"Remember when we had impending doom as a result of too much US government debt. Strangely as it happens, when you get economic growth, you get higher tax collections that deal with the problem of government debt. And whilst the US is hardly expected to report a surplus any time soon, the size and scale of the debt, relative to the size and scale of the economy is under control."

To market, to market to buy a fat pig. Definitely not the best of days for the local bourse, again some stroppy looking Chinese numbers, a snap election in Greece pending as the presidential appointment is likely to get to a stalemate situation (What, Greece again?) and another energy sell off. The good news, there is always enough of that to go around, is that US stocks bounced off their worst levels last evening, the mood on American companies and by extension stocks is still positive. Any opportunity to get the companies with better prospects at a cheaper price was lapped up by Mr. Market. Oh, and Chinese stocks after having been on an absolute tear (I see many pieces about margin trading having exploded), plunged over five percent on the day, it could have been worse. For Dilma Rousseff, Neymar Jnr. the day was awful, Brazilian stocks as a collective have now sunk more than 20 percent from their recent peak. That represents what the chartists call a bear market, that smells like somewhat of an opportunity to me, without knowing anything specific of course. In other words, more homework is required.

Locally it was pretty much a 2 percent across the board drawdown, all the heavyweight stocks sold off, perhaps with the exception of retailers, the falling oil price is going to have some positives for consumers. And costs for companies with lower fuel bills is going to be good news for shareholders too, everyone needs to move goods around in order for folks in all areas to consume. One thing we are good at, as humans, is knowing what to consume and how to do it, that is for sure. The gold stocks did buck the trend, the yellow metal has moved higher in recent days, after all and sundry having called the price lower to somewhere around 1000 Dollars a fine ounce (the most aggressive I saw) to stabilising at current levels. Show me somebody who can predict the commodities market with great accuracy and I will have to tell you that I am deeply impressed with their wicked skills.

The Impala platinum trading update was poorly received initially, the stock was down only half a percent from where they started by the end. Obviously the currency is of some major concern here in South Africa, the weaker the local currency relative to the majors, the less spending power that we have relative to our emerging market peers. Although, my go to graph on this matter almost always spits out a more sensible option. I map the Indian Rupee, the South African Rand, the Russian Rouble and the Brazilian Real (no point on the Chinese Renminbi, that has a Dollar peg of sorts) against the Dollar over a period of 1 year, just to be certain that we are not completely out there, as far as underperformance goes. The results are what you would expect, after a monster slide in the Indian currency to the Dollar, things have stabilised and in fact flat over the last year. The Brazilian Real and South African Rand weakness to the Dollar is about exactly the same. Spare a thought (or perhaps they deserve it) for the Russian Rouble, which has lost nearly 40 percent of their value to the Dollar over the last year, most of that in the last six months. Hey, good luck with that expansion and tough stance, well done on the oil price too. Pffff.....

Well done to the lawmakers on Capitol Hill, extending spending through to September next year. They averted a shutdown, shaving it close again, this time the funding would have run out on Thursday at midnight. If you are interested in politics and money, then read the WSJ piece U.S. Lawmakers Agree on $1.1 Trillion Spending Bill. I wonder where the debt hawks vanished to? Remember when we had impending doom as a result of too much US government debt. Strangely as it happens, when you get economic growth, you get higher tax collections that deal with the problem of government debt. And whilst the US is hardly expected to report a surplus any time soon, the size and scale of the debt, relative to the size and scale of the economy is under control. Would it be better in an ideal world if there was no debt whatsoever? Think about how most folks would go about saving for a house, which would probably make various asset prices cheaper. Lazy balance sheets all around (personal, government and company) does little for growth prospects, yowsers, I am going to get into a whole lot of trouble with that one!

To finish off the segment, I was interested with the Barron's article titled Might Vanguard Founder Jack Bogle Be Wrong for a Change? Not because Jack Bogle might be wrong or not, rather the way that people still think about investing as being purely confined to borders. Thank goodness companies do not think like that, they would miss many opportunities for their shareholders in engaging with new customers. After all, we are all consumers in nature, regardless of our backgrounds. What is still amazing however is that the US accounts for 48 percent of the total global stock market capitalisation. Of course that might be owned by many, it still is a gentle reminder (if you needed one) that when the stock market roars, soars or enters a funk in the US, it predictably impacts on valuations and value levels across the globe.

Company corner snippets

Anglo American had their investor day presentation release yesterday, the actual presentation can be downloaded. So, now what? I mean, Minas-Rio is on track, 400 million Dollars lower than the revised plans, and is relatively low cost 33-35 Dollars per wet metric tonne. The wet has to do with the transportation method, a slurry pipeline 525 kilometres long. That is just a little shorter than the distance from Jozi to Maputo, imagine that sports lovers! Capex has been cut for next year, and the year thereafter. The dividend is expected to be funded from cashflows generated during 2016, just around when debt peaks. The company identified 10 projects (see the statement) and you can see which ones are going to be key in the coming years. As much as Mark Cutifani can do at the company in terms of operational brilliance and deep mining insight (I do not mean deep as in the sense of shaft deep), the tough operating conditions, the patchy power supply and unhelpful government (in some instances) against the backdrop of weakening metal prices hardly makes the company any more appealing now. We continue to avoid, in spite of all the best intentions and cost cutting in the world.

Not much by way of news announcements from companies, so we do need to scratch like a chicken (two left right feet drags, followed by a left foot drag, all at high speed) in order to find stories that are relevant. I guess that this one does, Hulamin announced a clear trading statement for their year ending December (we still have three weeks left of this month), suggested that normalised earnings per share were expected to be as much as 73 to 90 percent better than the prior financial year. The stock jumped three percent on the day, that was the good news, the bad news is that since they have unbundled from Tongaat Hulett/Anglo American, the share price is down a whopping 77 percent. In 7 and a half years. At the time, the pre-listing prospectus said that the combined board believes that the unbundling and listing of Hulamin on the JSE will unlock value for shareholders and provide investors with a unique investment opportunity in a focused aluminium semi-fabricator company. No. I guess if you had held both assets, you would have been OK, the timing on the part of the folks from the sugar business was pretty good. Aluminium is a tough business, definitely not for sissies. I did notice that the IDC is nearly a 30 percent shareholder, the PIC owns 5 percent (and a bit more) and Coronation owns 10 percent, I wonder what their view is on this business. Anglo used to own 20 percent, the IDC stake dates back to 1996. Tough man, tough.

Things we are reading, we think that you should read them too

An interesting look at the role that psychology plays in saving and investing - Should Millennials Pay Off Student Loans or Save For Retirement?. This is the most basic way of showing that people are not rational and by extension the world is not efficient (So much for all those economic models which all assume the world is efficient!)

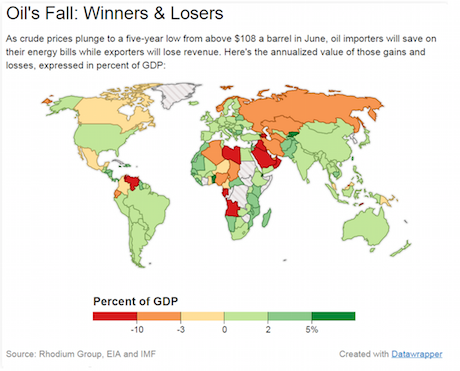

The last word on oil - Oil Price Winners and Losers Around the Globe. The countries that have not diversified their economies away from the single export of oil, the picture looks very ugly. Here is the map used in the article:

Warren Buffett, mention his name and people listen - Warren Buffett's 6 best investments of all time. The interesting thing about this list is that it seems all so easy. I think the hardest part for all of us is ignoring the short term moves of the market and to wait for the long term, which is ultimately where fundamentals rule and not emotions, which is the case over the short run.

Home again, home again, jiggety-jog. A mixed bag over in Asia this morning, whilst US futures are marginally lower at this stage. Where is my Santa Claus rally? Did I get too much in November? Possibly. Righto, the news might wear a little thin from here, we will try and keep you going with as much as possible from here on out. I am away shortly, I shall try and get a little in here and there when I can, just to keep the home fires burning. As ever we are all reachable on our cell numbers (if you do not have them, please email us) and of course email.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment