"Loads of Apple articles last week, Michael and I have put together all the links that we think you need (you are welcome), in order to see how far the product has come. There are some suggestions that the smartphone of the future may be glasses, or more augmented reality. The fact is that the iPhone is the most successful consumer product of all time."

To market to market to buy a fat pig I learnt something new this morning, and perhaps it is an age thing. Michael did not know what Rick-rolled was, even though there is a Wikipedia entry. Old Rick Astley went along with the flow, it is better than hiding away. The song was covered in layers of cheese, somehow we were caught up in the things that Rick was never going to do. The song (Never gonna give you up) may have won best British single at the Brit awards in 1988, by 2004 it was voted 28 on the worst 50 songs of all time by VH1. A bit like the Macarena, fun at the time, completely cringeworthy now. I have never been one for crowd dancing, I think I hid around the corner during the c'mon locomotion (without me).

Friday market was more inclusive for the bulls, stocks as a collective were up half a percent by the close. The long and meandering train of three years in the ALSI doing nothing continues, however. We need something meaningful to spur confidence, for the time being political scandals and flip-flopping on policy = a complete lack of confidence. Over three years, the ALSI is down nearly a single percent. That return does not account for inflation either, nor does it account for the weakening Rand over that same time. Equally, SABMiller would have boosted the exchange with their huge buyout at the hands of AB InBev.

A quick look at some of the majors reveals a tale of two markets. Notwithstanding the heavy handed selling of the Pound Sterling, British American Tobacco is up 34 percent over 36 months (and they pay a great dividend). Naspers's share price over the three years is up 89 percent. Richemont stock on the other hand is down 3.3 percent over the last three years. The share price of Glencore is down 22 and a half percent over the last three years, BHP Billiton is down 46 percent over that time period.

Steinhoff shares (lots of stuff going on in that time) are up 20 percent in three years, FirstRand are up 15.6 percent. Anglo American are down 37 percent over 36 months. Lastly, making up the top ten is Vodacom, that stock is up nearly 25 percent over that time. If one had avoided resource stocks over three years, it seems that you would mostly be ahead. It has mostly been a drag by commodities, as a collective the Resource 10 index has halved in three years.

The Industrial 25, mostly the majors as per above, is up 16 and a half percent over that time. It definitely feels like a case of two markets. Paris to London style (Charles Dickens "A Tale of Two Cities") with investors stuck in the English Channel (the French call it "the Sleeve"). Rowing their boats based on the currents and tides of emotion, politics and the tides of confidence. It is fair to say that currently we are in a spring tide of low confidence. Spring can be confusing when explaining tides and confidence, there are few green shoots currently and more shallows.

Ahead of what is a really short week in the US (halfway today and market closed tomorrow), stocks sank by the close of business. The Dow Jones Industrial Average may have ended off the highs, by the close the oldest blue chip index was up three-tenths of a percent. The broader market S&P 500 closed 0.15 percent higher on the day, healthcare and financials gave up a little ground, as well as technology stocks. That led the nerds of NASDAQ to close lower on the session, down 0.06 percent by the close. Not that much lower, right? The one stock that stood out was Nike, up nearly 11 percent by the close to 59 Dollars a share. Good news for investors that have seen the stock "stuck" for the last 20 months or so. North America is not the rest of the world, it seems that the analyst community (which is mostly US based) is coming around to that.

Like we said earlier, the market is only open until 1pm New York time, closing three hours earlier than usual today. And then the rest of the day off tomorrow for Independence Day (fighting aliens and all that), the US would have their "freedom" and independence from the United Kingdom for 241 years. Whilst fireworks may be the order of the day tomorrow, there is likely to be subdued trading all day long today. One strange factoid about Independence Day and the American Revolutionary War which was ongoing, the Treaty of Paris was only signed in 1783. It concluded that the USA was a sovereign state and came into effect May 12 1784.

Many "Loyalists" to the Crown (and the Empire), fled to neighbouring British North America, which in turn became Canada. Canada itself gained independence from the British Empire in 1867, and celebrated 150 years over the weekend, 1 July. Happy birthday to the largest parts of North America, Mexican Independence Day is 16 September.

Company corner

Loads of Apple articles last week, Michael and I have put together all the links that we think you need (you are welcome), in order to see how far the product has come. There are some suggestions that the smartphone of the future may be glasses, or more augmented reality. The fact is that the iPhone is the most successful consumer product of all time. Last week marked the 10 year anniversary of the iPhone, here are a couple of links to celebrate the occasion. First off here is Steve Jobs introducing it - Steve Jobs' iPhone 2007 Presentation.

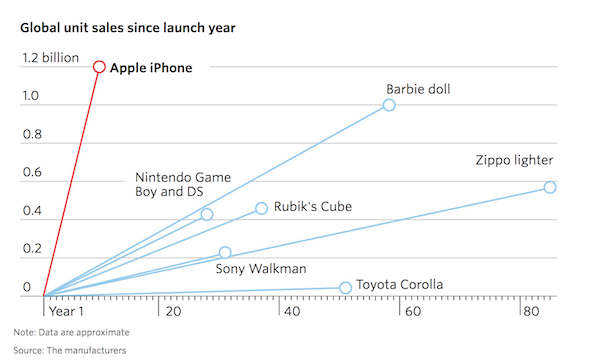

Here is a re-take on the very first iPhone, the version one of the iconic smartphone. A WSJ staffer decided to put it all to the test, her daily life cast back to the future with an iPhone 1 -> iPhone Review Redux: 10 Years Later, So Slow, So Small. Getting a sim card that is compatible is a problem. The battery sucks. There is no front facing camera. There are no apps on the iPhone 1. You have to access Facebook and Twitter via the internet. 2 megapixel camera. And how many did they sell? 1,389,000 ..... The 3G (which was the first one that I had), sold 12 million units. The iPhone 4S propelled Apple through 100 million. It was the 7 (and the Plus model, that came along with the 6) that saw the company sell 1 billion products, inside of a decade. Read the article, see how archaic the phone was you (may have) used a decade ago.

The iPhone is also the fastest to one billion units sold, and most units sold for a consumer product. Barbie is the only other product to break the 1 billion units sold.

Another one here, connected to the above, the very good (and you should sign up for the newsletter) Horace Dediu. Born in Romania, schooled in the US, lived in Helsinki (he was an analyst for Nokia), he is now a full timer at his business, called Asymco, which is around 7 years old. Horace often writes about the iPhone, we included this in links last week, it is worth another take - Defining the 21st Century. Horace reckons that Apple will have sold one trillion Dollars worth of iPhones by the end of 2018. The many things that we can do with the device amazes him, as should it you. The defining paragraph (for me) after Horace praises the device, was as follows: "That all this happened while the product itself was always perceived as fragile, vulnerable, copyable, doomed to early demise. That imitators outnumber it 10 to 1. That it somehow found ways to become better even though we exhaust what we can ask of it."

The Verge has an excerpt from the book The One Device: The Secret History of the iPhone, in an article titled: The secret origin story of the iPhone. It is a very long article, perhaps you are reading half a chapter of the book, I haven't got there yet I am afraid. One misstep in this whole process and perhaps we wouldn't have this incredibly successful product.

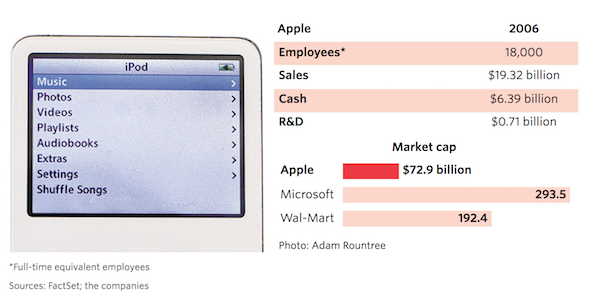

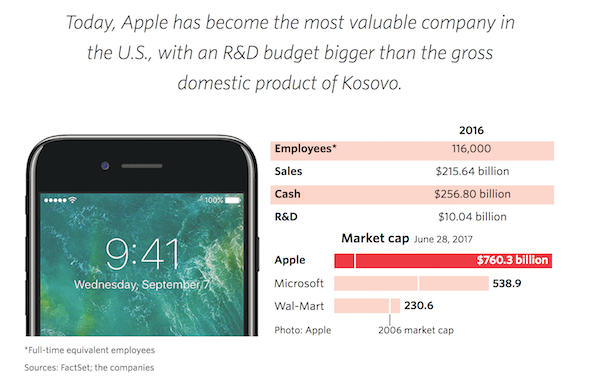

Having such a successful product has dramatically reshaped Apple from a Mac/Macbook/iPod company to cellphone company - How the iPhone Changed Apple in 10 Years

You will find more statistics at Statista

You will find more statistics at Statista

Look at how the employment numbers for the company have grown over the last decade, The iPhone Decade in 12 Charts.

With the rise of the smartphone other consumer products have become obsolete, when was the last time you bought a video camera? (The Losers of the Smartphone Boom)

You will find more statistics at Statista

You will find more statistics at Statista

Home again, home again, jiggety-jog. The G20 meetings take place this week in Hamburg. The city in which the Beatles spent large amounts of time in the early 60's. Around 2 years on and off as residents of Hamburg! The ANC Policy Conference meeting continues through to the middle of the week.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment