"We did come up with a new line, SA inc. sinks or SA(s)inc.'s, get it? SAsinks. Which is what you can now refer to when there is a sell off of local banks and retailers. Talking of which, there were results from Spar yesterday"

To market to market to buy a fat pig Stocks were dealt a blow yesterday, not all, and some worse than others. The JSE all share index gave up 1.1 percent, financials sank heavily, banks were wounded, down over three percent on the day as a collective. Standard Bank lost three and two-thirds of a percent, FirstRand lost nearly three percent, Naspers gave up three percent (not a bank). The worst hurt on the day was Barclays Africa (Mr. Market still cannot shake the ABSA label), down four and three-quarters of a percent. Other than the last cabinet shuffle knee jerk (in April), this is the lowest level for the stock since July last year.

Over five years Barclays Africa stock is down 8 percent. They have been rather generous with the dividend, if you have held the stock since the beginning of 2012, the dividends you have received after the taxes (was 15 percent, now 20 percent) is nearly 47 Rand a share. Add that to the current share price of 139 Rand, and the five year return looks a little better than the share price return. What is with the sell off? Earlier in the session there had been a Sky news report that Barclays Plc. were selling a stake in Barclays Africa, this was confirmed later in the afternoon by Barclays Africa. And not a small amount either, 22 percent of the entire issued share capital (187 million shares) of the South African bank. Whoa, that is a rather large sum of money. Remember that Barclays sold 12.2 percent of Barclays Africa last May.

If you think it is hard to find a buyer, you are wrong, the bookbuild is complete already. And it is a WHOLE lot bigger than announced. Due to "strong investor demand", Barclays Plc. sold more shares than they would have initially, 285,691,979 shares to be exact. At 132 Rand a share. Or a total price of 37.711 billion Rand (2.224 billion Pound Sterling). After this, Barclays Plc. will own 16.4 percent of the South African bank. That was quick, right? Remember yesterday's announcement was that the PIC committed to 59 million shares (or another 7 percent of the issues shares), this morning suggests that they want more. They do however require regulatory approval.

Is this good or bad news? I suspect you could view the divestment of a large bank (not without their own sets of issues and problems) as a negative. And I suppose that you could view the PIC (and other investors) stepping up and making a longer dated investment (at five year low prices) to invest more, not only here, across the continent, as a positive. Remembering that Barclays Plc. swapped shares in a tradable territory (South Africa) with lots of liquidity (relative) for more Barclays Africa shares. What I find particularly pleasing is that investors recognise that banks are profitable machines, and are willing to take a longer dated view, perhaps beyond the next five years. As negative as this was for the banks yesterday, I suspect that the market will view this favourably today, it will mean that an overhang of some sorts has been removed.

We did come up with a new line, SA inc. sinks or SA(s)inc.'s, get it? SAsinks. Which is what you can now refer to when there is a sell off of local banks and retailers. Talking of which, there were results from Spar yesterday. Yes, Spar at a global level has been around for 80 years, there are 12,545 Spars across the globe in 44 countries, as of the end of the year. Nothing in South or North America. Saudi Arabia, the UAE, India, Thailand, Russia, even China. Russia, Australia and Norway. And of course here in Southern Africa, Northwards to Zambia. Nigeria and Cameroon have a handful of stores.

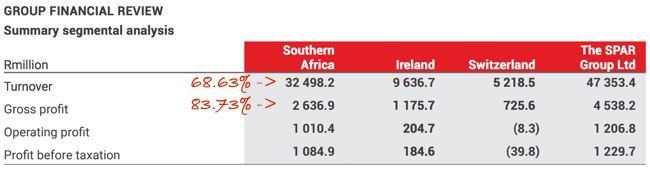

The company is now roughly, in revenues, two-thirds South Africa, 20 percent Ireland and 10 percent Switzerland, give or take a few percentage points. From a profitability point of view, South Africa is the bulk contributor to the group operating profit, Switzerland made a loss, see the summary below:

Switzerland? It is tough out there, the place looks lovely (great cheese, chocolate and watches, plus some tennis players of note!), Spar made a loss: "This was largely attributable to the declining sales performance which impacted all divisions, and the disappointing trading performance of the corporate retail stores." The stock price is down in Rand terms around 16 percent over the last year. I guess that reflects at some level the disappointment of the purchases abroad, or possibly more likely the outlook in their major market, South Africa: " ... the tough trading environment is likely to persist for the balance of this year, particularly with the political uncertainty undermining consumer and business confidence." Quite .....

Serge Belamant is set to get a huge payout after the company announced that he would retire a year early (he turns 65 next year), after having been at a business that he founded over three decades ago. The chair, Chris Seabrooke, describes Serge as a "visionary technologist". Perhaps he really is, having engineered a system that is not really able to be replicated, we all found that out, right?

Before tax last year, according to the proxy statement 2016, Serge Belamant was paid 3.6 million Dollars (including stock compensation of over 2 million Dollars). Before tax. As of the end of the last financial year for Net 1, Belamant owned 1.839 million shares, or 3.46 percent of the company. The largest shareholders include Allan Gray (at 16.38 percent, back then) and IFC Investors own 19.01 percent. The other significant shareholder is International Value Advisers, at 14.15 percent of the overall business. Add those all together, those three shareholders own just short of half of the business.

It would have been the shareholders that approve and approved various stock awards and executive compensation in the past (and in the future). The business and the profitability of the business belongs to the shareholders. Those are the people that share the losses. Those are the people that share the losses and the upside and vote on who gets to run the business by appointing the board, and are ultimately the owners. Forget the fact that they can transact over time (by selling their shares to other willing buyers in the market), that aside for a moment. Shareholders own the business, they suck up losses and equally share the spoils. It is called capitalism.

Allan Gray in this Bloomberg article express their dismay at the golden handshake - Net1 to Pay Departing CEO Belamant $8 Million, Share Premium. I recognise the name of the Allan Gray director here .... it could be from a long, long time ago in Grahamstown days. I suspect, that given that the tone is as such, the owners of the business may not be that happy. South African politicians will also have a field day .... see what happens in business? You see? I suspect that this is not finished by a long shot and this does leave a bad taste in the mouth.

Stocks across the oceans and seas, in New York, New York, had a tough old trading session, but managed to gain back most of the losses by the end of the session. The Dow Jones Industrial Average sank one-tenth of a percent (after being down over one-third of a percent at the start). The broader market S&P 500 sank 0.05 percent, the nerds of NASDAQ a little more than that. Tesla touched another all time high. Energy and basic materials gave up some more ground, tech stocks also gave back a little, Alphabet was amongst the majors that are lower. Healthcare stocks were particularly "good", Michael Kors, ummmmm .... those were not. The stock sank over eight percent, closing stores for days. You would categorise this business as "soft luxury". They are opening stores in China. You can buy a Michael Kors handbag for between 100 to 200 Dollars, there are many people who operate in that space.

Hermes, Chanel, Louis Vuitton (of course), those are at a whole new level. And there are of course, many, many different brands that I haven't explored. On Net-a-porter, in a high to low bag search, the most expensive bag was a 17 thousand Pound Sterling MarK Cross shoulder bag. At more than half the price comes a Dolce & Gabbana leather trimmed painted wood clutch, that I think is downright awful. Yet people will part way with 7410 Pounds. See here - Leather-trimmed painted wood clutch. Lovely, right?

Call me a prude, I prefer some of the older styles, more classic (and wearable for a while). All our ladies out there, who would have a better idea of what bags are stylish and not (I will also ask my wife), please let me know of your favourite brands and styles, for market research purposes. And then also ..... if money were no object, what would be the best bag money could buy for you?

Linkfest, lap it up

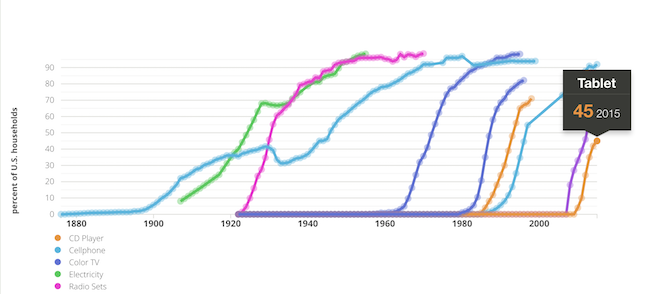

It is amazing how quickly some technologies are adopted. In 5 years the US went from 0% to 45% of the population having a tablet - Adoption of new technologies.

In 2014, Google (now Alphabet) paid $3.2 billion for Nest. Here is Nest's latest product, helping Alphabet make back their initial investment - Nest Cam IQ. As AI technology improves so will the functionality of this camera.

If this jet sounds cheap it is because it has no engines and needs large amounts of TLC - Elvis Presley's Private Jet Just Sold for Nearly $500,000.

"custom designed for the King including gold-tone hardware, red velvet seats and a red carpet"

Home again, home again, jiggety-jog. Stocks are mixed across the globe, down in Shanghai, up in Japan and Hong Kong. And here? Stocks are lower, down nearly two-thirds of a percent. The ratings agencies are getting ready to deliver some updates about South Africa. Standby!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment