" Recently there has been a more accelerated investment in internet enabled businesses and divestments of less core businesses in key geographies. Notwithstanding streaming technology taking hold, our continent is a little behind the curve, and the company managed to add nearly 600 thousand households to their satellite TV business over the last year."

To market to market to buy a fat pig Stocks in Jozi caught a bid Friday, in particular some local industrial stocks, Remgro and Naspers were top of the pile, Mediclinic and AB InBev were on the opposite end of "matters". The all share index added over four-fifths of a percent on the day, at 51 and a half thousand points now, a "lost" three years. We keep mentioning that those buying the index or SA Inc. stocks, with a high road scenario panning out, they have captured the same prices for 36 months now.

Of course, your guess on the high road scenario is as good as mine, low economic growth and flopping around a lot hardly makes for confidence currently. We do have a deep savings culture amongst employed people in South Africa and we do have to rely on fewer folks for debt issuances than many other countries, Russia, Turkey and the like. Spare a thought for our neighbours Mozambique, they are trying to locate hundreds of thousands of Dollars, which relative to their economy is a lot. Mozambique total GDP is less than 15 billion Dollars, we are talking about a number of 3-5 percent in loans unaccounted for. That is like us missing 200 billion Rand. Mind you ....

The trouble with our neighbours to the right (I have a soft spot for them, I lived there for a little less than a decade) is that a distinct lack of capital markets means that they are beholden to external funding. It is easier to lend money than it is to get it back, at least in this case. Just how, pray tell, is this possible: Mozambique debt audit says $500 million in loans unaccounted for.

Wow. Sounds unfortunately like the same old story, over and over again. Greece and those countries that are serial defaulters are hardly doing themselves a favour. No wonder trillions of dollars of developed government bonds are trading with negative yields. In fact, according to Fitch, at March 1 Global negative-yielding sovereign debt jumps to $9.5 trln. On the one hand there is the return of capital, on the other hand, even at the riskier and higher yield, there is no money coming back. I can't say that I find either attractive.

Across the seas from here, stocks were mixed Friday, the Dow Jones Industrial Average lost a fraction of a point, whilst the broader market S&P 500 added 0.16 percent and the nerds of NASDAQ closed the session out nearly half a percent to the good. Microsoft, Alphabet (Google), Facebook and Visa all spurred the tech heavy index higher. Visa had earlier seen some positive commentary from the analyst community post their investor day. It is a bit of a strange one, often when all are in agreement that Visa has decades of growth ahead, that may seem worrisome at some level. Yet, I have to agree with the commentary about the shift away from brick and mortar to ecommerce, the likes of Amazon are leading that charge. Pay with a tap or a fingerprint, Visa and their market peers still process the payments.

I read in this article, Visa Inc (V) Investor Day Takeaways, research from Barclays, that 17 trillion Dollars of consumer spending in 2016 was still in cash and checks. What is quite interesting is that the margins for Visa on the digital transactions, where most of the growth is coming, is higher than physical transactions. I suppose that not having to "see" your card (and perhaps only know the three digit code at the back) is the future for all of us.

The card details are stored in the cloud, either the phone is prompted for a fingerprint or you insert the CVV code, and no more physical card. With all the new payment options, all you need to have is your phone, or extension thereof, your watch. Keep your phone in your pocket and pay with your wrist. Next level skills, right? One earnings stumble from Visa and the market will no doubt punish the stock, up until now there has been next to nothing to fault in their relatively short period of being listed.

Company corner

On Friday we saw the release of one of the most widely held stocks here for our investors, and in fact a company that has attracted a lot of attention on both sides of the investment aisle for the better part of the last decade. Naspers. For one, a company founded in physical printing of newspapers over a century ago has managed to stay relevant with investments at the right time in the likes of satellite TV and of course the biggest home run of them all, a very early investment in Tencent. Recently there has been a more accelerated investment in internet enabled businesses and divestments of less core businesses in key geographies. Notwithstanding streaming technology taking hold, our continent is a little behind the curve, and the company managed to add nearly 600 thousand households to their satellite TV business over the last year.

The results are able to be downloaded from Naspers website: Summarised consolidated financial results for the year ended 31 March 2017.

Naspers have had a busy year, as usual. They have disposed of assets in Eastern Europe, have seen their investment in food delivery company Delivery Hero about to go public (this week), as well as Mail.ru purchasing a food delivery business in Russia. Tencent still forms the bulk of the business, more than three quarters. The e-commerce business has more profitable business segments now than ever, it will continue to suck a lot of cash! So much so that Naspers will continue to raise funds at what are historically low rates. See above, if you are reliable, you will attract debt investors.

There are many moving parts to Naspers, which makes the business difficult to value at any given time. It is of course a proxy for Tencent, that share price in Hong Kong Dollars is trading near the all time highs. Today it is 80 Hong Kong cents away. Not only does Naspers trade as a proxy for Tencent, the market discounts the rest of their businesses and in fact values them at next to nothing. We will do another detailed analysis of the results tomorrow.

Linkfest! Lap it up

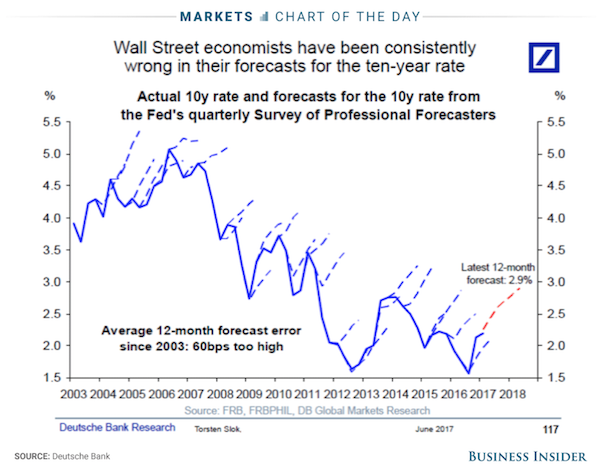

Forecasting interest rates should be easier than forecasting stock prices, interest rates are driven by fundamentals unlike the equity market that is emotion driven over the short run - Wall Street has been brutally wrong when it comes to making one of its most important predictions. The graph shows how trying to predict the future is a fools errand.

As the world becomes more automated the concept of a Universal Basic Income (UBI) has increasingly been talked about. Have the robots do all the work, leaving us with more time to travel and create. One journalist says that Apple should use around 0.2% of their cash pile to do a large scale experiment on the viability of UBI -Why Apple's next big investment should be reshaping capitalism.

Generation Y are fast becoming the generation that will have the bulk of the wealth in the economy, that means that they are a key demographic for companies to focus on. As spending habits change and the sharing economy becomes more central, the smart phone is central to modern day life (good news for Apple) - The Cheapest Generation.

Home again, home again, jiggety-jog. Markets have started mixed here this morning. Some up and some down. US futures are up and away, Nestle and associated European stocks are getting a lift from Dan Loeb's 1 percent stake in the Swiss food giant. Perhaps they need some sort of shakeup.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment