"A 12 year expedition for Barclays PLC. (the Breetesh) is almost finish. Perhaps they will remain a shareholder of the smaller stake. The history is as follows - in 2005, Barclays Plc. bought a 55.5 percent stake in ABSA, at the time, there were 666.8 million shares in issue. At a purchase price of 82.5 Rand per share, that equals around 30.5 billion Rand."

To market to market to buy a fat pig There was a lot going on yesterday. As usual .... really. It was a bad day for stocks (sticking to the basic adjectives for now, right?) locally, resource stocks down over two percent by the close (disappointing Chinese PMI data), industrials off a percent and one-fifth, banks slipping by a little more than that. At an individual stock level, inside of the majors, there were three in the green. One, up a lot, being Barclays Africa, following the success of the bookbuild (and then some), up nearly 4 percent by the close. Question here ...... if Barclays only owns 16 odd percent of the business, can they think up a name change that may stick across the continent? Or may it be a reversion to The Amalgamated Banks of South Africa Limited - ABSA. That was a rather complicated bashing together of the likes of United, Allied, Volkskas, Sage and Bankorp.

A 12 year expedition for Barclays PLC. (the Breetesh) is almost finish. Perhaps they will remain a shareholder of the smaller stake. The history is as follows - in 2005, Barclays Plc. bought a 55.5 percent stake in ABSA, at the time, there were 666.8 million shares in issue. At a purchase price of 82.5 Rand per share, that equals around 30.5 billion Rand. Around 2.9 billion Pound Sterling. I thought that I would put my old graphics skills to use and present a graphical representation of their holding of the Barclays PLC relationship with ABSA and the Barclays Africa Group. Let me know if you find this acceptable, this has been a wonderful collaboration between Google finance, my Mac notebook, the internet and my low level graphics package, Pixelmator. And of course, many thanks to the old SENS archive, where I had to find some of the information. Back of the matchbox, some of the lines drawn are to "roundabout" dates, ok!

Other than the very handsome dividend flow over the years (from ABSA to their shareholders, including PLC), this has not been the best investment for Barclays PLC shareholders. This you can tell, from the funds that they have extracted over the last 13 months. Oh well. If you are thinking that is bad, and somehow would feel "bad" for PLC, fear not, that may be the least of concerns for the shareholders of Barclays PLC. Since the middle of July 2005, Barclays has returned negative 62 percent. The US ADR is down 72 percent since then. So let us just say that even without this wonderful investment that is a South African bank (and the rest of the continent), shareholders of PLC have been sucking wind. And if you think that the outlook is better, earnings are going to have to do some heavy lifting here in order to justify the PLC share price. In a low interest rate environment, the uncertainties of their home market, the tide and wind is going to have to change for them in order to make material progress. Continue to give this sector a wide berth.

You have this strange thing happening here. The Rand is stronger because Fitch kept our debt rating on hold. S&P is expected to do the same today. That is good. StatsSA said that the unemployment rate is at a nearly decade and a half high. High and unemployment in the same sentence are a toxic mix. I heard a journalist, well known to all here no doubt, suggest that economic policy (or lack thereof) is to blame. I guess at some level yes, lower commodity prices also have something to do with it. If the platinum price was 50 percent higher, as was the whole commodities complex, this would be helpful for South Africa.

So against this backdrop, a stuttering and sputtering economy, you would not want to be owning South African debt, right? Well, that is true of locals and local pension funds. Check out this story from yesterday, from Reuters - Political turmoil prompts South African pensions to offload government debt. Foreign ownership of South African government bonds has risen to nearly 40 percent (39.4 percent), whilst local ownership has dropped to 27.2 percent. The foreign ownership is at a record high. The domestic ownership is at the lowest level since December 2012.

You would hardly suggest that against the backdrop of the "bad" (sticking to the low level adjectives) environment that we would see record international ownership, right? Yet that is the case, there are people who are hungrier for yield, in the global environment where rates are still low. Provided that you can make sure that you keep your currency hedges "cheap". Does anyone want to venture to suggest who is right and who is wrong? Is local ownership right, or are the foreigners unwashed by the "noise"?

Stocks in New York, New York, rallied to new highs for the broader market S&P 500 (up over three-quarters of a percent) and the nerds of NASDAQ (up just over three-quarters of a percent). The blue chip industrials America, the Dow Jones, added just short of two-thirds of a percent. All the major sectors rallied sharply, in anticipation of a good read on non-farm payrolls today. Remember that happens today, and the expectations are for around 185 thousand jobs. The unemployment rate is expected to stay at 4.4 percent. We wish. Average earnings are expected to rise 0.2 percent. We wish too. Standby for a little later in the session sportslovers!

Linkfest, lap it up

Did you know that this was happening? The transformation of agricultural land in KZN to more macadamia farming areas. I didn't. Nice story - Banana Farmers Go Nuts in South Africa Over Macadamia Boom.

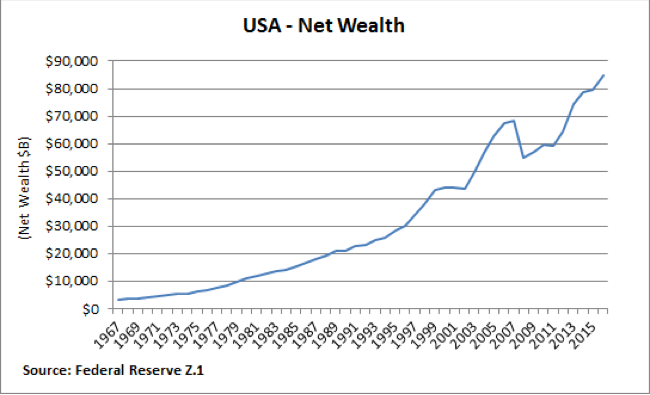

This is important. The stock market is not the economy, the economy is not the stock market, a country is not a person or household or corporation, there is no expiry date on a country. Unless of course something dreadful happens, war and treaties gobbling up land and the like. Here goes an important post from our old pal Cullen Roche - Chart of the Day - The USA is not a Corporation.

Remember the chart of the stock market in 1929 looking a lot like the stock market chart in 2014? I do. It turns out that if you sold, you missed out on another 30 percent rally since then. Sigh. The Unfortunate Rise Of The Misleading 'Scary Chart' Comparisons Again. When you see graphs and comparisons, remember that no two times are the same in history. Ask yourself, how many radios were sold in 2014 (in making the 1929 comparison) and more importantly, how many smartphones were sold in 1929? The answer to the second question is none, of course.

Home again, home again, jiggety-jog. Stocks locally have started a little better here. The Rand is weaker than yesterday afternoon, stronger than two days ago.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment