"Whilst it is easy to point to these businesses as society has painted them (it must have come from somewhere), not enough credit is given to their ability to come up with life saving therapies. "

To market to market to buy a fat pig Yesterday there was tons on the go, Kumba Iron Ore reported numbers that easily surprised the market, most especially with the re-instatement of the dividend, which sent the stock and that of the majority shareholder, Anglo American, much higher on the day. In fact, the resurgence of the commodities complex at one stage threatened to see the Jozi all share clock a new lifetime high. Of course, all of you who have been paying attention would have noticed that the All Share has been a stagnant beast for the better part of three years, part the handing of the baton to the industrials and the fall from grace of the mining stocks.

Kumba Iron Ore stock soared, like Icarus with the wax, up over 17 and one-third of a percent on the day. Stunning and very rare at the same time for a business of this size, this single day move propels Kumba back into the top 40 stocks by market capitalisation, the market value is now 65 billion Rand. The volatility of the share price over the last ten years is just as breathtaking, being an incredible success story as the price of iron ore itself experienced gyrations that would make any seventies dancer with bell bottoms and big hair to boot a disco sensation. Ten years, the Kumba Iron Ore price is up 2.6 percent. Five years? Down 66 percent. 1 year, up 51 percent.

It depends how well you timed the proverbial cycle, it just became and becomes too hard to time the exit and entry prices, plus the capital gains implications in-between. Overt ten years the share price has been as high as 611 odd Rand in Feb 2013 (you could have bought in the depths of despair of October 2008 at 112 Rand), and as low as 26 odd Rand in the great commodities washout at the beginning of 2016. It is now 203 Rand. If you can find a single person/entity who bought at 112 in 2008, sold above 600 in 2013, bought back at 26 in 2016 and holds them now, then good for you. Timing and cyclical commodities markets are too wild for ordinary investors, that is our experience.

Anglo American added seven and a half percent to close at nearly 200 Rand, the story for Anglo's South African Rand share price is not so pretty. Ten years, you are down 55 percent. There has been talks of revivals, in an uncertain environment that I wrote in an email recently, describing both the mood and the lay of the land: " ... the rules are unknown. It is like trying to play tennis on a court with shifting lines, you don't know where to serve, the net keeps going up and down and the ball keeps changing shape." It is what it is.

Session end, stocks rose around one-quarter of a percent, resource stocks up three and two-thirds of a percent by the end. Stocks in the down column included Remgro and Sanlam, Mediclinic was up smartly (1.7 percent) following an announcement that their chief would be retiring in the middle of next year, enough time has been given for the company to find a replacement. What I find amazing is that at the same time that outgoing CEO Danie Meintjes started out at Sandton Mediclinic as General Manager at the same time that Clifford Ross of City Lodge (now CEO) was starting at the first location over the road, in the mid eighties as City Lodge hotel manager number 1. It was a taxing time in Msanzi, Meintjes running a private healthcare facility trying to churn as many patients as profitably possible, and Ross over the road trying to do something similar, without worrying about their "health" too much.

Across the seas and oceans, stocks were propelled by earnings, the way it is supposed to be when investing. Not politics or the Fed, the market is made up of separate companies that incrementally improve in share prices over time, sending the market as a collective higher. The S&P 500 is not a beast or a mythical creature, it is the sum of the constituents, some have a very high market capitalisation such as Apple inc. at 806 billion Dollars, the smallest on the list (from my limited research) is JBG Smith Properties, with a market cap of 4.15 billion Dollars, or 54 billion Rand.

In other words, only ALSI 40 constituents really. Exclude the secondary listed stocks and the list may well be smaller, which is just another reminder that we do have some big businesses that punch above their proverbial market cap weight and that the ALSI is not a proxy for the economy. They are two different things. Session end the Dow Jones Industrial Average added nearly half a percent, the broader market S&P 500 traded up nearly three-tenths of a percent to a record high of 2477, whilst the nerds of NASDAQ squeaked out a marginal gain, Alphabet (Google) slid around three percent after the results, we covered those yesterday. McDonald's produced favourable numbers, that stock soared, the market super-sizing the share price by four and three-quarters of a percent.

Earnings propelling markets, the way that it should always be.

Company Corner

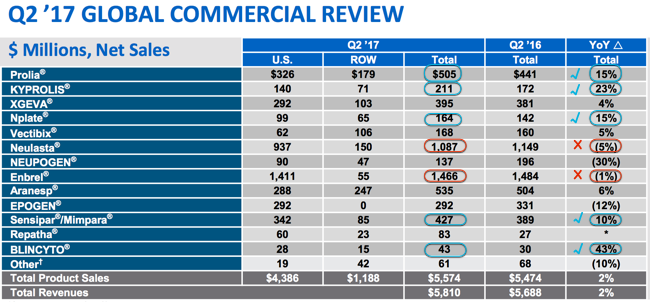

Amgen Reported their Q2 2017 results aftermarket yesterday, with both a top-line and a bottom line beat. Earnings per share clocked 3.27 US Dollars (up 15 percent) on revenues of 5.81 billion Dollars (up 2 percent). Whilst there was momentum on their new products, there was a definite slowdown on their older products which obviously face increasing competition over time. It is the nature of the beast. Which is why, when owning a business in this very important space, healthcare, you need to find a business like Amgen, which has multiple lines in the water, so to speak. To illustrate this point, you need to look no further than to the breakdown per therapy:

Through some very low level editing, I have managed to point out that there are two crosses and several more ticks, when it comes to the more competition (red cross) and new therapies (turquoise tick). The company spends, like most of their peer grouping, a large number on research and development, they have spent roughly 15 percent of their product sales for the first six months of the year.

Yes, around 1.64 billion Dollars of their 10.773 billion Dollars worth off sales goes into developing and finding cures for the likes of the prevention of the crippling migraine (Aimovig) and newer oncology drugs like Avastin (for the treatment of metastatic colorectal cancer) and Herceptin (Breast cancer targeted therapy). Along with several other therapies, these above are in the final stages of of their clinical programs.

Whilst it is easy to point to these businesses as society has painted them (it must have come from somewhere), not enough credit is given to their ability to come up with life saving therapies. I feel. We have often made the point that it is far better to part with your money and give it to the likes of Amgen, becoming a shareholder along the way in searching for a cure for certain cancers and other life threatening and debilitating diseases, than it is to parting ways with your hard earned money in supporting a product that ultimately is responsible for many dread diseases.

Without getting too close to the moral high ground (which is very dangerous territory), if one can profit by investing in a business that cures, rather than the opposite, it adds a certain feeling. There is of course the moral argument about the company recouping their investment by charging thousands and thousands of Dollars for their therapies, and whether insurance and government medical schemes can afford to pay. Which is why ethics and health are tough arguing ground.

There is also increased arguments to be made for governments who tax the products that cause dread disease that help pay for the therapies that cure the people later. i.e. prevention is better than cure, which always motivates the argument for an investment in Discovery. You are never going to change human behaviour to the point that everyone is a yoga praising, meditating, calm and collected vegan that has complete life/work balance. Besides, not everyone wants to be all those things, that is what makes us individuals, we like the choices.

The company updated their full year guidance, tweaking it ever so slightly. The Earnings per share range is expected to be between 12.15 to 12.65 Dollars a share on revenues for the full year of 22.5 to 23 billion Dollars. Whilst the earnings range moves higher at both the bottom and top end, the revenues range is pulled back a little at both ends, perhaps that is what the market is worried about. The stock is off two and one-third of a percent in pre-market trade, the stock is of course up 23 percent year to date (before this move).

At 176.6 Dollars, the indicated price, Amgen trades on a FY multiple of just less than 14 times. Which is hardly expensive. In this transitionary period in-between the decline of the old therapies and the rise of the new, the market is likely to be more cautious, and in that, I think there is an opportunity. A great business for the long run, and our preferred biotech stock. Continue to accumulate.

Linkfest, lap it up!

Amazing to see how small technology is becoming - Tiny robots swim the front crawl through your veins. My hope it that by the time I reach an age of high medical bills, nano bots are common medical practice. Nano bots making changes to me instead of a doctor cutting me open sounds good, to go along with DNA specific medications.

Home again, home again, jiggety-jog. Stocks are marginally lower on balance. Across Asia stocks are up, US stock futures are mixed. The repeal of Obamacare failed, I can't see how that is going to be overcome! The Fed meeting wraps up today, they are expected to "skip" this meeting. Inflation? Maybe.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment