"For the full year the company managed to grow revenues by 6 percent to 34.4 billion Dollars, that is up 8 percent on a currency neutral basis. There are now (as at the year end) 985 Nike stores globally. Some of the iconic ones stand out, in New York and London, the experience is always "good" and the variety and quality is always excellent."

To market to market to buy a fat pig Stocks in New York, New York, were all lower across the board, tech stocks taking a pasting again. It seems like the volatility has certainly opened up, there have been bouts of selling and buying of the NASDAQ, which is all of 3 percent from the all time highs. That hardly sounds like a massive sell off? By the end of the session the Dow Jones had fallen four-fifths of a percent, the broader market S&P a little more than that, whilst the nerds of NASDAQ had sunk nearly a percent and a half by the close.

Alphabet sold off again, down nearly two and a half percent by the close. Apple down a percent and a half, Microsoft down 1.88 percent by the close. Tech stocks selling off on matters such as the inability of the current US administration likely to get through their tax reforms without significant compromise. And of course the travel ban, which may impact on the ability of the technology firms to attract quality employees.

Locally stocks sold off around half a percent as a collective, industrials were down nine-tenths of a percent by the close. At the top of the pops on a sliding US Dollar were the likes of Glencore and Anglo American, as well as BHP Billiton and Capitec. Sasol and Richemont were at the bottom, as well as British American Tobacco. Resources by the close were around three-tenths of a percent better on the day.

More politics is likely to dominate the landscape as the ANC policy conference takes place over the coming days. It is always unfortunate that politics should trump the business of business, most especially when politicians around the world have very little real life business experience. Yet they dictate to the very people who produce the revenues as if everything is "so easy". We are in the interest of talking about businesses that succeed, despite any political meddling. And it is a busy day, herewith some company insights below.

Company corner

We promised another take on the Naspers results from last Friday. This is about the most muted price reaction that I have seen in a while to the Naspers results. First things first, Naspers trades at a significant discount to the value of the stake that they have in Tencent. I can see why in some investors minds, this is more than a little irritating. For starters, as of the close of business in Hong Kong, the price of Tencent was 284 Hong Kong Dollars a share. That puts the market capitalisation at 2.69 trillion Hong Kong Dollars. 33.85 percent of Tencent (what Naspers owns) is 910 billion Hong Kong Dollars. Which equals more or less 1.513 trillion Rand! The Naspers market capitalisation was 1.13 trillion Rand, a gap of almost 400 billion Rand. i.e. minus 400 billion Rand for all the other businesses.

How is that possible? Is it that Tencent holders are valuing the company at too high a multiple and are the local investors being more "realistic"? Even if Naspers were ONLY holding Tencent, applying such a deep discount on a fast growing asset would seem a little bizarre. The fact of the matter is that there are businesses deep in Naspers, not all of which are profitable and some are also legacy businesses. I suspect that a lot of it has to do with the very heavy weighting in the South African index, where foreigners have been net sellers of the stock. Added to that, the local investment community has always thought that the stock is overvalued, so you are stuck with the company trading at this big discount.

Plus of course, there is internal debt that belongs to Naspers itself, not Tencent. As an investment holding company, it is not uncommon to discount share price relative to the NAV. It happens often. Tencent is not cheap, it trades on a historical multiple of 50 odd times, growing earnings in the mid twenties (percentage wise). As such the PEG ratio is still pretty high, the market is expecting BIG things from Tencent and thus far it has delivered.

This is an incredible article from Bloomberg about how they ended up here, and profiles Martin Lau, the Tencent president -> Tencent Dominates in China. Next Challenge Is Rest of the World. Read it, from beginning to end. You will learn many things about the corporate culture at Tencent and how they are far from done, only starting out. Again, it is an entertainment business, widely misunderstood by the investment community. Let us face it, many investment analysts are unlikely to engage in the new game releases on their handsets. The president of Tencent (as per the article) did some deep research into the business they were buying, becoming so good at the game (that they were buying), he clocked a top 100 all time score.

Naspers holds a whole bunch of investments, other than Tencent. Delivery Hero lists today (Delivery Hero Prices $1.1 Billion IPO at Top End of Range) and Naspers owns around ten percent (less post the dilution of the share issuance). It is another reminder of their global investment reach and aggressive nature to stay current.

Unlike the noise making fellows who are looking for quick returns, we remain very patient on the prospects of the company having multiple businesses inside of their stable. Tencent itself continues to evolve, with multiple business avenues. And if you can continue to accumulate the stock at a discount. It is a great opportunity, we continue to recommend this company as a buy.

Nike reported results last evening, they are a little out of sync with the rest of the businesses that we own. These numbers are for their fourth quarter to end 31 May, a strange financial year end in any place. There certainly are no governments that run their fiscal year to end May. It must have been something about starting the financial year at the beginning of the North American summer, when athletes and enthusiasts get back on the road. Perhaps I will email them and ask them why this is the case.

Immediately one is struck with the fact that the direct business (website and own stores) and the international business, as we thought and conveyed, is doing better than the North American business, driving sales at a faster pace than the market anticipated. Revenues for the quarter were up 7 percent on a currency neutral basis (5 percent up in Dollars), the company saw double digit growth in the likes of Western Europe, Mainland China and other emerging markets.

Diluted EPS rose 22 percent over the corresponding quarter, to 60 US cents, for the full year up 16 percent to 2.51 Dollars. Helped by lower tax rates, outside of the US and fewer shares. 3 percent less shares, as a result of course of company buybacks. During this year the company bought back 14.9 million shares for 820 million Dollars, as part of the extended 12 billion Dollar buyback program. That is around 55.03 Dollars a share, which is higher than the closing price last evening, which was 53.17 Dollars. The 52 week trading range has been 49.01 to 60.33 Dollars a share. We will get to the market and the price reaction in a bit.

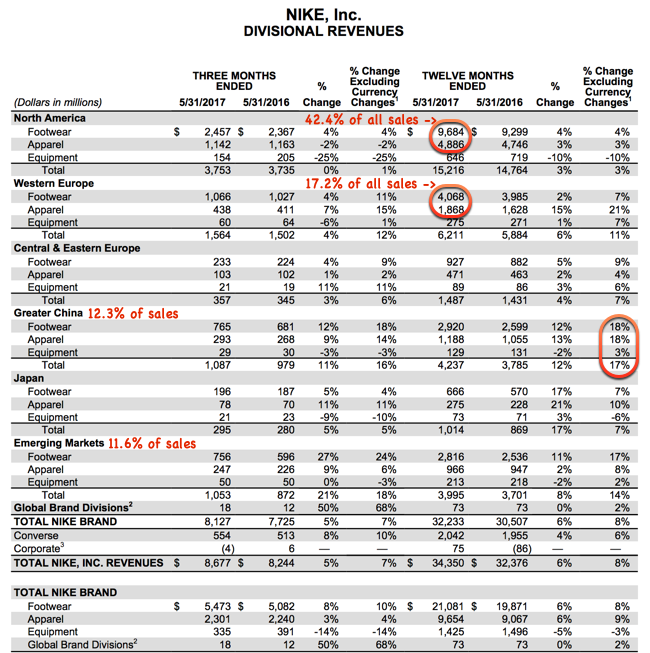

For the full year the company managed to grow revenues by 6 percent to 34.4 billion Dollars, that is up 8 percent on a currency neutral basis. There are now (as at the year end) 985 Nike stores globally. Some of the iconic ones stand out, in New York and London, the experience is always "good" and the variety and quality is always excellent. This sales matrix below tells you a lot about the business. It is still predominantly a shoes business, with 61 percent of sales coming from footwear (see right at the bottom of the table). It is still predominantly a developed market business, with 60 percent of the sales of shoes and clothing coming from North America and Western Europe.

China, although growing quickly, is only 12 odd percent of the total sales. Ditto emerging markets. These are the fast growing businesses and present big opportunities. In the unofficial transcript, the point is clearly made by Andy Campion (The CFO and executive vice president): "current per capita spend on Nike in those markets is still less than 1/10th of the per capita spend on Nike in more developed markets. Over time, macroeconomic drivers and consumers' expanding passion for sport will create even greater capacity for the Nike Brand to grow in those markets."

The market agrees wholeheartedly that the company is once again poised for growth and is through the worst of the North American "retail malaise". The stock, pre-market, is up 7.81 percent to 57.32 Dollars. I suspect that in the coming days and weeks, the analyst community will now be "excited" about the prospects and I think that they are likely to be upgraded. We continue to accumulate what we think is a positive multi-decade investment theme, thanks to growing health awareness and higher emerging market incomes. Likey, likey, Buy Nike.

Home again, home again, jiggety-jog. Stocks have started better here today. It is a short week in the US next week, a half day Monday and a day off Tuesday (4th of July). The start of summer in the Northern hemisphere, is that still a thing, with regards to the volumes?

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment