"Comair, a listed entity that answers to their shareholders, delivered revenues of 5.9 billion Rand for their 2016 financial year. They employ 2085 people. They lease and own 19 planes. They paid 29 million Rand in taxes (as a company) or 13908 Rand per person or 38 Rand a day. Or what you pay for a sandwich and a water on Kulula, midair South Africa, neat hey?"

To market to market to buy a fat pig Yesterday was a holiday in the US, and you could feel that "things" were a little quieter than usual. In fact, a whole lot quieter than usual, other than the Tour de France and re-runs of programs on business TV. We continued to hear news from the ruling party policy conference, these events are about as useful as the G7 or G20 meetings for me, a whole lot of talk by politicians and very little by way of skills in executing. I am going to make a strange comparison very quickly. And you are going to have to excuse me for going off on a tangent.

SAA received 2.3 billion Rand last week in order to pay off a creditor and in order to stay afloat. There are around 19 billion Rand worth of loans that the taxpayer (not the government) guarantees. It is easy to say that government guarantees these, it is the collective pool of the tax base that guarantees this, the ordinary citizens who work for businesses that pay tax, the ordinary citizens that pay consumption tax, the ordinary citizens that pay income tax. Some ordinary citizens are in a whole lot better shape than others from an earnings capacity, that is for sure. If you pay tax in South Africa (income tax), then you are in a MUCH better place than those who do not pay tax. It may sound strange, I can assure you that the 9 million unemployed in the workforce would prefer to be taxpayers than not at all.

What does 2.3 billion Rand get you nowadays? For starters, if you injected these funds into Lonmin, the third biggest platinum producer on the planet, at current levels, you would own more than 40 percent of all the shares. Lonmin, at the market close last evening, has a market capitalisation of 3.23 billion Dollars. Inject (and dilute existing shareholders) 2.3 billion Rand and you have that stake. It could be a good start to seeing what mine ownership is like in South Africa as the government. Right?

Oh, and all this talk about owning steel makers. A bearded fellow who never set foot on a factory floor suggested that was a good idea, that was around 150 years ago, even before the automobile was invented (riding horses and making saddles was a good idea then too). Arcelor Mittal had a market cap of 6.15 billion Rand last evening. Injecting 2.3 billion Rand would give you an ownership of 27 percent immediately. A couple of board seats and a "new direction" and agenda could be set. Harmony Gold has a market capitalisation of 9.547 billion Rand, that kind of money buys you a nearly 20 percent stake in the business, how about that one? PPC, they make cement and key to a developmental state, how about a 21 percent stake there?

Or ..... I have a better idea. How about Comair? This is a private business, that operates in an environment that has a dominant state owned enterprise, SAA. Comair, notwithstanding the bottomless money larder that their competitor has access to, has never reported a negative trading half. Therefore it cannot be that the operating conditions are "hard". They (Comair) have a market capitalisation of 2.417 billion Rand, as of last evening. That is correct, the amount that Treasury gave to Peter to pay Paul (SAA needed to pay Standard Chartered) is 95 percent of the market capitalisation of the their main competitor.

SAA (according to the last annual report that is available on their website), has staff of 10706 (that was March last year, 2016). 53 Planes in the fleet, 3 cargo, the rest passenger planes, ranging from A330s to A340s to smaller short haul B737s and A319s. 9 international destinations, 7 countries. 21 African countries, 25 destinations. The company achieved revenues of 30.3 billion Rand and paid 2 million Rand in taxes for the financial year to end 2016. Airlines is a hard business. Let us have a look at a few metrics. Revenues to staff, 2.838 million Rand. Tax paid per employee (this is hard, this is a tricky thing being a government entity that has a "mandate"), is 186 Rand. Or 50 cents a day. If you make a loss, you can't pay taxes.

Comair, a listed entity that answers to their shareholders, delivered revenues of 5.9 billion Rand for their 2016 financial year. They employ 2085 people. They lease and own 19 planes. They paid 29 million Rand in taxes (as a company) or 13908 Rand per person or 38 Rand a day. Or what you pay for a sandwich and a water on Kulula, midair South Africa, neat hey? Revenue generated per employee over at Comair? 2.858 million Rand. That number looks surprising similar to SAA. If only it was so easy and if only we didn't engage in an ideological debate about the importance of having a national carrier. Britain, Spain, Germany and France, the Netherlands and the like all have national carriers that are listed entities. That are answerable to a host of shareholders.

The relative boards, non-execs, got paid around the same amount in the 2016 financial year. Including the share awards, the Comair Directors were paid nearly 38 million Rand. About 17.5 million in basic, performance and other. There are 4 of them in total. SAA? On the executive committee, there are 12 people on the Executive committee and 4 executive directors (there are overlaps, i.e. people serving on both) who got paid a collective 34 million Rand in benefits and salaries. Big team. Perhaps too big. These directors at SAA also get a benefit of nearly 230 free flights a year. And I am guessing those are not row 31B. We haven't even looked at Airlink or SA Express.

It is just not that easy to quantify what the importance of a national carrier is to your tourism numbers. Including SAA, there are 27 airlines that fly internationally to South Africa every day. With the lower cost airlines such as Qatar, Etihad and Emirates, as well as regional bases such as Ethiopian, Turkish and Egyptian, how can SAA compete on price? My only observation is that 2.3 billion Rand in "emergency" funding is a big number, and 95 percent of the closest competitor quantifies the amount. Private always trumps public, look at the mess that Alitalia is in currently. Which one would you rather own? If you had to pick one of the ones that we have spoken of, SAA, PPC, Arcelor Mittal, Lonmin or Harmony Gold?

Markets quickly, although the US ones were NOT open yesterday, of course we were. July the 4th is not a date on the national calendar that attracts a day off. Stocks in Jozi as a collective sank around one-quarter of a percent, some big winners in the resources sector, the biggest loser on the day was Naspers. And it was related to ....... Tencent. The stock was down over 4 and one-third of a percent by the close of the session. Why? The Chinese government wants Tencent to limit the amount of time that children can partake in the mobile "activity" (can't say the word that rhymes with lame) Honor of Kings. The Chinese government are worried that it is becoming addictive.

Addicted? There are around 350 million Chinese smokers. The country produces over 40 percent of the cigarettes in the world. Around one in four Chinese doctors are smokers. Yes. Hong Kong interestingly has a much lower smoking rate, around 12 percent. They are addictive too. It does however generate high single digits of revenue for government, the cigarette companies which are all owned by Chinese companies. Be that as it may, Honor of Kings has around 200 million users. The public mouthpiece (i.e. the national paper) has the story - China's Tencent to limit children's playtime.

As it says: "Honor of Kings, which sees players battle mythical beasts in a fantasy landscape is essentially a mobile replica of the world's most played game, League of Legends (LOL) created by US developer Riot Games."

Tencent replied, which is pretty hilarious: "'We will make continuous efforts with all walks of the society to create a healthy cyberspace for adolescents,' noted Tencent, which also called on parents to spend more time with their kids to have them feel the warmth of family." I like that, hey parents, spend more time with your kids, so that they can feel the warmth of being a family.

Meanwhile teenagers around the rest of the world are addicted to their cell phones in the same way. Teens in the US spend 6 hours a day on their phones. Snapchat, Instagram and Spotify, Twitter and very little Facebook. Mostly Facebook Messenger. Musical.ly. What is the difference whether it is Honor of Kings or Musical.ly? They both involve a little escapism.

For context of where we are in humanities advances - When the Car Radio Was Introduced, People Freaked Out. 56 percent of Americans polled, agreed that a car radio was a distraction.

Linkfest, lap it up!

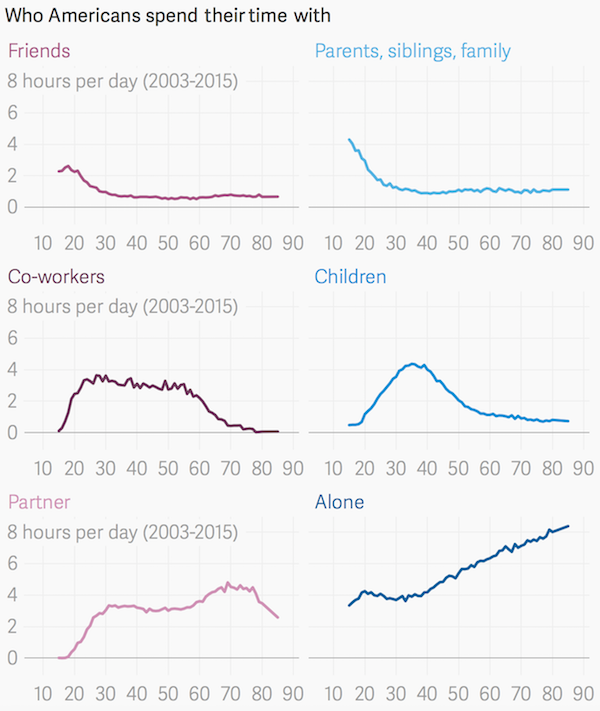

I'm not sure what to make of this data. If people spend more time alone as we age, the likes of Facebook and Netflix should see usage time increase as we get older? (These charts show who you'll spend your time with across your lifetime)

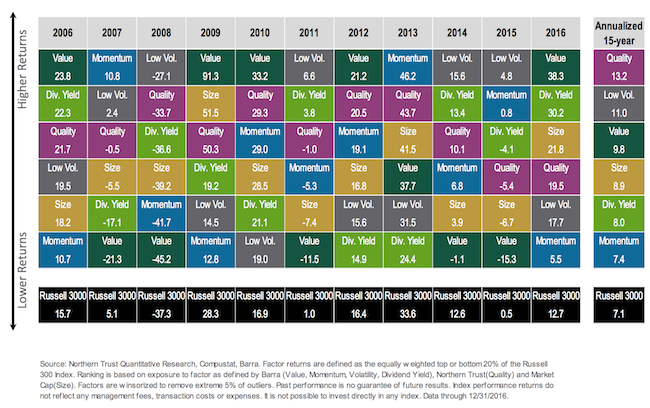

The new fad in investing is factor based investing. Basically someone does a bunch of back tests and then comes out and says "this style produced these returns with this amount of volatility". I would say the optimal approach is not to be too stuck in your ways but at the same time, making sure you are not chasing after the style that did well yesterday - Factor Picking is the New Sector Picking. Interesting to note that all 6 factors have done better than the Russel 3000, does that mean that all the other factors you could follow had really poor returns?

Immigrants and the current emotive debate globally needs to be quantified, the country that has (almost always) accepted people looking for a dream is the US, herewith a Visual Capitalist piece on Who Came to America, and When?. It would be interesting to add in a "Why?" there, i.e. war/famine/economic malaise in the other countries.

Home again, home again, jiggety-jog. Stocks have started mixed to better here, the Rand unfortunately is against the wall, being sold off pretty aggressively over the last week or so.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment