"And that is the number one reason we write this daily message. To stay as close as possible to the news flow. To make sure that we continue to share the news with everyone. Investing is a little like running the Comrades, although the finish line is never really in sight. At some points you feel so tired mentally and physically that you want to give up. At other stages you feel strong and must keep going either at this pace or a little faster."

To market to market to buy a fat pig Friday was jobs day. The day that the whole financial world turns to their screens for direction. Even though the number is notoriously volatile and equally unpredictable, as the Department of Labor (no u in that labour) revise this number in the coming months. I often ask, when someone places supreme importance on this number is to ask them what the number was three months ago, whether it was a "beat" or "miss" relative to the market predictions given. Sadly, very smart people are asked to predict what is a volatile number. It may be just as easy as guessing who is going to win the football on the weekend. Which is not too impossible .....

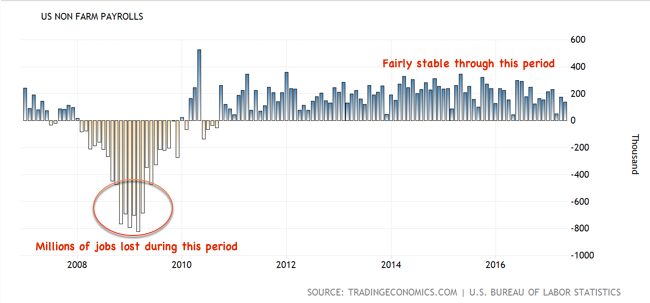

Anyhows, here is the last release of the Employment Situation Summary. The headline number of 138 thousand jobs was a miss (relative to expectations of course), the unemployment rate was the lowest in 16 years. Back when George Bush was president, remember him? If not, here is a reminder -> Bush GOOFS. Talking Goofs, the shrinking labour force and the lacklustre wage growth was the concerns that still remain. That aside, Mr. Market clearly liked the "trend" which is all that matters here for the time being. Few recall the labour force been sliced and diced as it was post the financial crisis. In case you forgot, courtesy of Trading Economics:

The graph above looks boring. And that is a very, very good thing for all of us. I suspect that for many years, those wanting a normalisation of rates have failed to see that wages, as a result of productivity gains and immense pressures from technology have meant no inflation. Recall that graph that Michael stuck in links last week, where the likelihood of each segment being replaced by a computer related technology depends on your skillsets - Visualising the Jobs Lost to Automation. Nurses and Teachers! Police Officers and Counselors. See it all there my friends.

OK, quick market wrap. Stocks in New York, New York reached a record high. For all three sets of indices. The nerds of NASDAQ added nearly a percent, the broader market added nearly four-tenths of a percent, whilst the blue chip Dow Jones industrial average added nearly three-tenths of a percent. Energy stocks taking a bit of a whack, today oil prices are on the up and up as a result of heightened tensions in the middle east. Qatar versus the rest! Saudi, the UAE, Bahrain and Egypt have given Qatari diplomats 48 hours to leave. And they have cut off all ties, no sea, air and land travel. Jeepers, that sounds serious.

Why write this daily news brief? We often champion the idea of owning companies, paying attention, at the same time trying to be as sticky as possible. Not getting spooked. Making sure that the initial purchases and subsequent purchases of stock are done at the "right" levels and most importantly, owning the quality. The best of the best, the best that money can buy. So why then report back daily? Investing is a multi decade affair. Investing is something that happens over your lifetime, in the same way that you choose someone to spend your whole life with, in the same way that you choose to live in a particular house. You don't buy and sell houses as the result of the market for houses feeling high or low. You buy a house to live in and to enjoy.

We write this letter in order to educate, both for ourselves and for all the readers. The daily routine of making sure that we turn up (no golf days, no conferences, few meetings) and pay attention. There is a fabulous fellow to follow, his name is Samuel Arbesman, see his website for more. He referred and coined a term Mesofacts, that I love to think about. The slow and incremental changes that compound to eventually become reality for all. Arbesman suggests that they are like this: "Mesofacts are the facts that change neither too quickly nor too slowly, that lie in this difficult-to-comprehend middle .... "

A bit like where we are now with Virtual Reality headsets and Autonomous driving and Artificial Intelligence. At least from my reading, anyhow. Not everyone is an adopter of these technologies, at least they don't think that they are. Not everyone has an Amazon Echo, an Oculus headset and a Tesla Model S. Some people no doubt do. If you use a smart assistant (like Siri, I sometimes tell her to set a timer), or browse online for goods (Amazon and the like predict what you may like), read simple news (AI writes some news from reports), listen to online music (AI plays you "music you may like") or even have a home smart device that learns your patterns, you are there already. Plus of course your web searches are being optimised.

As the world changes around us, so do the businesses that afford us services and products. They must, in order to stay relevant with the times. Inside of that, the slow and incremental changes that allow you the possibility to stay relevant with all that goes on around you, are investment opportunities. There are some industries that we bet will be around for centuries, food production, food eating, medical care, clothes production and fashion, housing, transportation, heating and cooling, we can have a fair sense of what will not go out of fashion. Technology is one that you have to keep a finger on constantly. Without the paying attention part, you can easily find yourself less relevant in your investments.

And that is the number one reason we write this daily message. To stay as close as possible to the news flow. To make sure that we continue to share the news with everyone. Investing is a little like running the Comrades, although the finish line is never really in sight. At some points you feel so tired mentally and physically that you want to give up. At other stages you feel strong and must keep going either at this pace or a little faster. The disciplines learnt in investing stand you in good stead, the experiences of the past help put the current into perspective, remembering however that no two times in history are the same. Other than that Bruce Fordyce once won the Comrades with identical times ('85 and '87 up runs), I am sure that he'll tell you that they were different, other than on paper.

The overriding message from our investment style is to be patient. Which is increasingly difficult in a world when news is available on the little device in your pocket that has more processing power than the entire US military from over three decades back. The same is likely to apply in three decades time. You should still find yourself invested then too. Be an owner of a company and not the share price. That is a difficult and essential investing characteristic. Share prices will change today, perhaps not much, perhaps a lot, the company hardly undergoes 2 percent changes in their makeup daily. To finish off with a Buffettism, be prepared to own these companies on the basis that the stock market should and could close for five years tomorrow.

Linkfest, lap it up

I have never considered the possibility of placing solar farms on the water. In a South African context, areas of the Northern Cape would still be better than off our coast I would assume - China Is Now Home To The World's Largest Floating Solar Power Plant

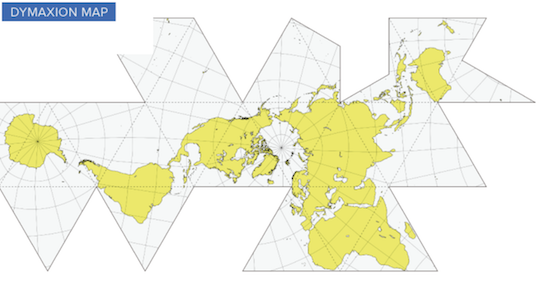

The problem with taking a globe and making it flat is that you will have some sort of distortion. Here is another interesting look at the maps out there trying to solve the distortion problem - The Problem With Our Maps

With most people in China using Tencent's QQ chat or WeChat, they have a fairly sizable moat between them and their competition. This means that Tencent is able to continue selling/ pushing products to their users - While the rest of the world tries to "kill email," in China, it's always been dead.

Home again, home again, jiggety-jog. Stocks in Jozi are lower, thanks in large part to the much stronger Rand to the US Dollar. The last time we saw such a level was August 2015. Which as you can imagine is good for inflation, which is good for the outlook for banks and retailers (as this may mean lower interest rates), this is good news. Not for the dual listed businesses though!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment