"New Look was once valued (this time last year) at 34.8 billion Rand. By the first half of their financial year, the New Look value was 18.7 billion Rand. Around half. And now? I am afraid ..... 7 billion Rand."

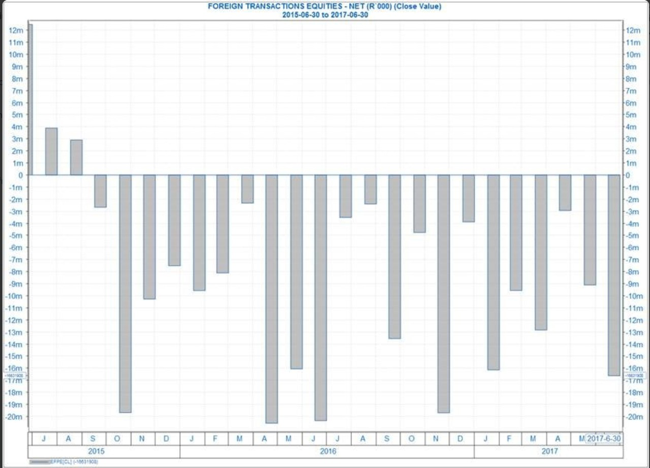

To market to market to buy a fat pig A stronger Rand held back equity markets for quite some time, eventually the Jozi all share index closed with a marginal positive bias, it could have been so much more. Shrugging off downgrades left, right and centre. What gives friends? Are you puzzled as to the strength of the currency when the ratings agencies are pointing to a worse to come scenario? Why are international investors piling into our bonds when local institutions are sellers? International investors have been net sellers of our local equities markets for months and months, Michael sent the Vestact WhatsApp group this graph he came across on Twitter, via Independent Securities. Which basically tells you everything that you need to know about foreign ownership of South African equities:

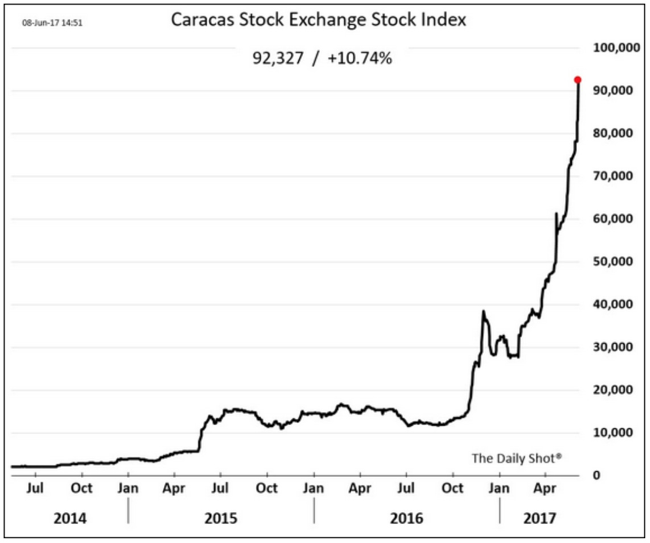

Basically, there have been outflows since August 2015. For over 20 months, foreigners have sold ZA inc. stocks. Naturally, local institutions and pension funds must have been buyers. I suggested to my colleagues the other day that if you take the high road scenario in South Africa, you may well find that people who are buyers of these stocks are getting at least a "half a generational" low on stocks. i.e. the price for some quality South African businesses, on an inflation adjusted level and even in Dollars, would prove to be a great price in the coming decades. That is of course, if you go with the high road scenario. I was also reminded by Michael too on the fabled Vestact WhatsApp group that this is what happens when your country melts down:

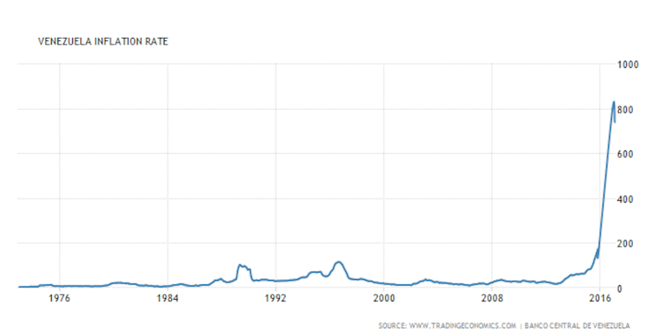

What is happening there? Well, for starters there is a thing called inflation going on. Venezuelan inflation hit 800 percent per annum last December. The economic policies disasters of the Maduro administration (yes, yes, the former bus driver) has led to chronic shortages of everything. Socialism does the very best to make everyone equal, equally poor that is. Herewith a graph of the inflation rate, courtesy of Tradingeconomics:

The other thing that is happening is that people buy hard assets, and equities fills that gap too. No matter how messed up things are, if you can still maintain hold over your fixed assets and the government does not seize parts of your business (always in the best interests of the people, you know!), they will be worth something when there is a downfall. It is inevitable, and the rebuild will happen. The problem is that doctors have fled. And are not coming home any time soon. I suspect that if "things" improve, the stock market will also fall to levels that are more agreeable, i.e. rerated as a result of stability. The short answer is that there are examples of stock markets that go to zero, namely Communist China in the late 1940's and Communist Russia around late 1917. So unless that happens, in a stressed environment, stocks hold their value better than cash.

Quick sticks, here is a breakdown of the Jozi market yesterday. Industrials added four-tenths of a percent, resources fell by that amount. There was unfortunate 12 month lows for the likes of Bell, Brait, Basil Read, Tsogo and Sun International, as well as Lonmin. Lonmin may be one of the biggest platinum miners in the world, the market values the business at 3.17 billion Rand. Or 250 million Dollars. According to the Mineral Resource and Mineral Reserve Statements, there are mineral reserves of 31.7 million ounces (and mineral resources of 180 million ounces).

All that matters is the cost of extracting said platinum. At current prices of 933 Dollars an ounce (Platinum price) multiplied by 31.7 million ounces, that equals 29.5 billion Dollars. Do the Math. If, as per their last results, the unit cost to mine an ounce was guided to be around 11,300 to 11,800 Rand. Multiplying the current platinum price (933) by the current exchange rate (Dollar to Rand) of 12.75 and you get to the current Rand price for an ounce of platinum - 11,898 Rand. The company is barely profitable and marginal at best with current prices. So ...... if you were a hardcore socialist, you may be doing the simplest of math and suggesting that these businesses are worth billion of Dollars, the truth is that it is teetering on the edge.

Across the oceans in New York, New York, stocks rallied. The Dow closed at an all time high. The nerds of NASDAQ were back to levels seen at the beginning of last week. Yes, such was the anxiety of the tech sell off, that were are within one-third of a percent of the all time highs. It does show you the irrationality of market participants. Do you recall at the beginning of 2016, the NASDAQ sold off nearly 15 percent. Remember? The broader market S&P 500 was down nearly 10 percent. 45 days of carnage. Now just a distant memory really, at the time of course you were hearing people talk about the end of technology, the valuations were hairy and scary. They may still be, the point I am trying to make is that there are recent events in markets that felt like a scary and wild rollercoaster ride, equity markets are designed to transfer wealth from the fidgety to the patient. My advice when you feel like selling, buy a 20 Dollar fidget spinner, it may save you more money than you think!

The broader market S&P 500 added 0.45 percent whilst the Dow Jones was almost exactly the same, to the better. Tesla stock reached an all time high, the stock was up 4.7 percent to 376 Dollars (nearly) a share. Paul tweeted a link that is worth reading - Apple, Tesla shares are two of the biggest shorts in the world right now. They take their chances the shorts and are a necessary part of the market, in order to reach full price discovery. When the shorts really throw in the towel, you may see some irrational and explosive price action that defies some of the recent price moves. I suspect that 5.2 days of cover and margin calls coming, the "worst" for the shorts are pending, is my sense.

Company corner

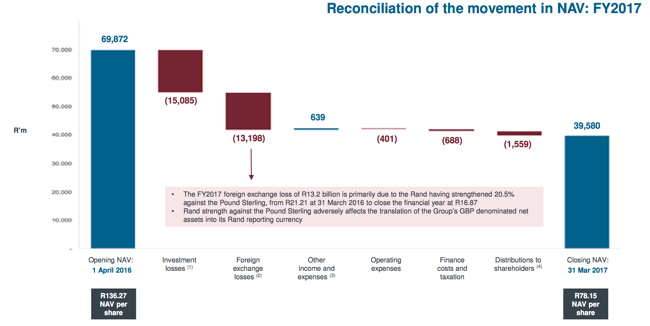

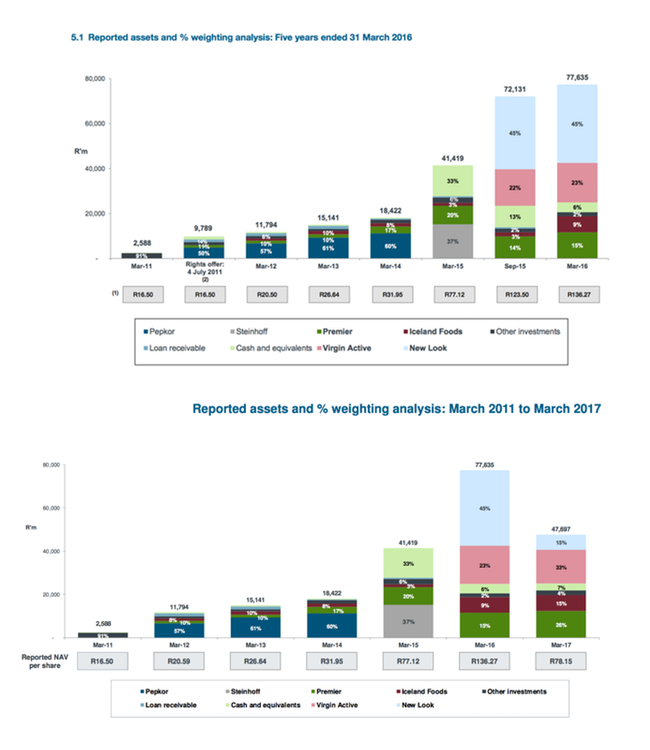

Whoa. Brait has been a disaster as an investment over the last 12 months. Yesterday the company suggested that it was largely to do with their revaluing of their fast retailing asset, New Look in the UK and that Brexit had a marked impact on the currency translation back to Rand. In fact, New Look was once 45 percent of the value of their portfolio, it is now 15 percent. There are two graphs worth noting from the presentation yesterday, firstly a reconciliation of the movement of the net asset value. Their net asset value is reflected in the internal valuations of all their assets, divided by the number of shares in issue (506 million shares in issue).

New Look was once valued (this time last year) at 34.8 billion Rand. By the first half of their financial year, the New Look value was 18.7 billion Rand. Around half. And now? I am afraid ..... 7 billion Rand. How is that possible? Firstly, there has been multiple contraction from 13.3 to 10.3 times, by their own internal metrics. So that is around 30 percent lower for starters. Another 20 percent is the currency, as per the slide. That is a collective 13.2 billion Rand less is their UK asset. The situation (Brexit) has worsened in recent days, a big backfire election on the incumbents has led to a moment of weakness where German Minister of Finance, Wolfgang Schauble (minus the umlaut on the a, bad for our html) has suggested that the door is open. i.e. If you are thinking about reversing that moment, you can. Politics ......

Wow. That is a massive fall off and a major embarrassment for a team that prides themselves on putting quality deals together. It has been nearly two years since they acquired New Look and since then there has been nothing but heartache for investors. These two slides, one taken from the last year annual report and the other taken from the recent results (we can put them on top of each other to save space), tell the story of the value of new look falling into a hole.

So what now? If you hold them, you can see that there is a discount to the NAV. That NAV has plunged. We like the business. We like the fact that Virgin Active should continue to grow (they have increased their footprint by 7 percent). We like their food businesses. Iceland and Premier. New Look do have debt of around 1.2 billion Pound Sterling. Consumer confidence in the UK remains subdued. Whilst several of their businesses have good prospects and remain solid, New Look may be more and more reliant on their expansion in China to start delivering. Those businesses roll outs will take time and be costly, as will their European expansion. We dig in our heels at these levels. Whilst it feels terrible as a holder to see a share price swoon from their levels over a year ago (down 60%), the management team and the biggest shareholder (Christo Wiese) certainly are working hard to deliver the superior returns that shareholder are used to.

Linkfest, lap it up

If you go to a restaurant, the service is part of the experience, right? Ordering a gourmet burger, does that apply? What if your burger was cooked by a machine? This business (backed by Google) just raised 18 million Dollars to proceed even further down that path, the automation of basic cooking jobs - Momentum Machines Company. As they say: "Serving a burger this great at such affordable prices would be impossible without culinary automation." Who wins? The consumer. Who is the loser? The burger flipper, an iconic starting job for many Americans.

Netflix is up over 1 500% over 5 years and is the 'N' in the FANG acronym, here is the reason why - Netflix Surpasses Major Cable Providers in the U.S.

You will find more statistics at Statista

You will find more statistics at Statista

Another tech stock that has been on fire over the last 2 years is Nvidia, here is a great interview with the company's CEO and founder talking about the company and their products - The Most Important 24 Minutes of Your Year. They are positioned well for the explosion in growth that is coming from AI (Artificial Intelligence) and the IOT (Internet Of Things).

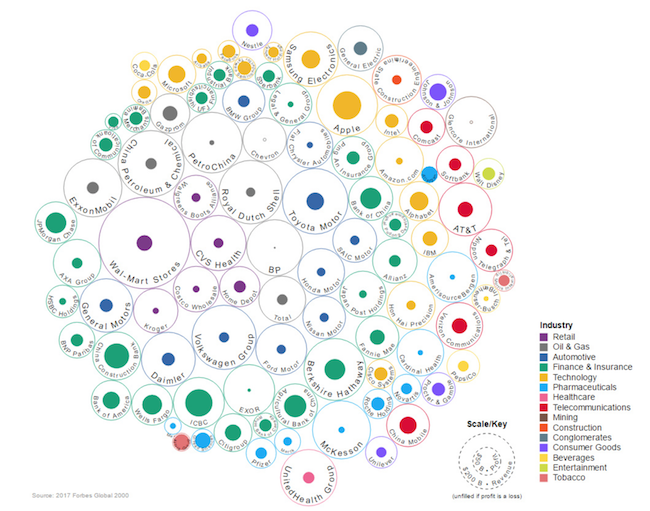

Here is the reason why tech companies are great businesses, their profit margins are huge! - The Top 100 Companies: Revenue vs. Profit

Home again, home again, jiggety-jog. Stocks have started mixed to better here in Jozi, Naspers is recovering after a solid sell off days ago, now back at levels seen in early May.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment