"So what next? More debt to GDP (as a result of lower GDP and more borrowing) and unfortunately less spend means lower tax collections. Which means lower revenues. Which leads to lower government spend. The other unfortunate part is, as Michael pointed out whilst he was listening to the wireless, is that radio stations are saying to Mr. and Ms. Consumer: "so now that we are in recession, what are you going to cut back on"? No, we were in it already, this was just the confirmation from all the way back to last October to now."

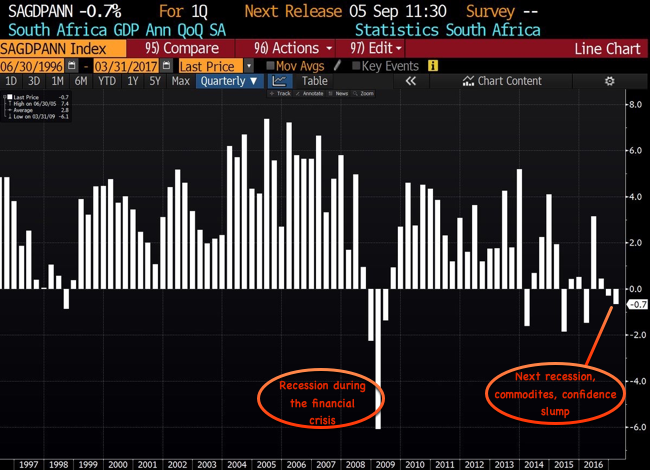

To market to market to buy a fat pig Whoa! That was ..... not good! A surprise read from StatsSA (who themselves have seen their budget slashed and may have less resources), has seen GDP for a second quarter in a row register contraction. Negative growth? That means the R word, R is for recession. There are a whole host of graphs that we need to pull out, including some really good ones from StatsSA, for historical context. So let us start with a Bloomberg graph that I managed to get via the Twitter thingie, that shows quarterly growth (and contraction). Here goes:

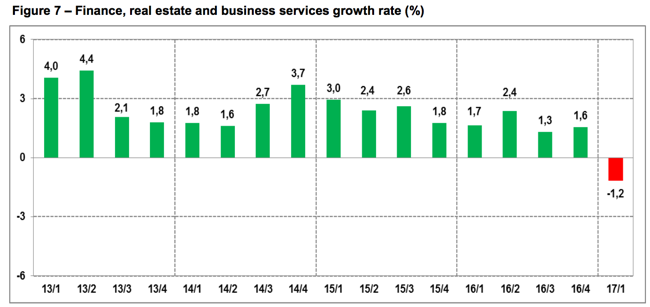

OK, so it is official. You can see the StatsSA release - Gross domestic product - First quarter 2017. Here is confirmation of "things are bad out there", in the form of the services sector, Finance, real estate and business services growth rate.

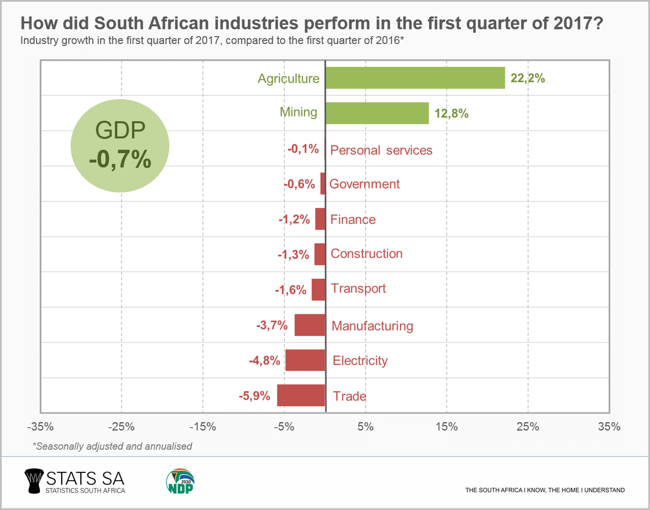

This is clearly a sign that people are "pulling back" and battening down the hatches. Another sign of lower activity is lower electricity usage, and there is no coincidence that manufacturing was lower. Whilst there are bright spots in the form of Agriculture and Mining, see below in what the major contributors are, the truth is that these sectors are both small, relative to the rest of the economy. Secondly, mining and agriculture are at the same levels (more or less) that they were back in 2012/2013. They have been going nowhere slowly for a while.

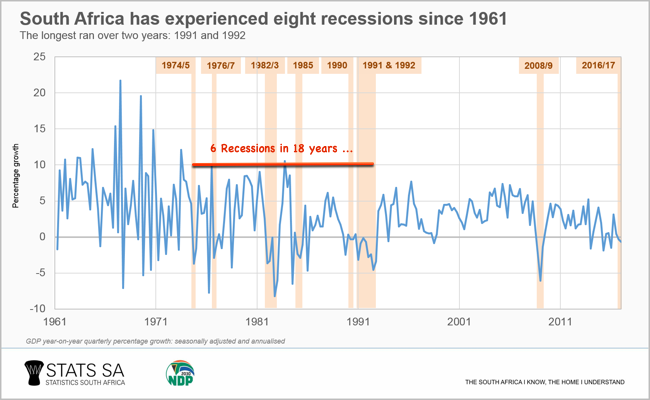

Insert sad face emoji. Before however you lose historical context, StatsSa had published a LONG dated graph, just to remind all of us that we had forgotten that this was a more regular occurrence than we think. We had forgotten. If you finished school over thirty years ago (OK, let us say 40), you would have lived through many of these recessions, thanks to StatsSA for all of these amazing graphs (and job well done, notwithstanding the pending job cuts there):

Through the end of the oppressive days of Apartheid, recessions were a regular thing. It turns out that attracting capital when you are a pariah state is nigh impossible (ask North Korea). As Paul mentioned yesterday, some of this is related to the lower commodity prices, this is confirmed with a five year DOLLAR commodities index from Bloomberg:

So what next? More debt to GDP (as a result of lower GDP and more borrowing) and unfortunately less spend means lower tax collections. Which means lower revenues. Which leads to lower government spend. The other unfortunate part is, as Michael pointed out whilst he was listening to the wireless, is that radio stations are saying to Mr. and Ms. Consumer: "so now that we are in recession, what are you going to cut back on"? No, we were in it already, this was just the confirmation from all the way back to last October to now. That is kind of reactionary. And with a very high unemployment rate (as per the release last week), we are unfortunately in a very sticky situation.

The ratings agencies will no doubt re-look their recent adjustments. The market locally reacted as you may have thought, the Rand was a whole heap weaker in a hurry, the SA inc. stocks were sold off too. Retailers and banks. Bidvest (local services business) sank nearly four percent, Standard Bank lost three and a half percent, Barclays Africa three and a half percent and Woolies sank three and one-quarter of a percent. At the other end of the spectrum were the likes of AngloGold Ashanti, South32 and Anglo America, all benefitting from a weaker Rand AND stronger commodity prices. By session end the story looked pretty one-sided, the Jozi all share down nearly one and two-tenths of a percent.

What should you as a holder of stocks do? Nothing. As you can see from past dips, these moments come and go. Revert to the ownership model, you own the company, and not their share prices. Whilst the political clouds resemble the Cape Town weather today, it brightens eventually.

Stocks in New York, New York ended the session lower after having been better earlier in the morning, and earlier in the afternoon. It isn't the best time, in-between company earnings and "eyes on the Fed" who are expected to raise interest rates next week. Yesterday was, believe it or not, D-Day, the Normandy landings that ended the second world war in Europe. 73 years ago yesterday, nowadays we have a relatively united Europe. Apart from the simple fact that we have UK elections tomorrow, right? The conservative's grasp on "things" may not be as wide as earlier suggested, we shall see. Apple had a decent enough day, after the multiple releases of products and software updates.

Session end the Dow Jones Industrial Average sank one-quarter of a percent, the broader market S&P 500 sold off by just over one-quarter of a percent, whilst the nerds of NASDAQ sold off one-third by the close. Energy stocks rose, as did basic materials, largely in response to a weaker Dollar.

Linkfest, lap it up

Byron found this great link, showing the top 10 success stories for SA tech start ups - Are these the 10 all-time biggest exit deals for SA startups? [Digital All Stars].

If you want to understand why Economics can be irrelevant in a normal world, this story about doughnuts will help explain why - The Doughnut Dilemma: What The Office Pastry Teaches About Behavioral Economics. The link also gives a hint as to why you struggle to stick to that new years diet you promised.

This is good news for Tencent and Naspers. - Alibaba Falters in Bid to Take Mobile Phone Control From Tencent. As we spoke about on Monday, Tencent's WeChat dominates Chinese smartphones which allows the company to divert shoppers to their shopping sites and away from Alibaba sites.

My goodness me! These fellows, you would think, have more exciting stuff to do. The truth is, they are just regular fellows. Around the Berkshire AGM, Buffett takes his mate Bill gates around the Nebraska Furniture Mart, where they get to experience "stuff" - Testing Mattresses with Warren Buffett. Lovely. This will make you feel warm and fuzzy inside, especially the part when they talk about their friendship and Bill's credit score.

You must have seen this before, here goes - The $35 Nike Logo and the Woman Who Designed It. According to the article though: "She was also given a generous amount of stock in the company (estimated to be worth upwards of $1,000,000), as well as a diamond and gold ring featuring the Swoosh design."

Home again, home again, jiggety-jog. Stocks are mixed here, there are results from Steinhoff that looked OK, perhaps not meeting market expectations. We will review those shortly.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment