to remain the same and lastly the average weekly hours to remain the same, at 34.6 hours a week. Sounds low, not so? It sure does to me, that is the average which factors in a lot of part time workers. I stumbled across an article that suggested that the average number of hours worked in a household in the US is down 6 percent since 1980. I said to the chaps in the office, what does it mean and Michael said something that made sense, the more money you have, the more chance that you can balance things out. From a generational wealth point of view, you can afford to do what you want to do, and not what you have to do, if you get my drift.

We are one year on from the death of the most loved South African person, Nelson Rolihlahla Mandela. He basically is to us, South Africans, what probably Abraham Lincoln is to the USA, what Mustafa Ataturk is to the Turkish people, what Mahatma Gandhi is to India. If I learnt anything from him, it was simple, treat each and every single person that you come across as you would want that person to treat you, make sure that you afford the same respect to each and every person you come across. It works for me, the barriers are removed immediately. Enjoy your day of reflection on a South Africa past, how far we have come and a South Africa future that you would like to see, a one that you personally could change. The power of the individual.

Company corner snippets

I do not mean to be mean, more especially about a company that has deep roots in this town of ours. I am talking about DRD Gold, the most talked about company on the local exchange that has a market cap of less than one billion Rand. In fact it is somewhere in the region of 875 million Rand, the market cap at the last evenings close in New York was 79 million Dollars. The ten year performance of the stocks is dismal, they are down 74 percent, something however has changed in the last five years, credit must be given. The dividend has returned, albeit irregularly. Shares in issue in June 1999 were 61 million. It doubled the next year to raise money. 183 million shares in June 2003 grew to 385 million by June 2014. Higher costs, lower grades and sliding output have seen profits patchy at best. Avoid I think, too small and whilst they may be able to scratch around and be the best at what they do, it really seems like a million miles away from their heritage and history. It looks like most of the shareholders are foreign gold bugs.

Holy smokes, talk about a tough business, Argent has had a tough time over the last half a decade, the stock is down 37 percent over that time frame. They released their six month numbers almost on the stroke of the market closing, revenue down over 8 percent. Phew, this hardly sounds like a good outcome for organised labour, under their manufacturing reporting segment, when talking about the recent strike: "NUMSA prevented all of our operations from opening up during the strike which included preventing salary-earning staff from entering the various premises and included the intimidation of non-union members. The group is on track with its planned staff reductions via its automation and product import plans." It certainly has been tough for industrial South Africa, this is their response, the response of capital.

The business of building houses seemingly is better, much better. Calgro M3 released a trading update this morning, they are anticipating a 35 percent increase in earnings per share for their full year to end February 2015, which is over 80 days away. That is pretty astonishing, then again I guess in the broader building industry there is a slowdown and then a shutdown for a while. To tell that far out however must mean that things have gone well. Building housing and engaging both business and government means that you get the efficiency of business and the objectives of government at the same time, perhaps the citizens of the cities and country can feel like they are getting more bang for their buck. The stock still looks cheap, the outlook for the sector, well you make up your own mind.

Things we are reading, we think that you should read them too

Here is some of the ins and outs of the new proposed tax-free investment accounts that will come about next year - Will tax-free savings accounts trump RAs?

Staying ahead of the curve in the technology game is key to survival - Apple patent No. 8,903,519: Five ways to protect a falling iPhone. Some of these ideas are very out there but I'm glad to see that they are thinking this much out of the box.

Learning about the past helps us hopefully not repeat it in the future - What Caused the Great Depression?. Another point made in the blog piece is how things in the market are dynamic and that it is very rarely just one thing that causes prices to move.

7 things that seem simple on paper but less so when there is skin in the game - 7 Simple Things Most Investors Don't Do. "Charlie [Munger] and I always knew we would become very wealthy," he told us, "but we weren't in a hurry." After all, he said, "If you're even a slightly above average investor who spends less than you earn, over a lifetime you cannot help but get very wealthy — if you're patient."

If you buy Amazon.com you are largely placing a bet on Jeff Bezos - BEZOS: I Have Spent Billions Of Dollars On Failed Bets - But I'll Never Do This. When you listen to Jeff it makes you feel better as a shareholder of a company that doesn't make a profit.

There are some interesting healthcare and income stats in here, each graph gives an interesting storey - The Quartz Chart of the Year short-list is here

What we could have done with the 140 million man hours or 16 000 years spent watching Gangnam style - The hidden cost of Gangnam Style

Here are the stats of Apples growing popularity across different regions - Kantar Worldpanel: iPhone sales in October were ‘huge'.

Home again, home again, jiggety-jog. Resource stocks are slightly down again. The rest of the market is higher, there was decent enough German Factory orders, the Russians delivered their state of the nation yesterday, it was juicy and full of quotes. Crude oil prices are falling again, this is again good for consumers, not so good for the producers.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment