"Equally, another business that reached an all time high last evening was Amazon. The stock price crested 1000 Dollars a share for the first time, having listed just over 20 years at 2 Dollars. Dividends you have been paid along the way? Zip."

To market to market to buy a fat pig Stocks were lower in the Wall Street session, open again after a long weekend. Most of the losses were as a result of the energy sector slipping over a percent on the session. The irony was that the Tesla share price reached an all time high, Elon Musk suggested recently that he thought the stock was overvalued (a week or two ago), that does not seem to bother those buying recently.

If anything, it is becoming incredibly difficult to dispute that the future of transportation and energy storage will be involving this business more and more. And their competitors of course, which is why Musk opened the book to all his competitors, that shows at some level that he genuinely cares about the environment and the future of the planet. In fact, he cares deeply about it so much (humanity), that he is exploring (like Amazon chief Bezos) about interplanetary living. And nobody thinks he is nuts, they rather think ..... when Elon, when? To own Tesla, you must be painfully aware that building an empire of this sort requires an enormous amount of capital and will suck cash in getting there. There will be moments that it looks like a failure, and it is not working.

Remember the fellow Austen Allred, who said that he was "all in" (his life savings) in Tesla in the high 180's, the stock is now 335 Dollars as of last night. And this is all in mid November last year. Astonishing, right? Musk simply answered (in-between all the haters telling Austen how dumb he was) "Wow, thanks. We won't let you down." There was another interaction on the same tweet sequence in which people were reminded that in the darkest hours when Tesla and SolarCity were on their knees (those of you who have read the book will recall this), late 2008, a day before Christmas, that Musk was all in on these investments too. And had run out of cash. He knows what it is like to "burn" and almost crash. In fact, he wrote off his dream car. He knows what it is like to write off dreams too.

All I can add to Tesla is that this is a company that you do not want to be against succeeding. The actual valuations, losses for the foreseeable future and question marks around the ramp up in Model 3 vehicles and deliveries will no doubt motivate Tesla more and more. People who work there want to change the future. The share price could halve from here. It could double. It may go nowhere for five years. Unlike old Austen (who may be in his twenties, judging from his pictures), I would advocate owning a "slice" in your portfolio, enough to take ownership and be a difference. Whilst I don't think that the outcome could be binary (it is not going to zero), the share price will definitely take heat if they do not meet lofty expectations.

Equally, another business that reached an all time high last evening was Amazon. The stock price crested 1000 Dollars a share for the first time, having listed just over 20 years at 2 Dollars. Dividends you have been paid along the way? Zip. I recall an older letter from founder Bezos that suggested that if you wanted short term returns, quarter to quarter, you were owning the wrong company in Amazon. In fact, so much so, that Bezos has not been on a single conference earnings call since the company listed. Four a year for twenty years, that is around 80, right? Not one. Nor does he partake in ringing the bell at celebrations at any exchange of any sort! He is too busy trying to help and empower consumers.

When Bezos asks himself questions in the latest annual report, there is something very simple about his questions and answers:

"There are many advantages to a customer-centric approach, but here's the big one: customers are always beautifully, wonderfully dissatisfied, even when they report being happy and business is great. Even when they don't yet know it, customers want something better, and your desire to delight customers will drive you to invent on their behalf. No customer ever asked Amazon to create the Prime membership program, but it sure turns out they wanted it, and I could give you many such examples."

Rather than obsessing about what shareholders/analysts want to hear on the conference call (in fact, Musk does his best to sideswipe these folks on these calls), Bezos keeps on trying to continue to commit to the original letter. The part that I was/am referring to is in the 1997 letter to shareholders, when he truly talks about the long term:

"We will continue to make investment decisions in light of long-term market leadership considerations rather than short-term profitability considerations or short-term Wall Street reactions."

AND

"We will make bold rather than timid investment decisions where we see a sufficient probability of gaining market leadership advantages. Some of these investments will pay off, others will not, and we will have learned another valuable lesson in either case."

In 1997 Amazon employed 614 people. At the end of 2016, there were 341,400 full and part time employees at Amazon. And as Michael said, how many robots? Lots. As Bright said, think about this for a second, Bezos is only 53 years old. He has plenty of road ahead. As does Musk. As does Zuckerberg. All these businesses were worth zero one quarter of a century ago. I get the sense that we are somehow in the middle of the next industrial revolution and instead of names like Cornelius Vanderbilt, Henry Frick, James Fisk, Charles Schwab, J. P. Morgan (John Pierpont), Andrew Carnegie, Andrew Mellon, John D. Rockefeller, Jay Gould and others, we have these titans of the internet and technology era. Page, Brin, the aforementioned Zuckerberg, Musk and Bezos, alongside the many others. Think Gates, Jobs, Ellison as earlier than these guys, in the same way Vanderbilt was ahead of those others.

Investors struggle to see how these businesses can be worth what they are (most noticeably the ones who don't own any shares in these businesses), the valuations will normalise in time and of course the businesses profitability after the grand plan has been implemented. In the case of some of these individuals, Musk, Bezos, Zuckerberg, they would suggest that they are only just beginning. A share price reaching 1000 Dollars is just an event, is my sense. I could not possibly know what is likely to happen next. Recognising that you are in a multiyear shift and in the midst of a disruptive business environment (and the investment opportunities that arise as a result of that) is another. Always hold the line when in doubt.

Linkfest, lap it up

You have seen this piece of plastic thousands of times. The Kwik Lok is the piece of plastic on top of the bread bag. A fellow by the name of Floyd Paxton hand carved (with a pen knife) out of a credit card whilst on a flight home from a business trip. Yes, pen knife, airplane and an expired credit card in his wallet. Kwik Lok makes tons of these things - Most of the World's Bread Clips Are Made by a Single Company. Simple ideas friends are all around us!

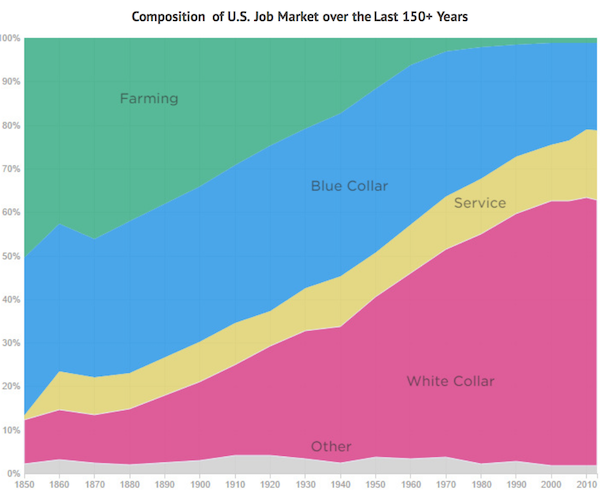

This is a debate that I think will intensify in the coming years, "Will automation lead to mass poverty?" - Visualizing the Jobs Lost to Automation. I came across a stat on Monday that said if you have over $2 200 in NAV you are in the top 50% of the globe. So if you have around R29 000 in assets you are better off than 3.8 billion people! Below is how the job mix has changed in the US, more skilled people are needed.

I'm not sure if I could start a business knowing it will be loss making for years. Tech companies need scale to make money and scale only comes by being around for a long time and allowing users to find you - Inside the GIF factory: How Giphy plans to build a real business by animating the internet.

"One thing Giphy hasn't figured out yet is how to make money. But after raising $72 million in additional venture capital funding last fall, monetisation is being talked about more seriously internally."

Surprisingly index investors tend to be less jumpy than expected. I think it comes down to being mentally prepared. Knowing that when investing in stocks, down turns will come around and being prepared for the "pain" of watching your stock portfolio go down is important. Being prepared means that you don't sell at bad times and if possible add during the down times - How Many Will Stay the Course During the Next Bear Market?

Home again, home again, jiggety-jog. Stocks have started lower on balance here in Jozi, The Spar group (with moving parts) reported numbers that were "ok". Amazon at 1000, Alphabet there nearly again (they did a stock split remember).

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment