"I have never seen anything like the NASDAQ glitch last evening. This was after the market had closed for a half day, remember that today in the US is a holiday. As far as I can tell from the reading that I have done, some improper use of test data sent to third party vendors caused the mistake, across platforms such as Google Finance and Bloomberg."

To market to market to buy a fat pig I have never seen anything like the NASDAQ glitch last evening. This was after the market had closed for a half day, remember that today in the US is a holiday. As far as I can tell from the reading that I have done, some improper use of test data sent to third party vendors caused the mistake, across platforms such as Google Finance and Bloomberg. Eeeekkkk! So on paper, at least according to the data being provided, the wildest swings that I have ever seen transpired.

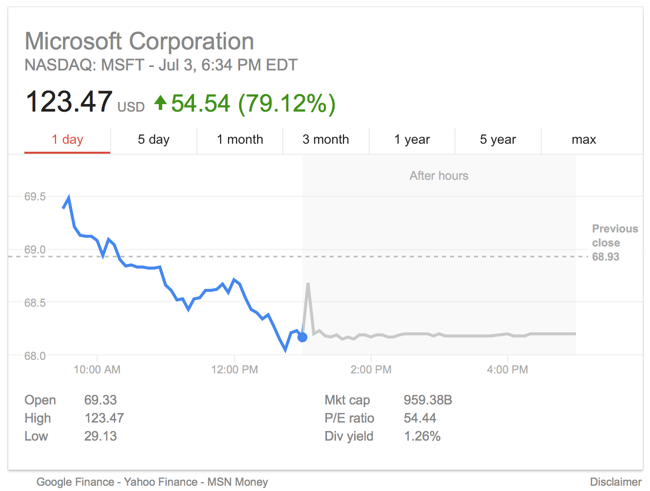

There were multiple share prices stuck at 123.47 Dollars a share. Amazon was there (as was Google/Alphabet, the C class shares), implying that they were down 80 percent plus on the day. I saw that Amgen had halved, it then closed near the same number as all the others. Apple was up so much that the market cap was above 3 and a bit trillion Dollars. Then the stock price of Apple was back down 14 odd percent to that 123.47 Dollars. The BusinessInsider managed to grab a few screenshots before the NASDAQ corrected the data - Amazon and Google share prices were reported down more than 80% after test data went live. Microsoft was also stuck at 123.47 Dollars a share (up 80 percent), as was Zynga (up over 3000 percent a share).

The FT reports - Nasdaq stocks including Apple, Microsoft, Amazon see prices changed to $123.47. What I found interesting is that the prices of the stocks on the NASDAQ website, the actual platform, was unchanged. I suspect that techies had been working on some data set for testing purposes, they had put in a few prices of big stocks and fun stocks (Zynga in there). I managed to find a place where the data was still compromised and grabbed a few screen shots. What is important is that there is a disclaimer there at the bottom. So here goes a few share prices, designed to show that technology is not fail proof.

Notice that the prices of the stock during the half day of trading are actually the right prices, the last traded price is wrong. All is well that ends well, the data is not really compromised. Recently there have been a few hiccups, CNBC stuck together a list - A short history of stock market glitches. I recall most of them, the flash crash was the most horrifying of them all.

At the half day session end, stocks in New York closed mixed, the Dow was up just over six-tenths of a percent, settling at a new record, thanks in part to a bounce back from oil and materials. Expect the same here today from those stocks. The broader market S&P 500 added nearly one-fourth, whilst the nerds of NASDAQ saw some more selling of the tech sector (ignoring the above), down half a percent by the close. The likes of Facebook, Alphabet and Amazon (in the real market) sold off over a percent.

Tesla, the most talked about company on some of the platforms I follow, released a production report last evening. Whilst the headline number sounds impressive (an increase of 53 percent), it fell short of the market analysts. "Q2 production totalled 25,708 vehicles, bringing first half 2017 production to 51,126." What is more interesting is that Model 3 "keys" are set to be handed over to the first 30 owners at the end of this month. Good news. Tesla reckons they may get to 20 thousand Model 3s a month by the end of the year. We shall see if they can meet that lofty goal. I am interested to see how excited Tesla Model 3 customers are in their new products.

Stocks locally were unfortunately powered by losses in the Rand, in turn the Rand hedges bolted ahead, driving the overall market up over a percent here in Jozi. Resources were on fire, those stocks up over two percent as a collective. Glencore, BHP Billiton, Anglo and Naspers were in the winners column, as was South32, Kumba and Steinhoff, at the other end of the spectrum were mostly ZA inc. stocks, the likes of PSG, Capitec and Aspen, as well as Discovery all losing ground on the day. The news was relatively sparse, other than a joint announcement from Long 4 Life and Holdsport in which the former was expressing an interest in acquiring Holdsport for a scrip swap ratio. Holdsport ended up two and a bit percent on the day. Long4Life about the same amount. We will look at this in a little more detail during the course of today and then revert.

Long4Life raised 2 billion Rand and has a market cap of 2.53 billion Rand, as at last evening. They must have earned decent enough interest, they must have had some costs along the way. 10.44 Long4Life shares for every 1 Holdsport ordinary share is the swap. There are currently 405 million Long4Life shares in issue. There are currently 43.15 million Holdsport shares in issue. So there could potentially be another 450.5 million Long4Life shares issued to shareholders of Holdsport.

Long4Life would then have around 855 million shares in issue, you will own Holdsport (currently worth 2.55 billion Rand) and cash of 2 billion Rand. And the combined smarts of the boards of Holdsport and Long4Life, the overlap is Kevin Hedderwick of Famous Brands fame. He is a non-exec at Holdsport and appointed the L4L Chief Operating Officer in May this year. So let me get this right, you are paying (if you buy L4L) a twenty percent premium on cash currently, and the deal making ability of Joffe and Hedderwick.

It better be darn good if you are a Holdsport shareholder, the premium is not much, the stock currently trades on a historical multiple of 13 times (at the "takeout" price). It will now become a shareholder issue, if Allan Gray as the biggest shareholder feel that the premium is not enough, they will ask for more. Kevin Hodgson, the CEO of Holdsport is the second biggest shareholder, this is a big deal in his life.

Kevin Hedderwick owns 60 thousand Holdsport, relative to his Famous Brands holding, I cannot imagine that this is "material" for him. For Brian Joffe, who got a "better price" than some of the others (he got 4 Rand a share). Joffe owns 6.2 percent of the company, if he works there for another three years, which should be the case, he will get (as per the listing document), another 3 million shares in remuneration. He will then own 28 million shares. If this dilution happens, then he is around a 4 percent shareholder. Not a lot in percentage terms, at 6 Rand a share, quite a lot. Let the shareholders of Holdsport decide, they are after all the owners of the business.

Linkfest, lap it up!

Investing in stocks is not easy because no one likes to see their portfolio values drop, which happens regularly if you have been in the market long enough - Every Time Stocks Fall. . . .. We see this regularly where, when things get bumpy our daily newsletter gets read more and we get more phone calls. When the market is going up generally things are quiet.

With global wealth at an all time high and the topic of inequality increasingly coming up, the idea of a basic income for all is gaining traction - The largest basic income experiment in history is coming to Kenya. The above link is from 2016, here is where you can follow the progress of the study - New study published on results of basic income pilot in Kenya.

The next question to ask is where do you get the money from to pay everyone a basic wage? If you are like Alaska where there is a vast amount of oil and a small population, there is enough cash to go around (The largest cash transfer program in the US just got a huge vote of confidence). Most nations though have large populations and governments running deficits already.

Home again, home again, jiggety-jog. Stocks locally are lower. Naspers has understandably sold off as a result of the tech selling across the globe. There should also be slower volumes today, as a result of the 4th of July.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment