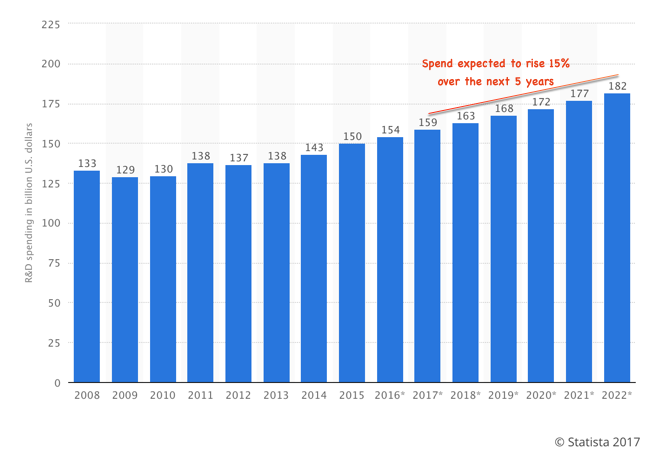

"Whilst I believe that regulators are trying to do their best to protect consumers, sometimes they discount the huge shareholder funds that are spent on looking for the next blockbusters. Statista has the number, total global spend is around 150 odd billion Dollars a year, from the pharma industry. Each business, amongst the majors that is, spends around 12-14 percent of their revenues looking for life saving therapies, that obviously comes at a cost."

To market to market to buy a fat pig I remember when the Fed moving interest rates was going to be the most telling event of them all. I remember when the Fed were going to stop their asset purchase programs and how that was going to be the most telling of all. I recall when the Fed were going to unwind their balance sheet and how that was going to be the most telling of all, it was going to finish us all, you remember?

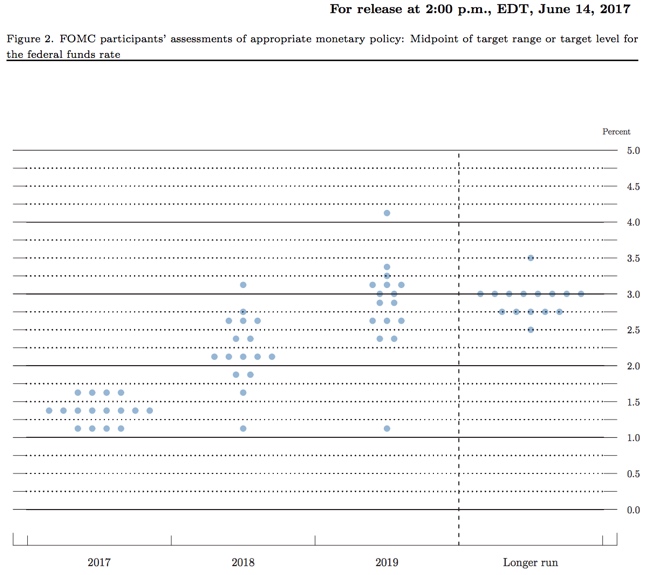

Well, the Fed raised rates over half a decade later than most people anticipated (in 2010 it was the topic du jour), and the trajectory has been lower than anticipated. And the end point, where interest rates in the US finally level off (the so called dot-plot, we will get to that in a second), is at a lower level than historically. That said, so is inflation, as a result of productivity gains and efficiencies. And the manufacturing at the global level, globalisation is where everyone wins with cheaper goods and cheaper skills to transfer. If only all and sundry would see that!

So the Fed raised interest rates last evening, and it was widely anticipated this would happen. So there was a blink and a slight stare, and then "as you were". Some saw this as a slightly "easier" rate hike, possibly the Fed would not stick to their more aggressive approach, and perhaps skip a hike later. The Fed release, here is the FOMC statement. All members except Kashkari voted in favour of hiking rates at this point. There was also the announcement of Fed balance sheet shrinking, winding their necks in - Normalization Principles and Plans.

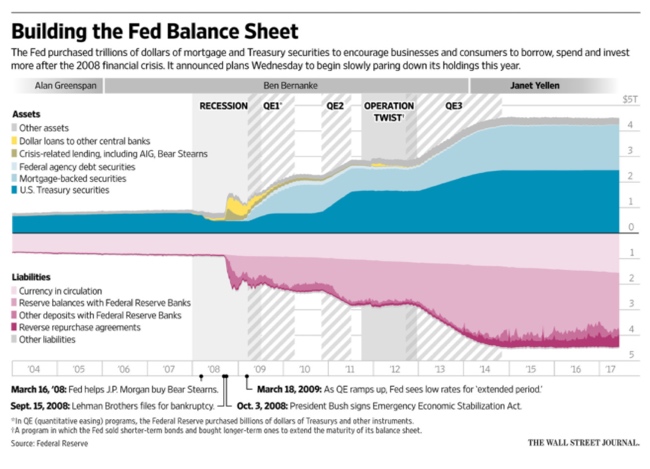

The WSJ has an amazing graph, from a story titled Fed Raises Rates, Sets Out Plan to Shrink Asset Holdings Beginning This Year. Courtesy of the WSJ and the Fed.

And then the dot-plot, where the voting members see their long term projections end up, at around three percent:

According to the St. Louis Fed website, this is their Effective Federal Funds Rate from 1954. As you can see, even a three percent projection "long term" is very far away from the long term averages:

So there it is. The long term projections are three percent, at least for now. The most important question, should you change your investments or your investments style to accommodate or try and pre-empt the Fed's next move? No. Don't do it. Stay the course and own real businesses through when rates go up and down. There is of course, nothing you can do about interest rates. Session end in the US trading session, the Dow Industrials added nearly one-quarter of a percent to end at an all time high. Energy and materials had a horrible no good day, the oil price barrelled to a "near" six month low. My go to person on all of this is Javier Blas, who suggested that this wasn't going as planned for Moscow and Riyadh:

The broader market S&P 500 fell off the worst levels and into the red, down one-tenth of a percent. The nerds of NASDAQ also gave up some ground, comfortably off the worst levels for the session though.

Locally here in Jozi, stocks fell around one-quarter of a percent as a collective, industrials sank one-fifth, it was resources that were the biggest losers though, down around a percent and one-third. Financials were the stocks that were holding the market from further losses, at the top of the leaderboard were SA inc. and financials. In the down column were the commodity stocks, sensitive to the ebbs and flows of commodity prices and the currency. Anglo, BHP Billiton and MTN, as well as Richemont were the losers.

There was a trading statement from Naspers pretty late, there are three metrics for Naspers, the one that they think counts the most is "core" headline earnings per share. On that metric, Naspers expect to be 33 to 39 percent higher, at the top end of the range, somewhere around 414 US cents, or 52 Rand a share at current levels. The stock is marginally lower this morning, along with the rest of the market. Results expected on the 23rd of June.

Company corner

The competitions authority are investigating Aspen and their peers with specific reference to their oncology drugs here in South Africa. It made headline news on the various wireless stations that I listen to. Price gouging and the like, another head-shake from the pundits. How can this be? Paul initially when he heard the news suggested that prices were regulated in South Africa, how could this possibly be?

"To provide context to shareholders it is confirmed that, while Aspen fully acknowledges the vital nature of the four oncology products listed in the Commission's announcement, these products have a collective turnover of about R3 million in the South African private market"

Oh? I am against unethical behaviour of all sorts, pharma companies have a "history". Yet, they are well regulated. In fact, over regulated, another announcement from Aspen is that they have been fined 5.2 million Euros by an Italian court. Listen to this though, the generic drug (of the one that Aspen sells) was approved in Italy for double the price that Aspen sold their drug. Yes. How can that be possible? Italian bureaucracy my friends, it is a sight to behold! Some of the prices in Italy for the drugs that Aspen raised, had not been raised for between 40 to 60 years. Ughhhh. No wonder the company will try and avoid some of the regulatory minefields. Aspen may, or may not appeal this ruling.

Whilst I believe that regulators are trying to do their best to protect consumers, sometimes they discount the huge shareholder funds that are spent on looking for the next blockbusters. Statista has the number, total global spend is around 150 odd billion Dollars a year, from the pharma industry. Each business, amongst the majors that is, spends around 12-14 percent of their revenues looking for life saving therapies, that obviously comes at a cost. And unfortunately that needs to be paid for by someone, the drugs cannot be free. See here below, courtesy Statista - Total global pharmaceutical research and development (R&D) spending from 2008 to 2022 (in billion U.S. dollars):

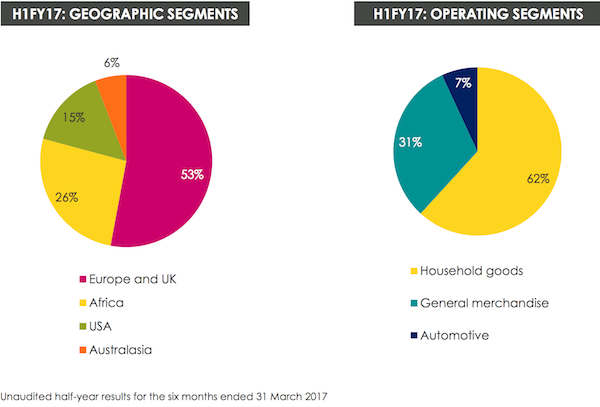

Last week we had 6 month numbers out of Steinhoff, who are the world's third-largest integrated household goods retailer by turnover (Half year numbers). Given how active management are, it is difficult to get comparative numbers, but based on managements calculations normalized revenues are up 7% and normalized EPS is up 4%. Here is a look at breakdown of the group sales:

The big change up there is the new US segment, thanks to their purchase of Mattress Firm in September last year. At the time the "analysts" view was that on the surface it looked like they overpaid for the asset, time will tell who are right, management or the analysts. Since then management have been very busy! One of their major suppliers was Tempur Sealy, who resisted attempts by Steinhoff to renegotiate their partnership with the end result being Sealy pulling out of the partnership (and the Sealy share price dropping by 23%).

To fill in the Sealy gap Mattress firm increased their partnership with the other major mattress maker Simmons, where they have agreed to spend over $100 million on marketing and then collaborate to come up with new products over the next 5 years. Have a look at their new advertising campaign - Mattress Firm Launches New Campaign And Announces Strategic Partnership In Pursuit Of Sleep Innovation

Next up management have also bought a majority stake in bedding maker Sherwood bedding, to roll out more in-house merchandise, improving profit margins. Then lastly they have a trial partnership with an online bed retailer, Purple beds, who started in 2016. The idea is to sell Purple beds in the Mattress Firm stores, hoping to increase foot traffic to the stores and then sell the extra customers bed 'add-ons' like bedding and pillows. Then lastly Mattress Firm applied for a trade mark in the UK last year, does that mean Steinhoff are thinking of rolling out that brand in the UK too?

The next phase for Steinhoff is getting the African assets listed which is expected to happen towards the end of this year. I think listing the African assets is in part a play to try court Shoprite again in a few years. Remember last time the sticking point in the deal was "what is the value of the Steinhoff African assets".

My one concern about Steinhoff is that tax dispute that has been ongoing with Germany. The company says that talks are still in progress and they should reach a settlement agreement soon. Remember that the dispute is around where the company records their profits and by extension pay the taxes on those profits. This fine could be expensive.

Steinhoff management have shown their skill in taking tired businesses, shaking them up by improving their backend and logistics, resulting in better margins and happy shareholders. Given how active management are both in terms new businesses and financial restructuring there is always the increased risk that they make a misstep. The risk reward matrix looks worth it though.

Linkfest, lap it up

Exciting times as a Jo'burger and Facebook shareholder - Inside Facebook's new Jo'burg office. It looks like a great space to spend your "9 to 5" in.

As retail moves online shopping malls are increasingly under pressure, the result adapt or die - The Mall of the Future Will Have No Stores. The Mall of the future will have more experience offerings, still food outlets and then have companies base offices in them. Good news for our Starbucks investment.

Home again, home again, jiggety-jog. Stocks are lower across the globe, this special investigation into the relationship between the Trump campaign, people close to him and the Russians is just starting to "get real", or more real. The US futures market has taken a bit of a swoon.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment