"They have the firepower to develop and bring the consumer what they want. Jony Ive and his team are key to product development. I suspect they will be key to the next great product that the company will develop. It will come, just stay patient, the company makes an amazing product that people want."

To market to market to buy a fat pig Stocks in Jozi were in catchup mode, having skipped a public holiday Monday. Workers day, which is essentially a holiday celebrated by socialist countries. Italy, France, Portugal and Malta celebrate this holiday in Europe, not Germany, get my drift? In Africa, our surrounding states celebrate this. China celebrates it. Not Singapore. Get my drift here? Zambia, Zimbabwe, Namibia and South Africa. Not Botswana. Get my drift?

Session end the Jozi all share index closed near the bottom end of the day, nonetheless still up on the day by nearly one-fifth of a percent. Financials were up nearly half a percent, resources down around four-fifths of a percent. At the top of the leaderboards were Sappi, up over three percent and Capitec, up nearly one and three-quarters of a percent. Anglo American fell over three and a half percent, Glencore a little less than that. There were new 12 month highs for Naspers (and all time highs), Mondi and Shoprite.

New lows for construction stock SteffStocks and a new 12 month low for DRD. There is a quarterly update from MTN this morning, which shows good growth in Iran and Nigeria, South Africa pretty flat. Subscribers numbers now sit at 237 million. This is Rob Shuter speaking for the first time. I am waiting for big things from this business, in particular this year. The stock is up a little this morning. More on this tomorrow, OK?

Stocks in New York, New York ended the session marginally higher than where they left off. The nerds of NASDAQ crossed a new all time high of 6100 points, the index did end up closing marginally lower than that, up 0.06 percent at the close. The Dow Jones Industrial average added nearly one-fifth of a percent whilst the broader market S&P 500 added just over one-tenth of a percent. A broad based technology stock follow through as a result of positively received earnings, that is better to see than any politics or any economic read. Remembering that we own companies, not the Fed (who deliberate today for a conclusion this evening), not the economy and so forth. There has been a slew of results, we will deal with all of those!

Results last evening from Apple, which we will deal with below and then results tonight from Facebook, which will be exciting too! And Tesla. Tesla is an amazing company that is hell bent on changing perceptions of energy usage. Energy ..... it is very, very important to be able to optimise usage as we head towards a higher population. I think that what the company has done is that they have forced all of their competitors to look at a strong line of electric vehicles. Check out this C-Net piece - Mercedes-Benz has a Powerwall-style battery of its own.

Company corner

Apple inc., the world's largest company by market capitalisation, reported numbers for their second quarter of their 2017 financial year, after the market closed last evening. Revenues clocked an incredible 52.9 billion Dollars (although that fell short of what Mr. Market was expecting), earnings per diluted share clocked 2.10 Dollars (which was more than Mr. Market was expecting). The last comparable quarter clocked 50.6 billion in revenues and 1.90 Dollars in earnings. International sales represent 65 percent of all of the Apple business, it is fair to say that this is truly a global business with a very large "home" market. The services business continues to make big strides, having the best 13 week quarter in the history of the business.

The board has also announced that they have expanded the capital return program by 50 billion Dollars, the company would have, by the end of this current round (March 2019), returned 300 billion Dollars to their shareholders. That is in buybacks and dividends, which total 211 billion Dollars thus far. Of that, 151 billion has been in share repurchases. And talking of the dividend, that has been hiked by 10.5 percent to 63 US cents per share. That is payable in the second half of May, 15 days from today actually. Shares in issue, as you would expect with the buybacks being of such a big size, are down to 5.261 billion. This time last year it was 5.567 billion. The increase in operating income is not really that different from the last time (comparable quarter measurement), meaning that the increase in earnings per share is largely attributable to fewer share in issue.

On a geographical basis, the only region to show lower revenues, over the comparable quarters, was greater China. Mainland Chinese sales for Apple were 14 percent lower than this time last year. The Americas and Europe were strong, both registering low double digit sales growth. And then products and product sales, the iPhone still remains the king. After the wow reception in the first quarter of the new iPhone cycle (the iPhone 7), unit sales of the iPhone was 1 percent lower, whilst revenues was 1 percent higher. Services was huge, 18 percent higher than this time last year. The "other products" division, which is around 5 percent of total sales, grew 31 percent. Why that is significant is that it includes watches (as well as Beats products, Apple TV, and accessories), which indicates a strong future demand.

Cash on hand swelled to nearly 257 billion Dollars. Last night at the close, the company value was 789 billion Dollars, 32.5 percent of the company is just cash. Remembering that if they (Apple) need to repatriate that, they will be subject to paying tax. If there was a window to send some of that cash home, this cash may ironically be rated slightly higher. If that makes sense. The stock is down pre-market, by around 1.8 percent. Partly due to a miss in iPhone unit numbers, and partly due to the outlook for the current quarter "not as rosy". Fear not, I suspect that the release of the next phone will be incredible, people are going to want it. The ecosystem is becoming more and more important, the applications are endless.

Having seen an incredible run up in the stock share prices (stock is up 27 percent year to date), it may be that the share price "pauses" at this point, and drift for a bit. Having said that, I think that this is a great long term own and accumulate. They have the firepower to develop and bring the consumer what they want. Jony Ive and his team are key to product development. I suspect they will be key to the next great product that the company will develop. It will come, just stay patient, the company makes an amazing product that people want. And it has a luxury appeal, at an affordable level. Everyone likes and loves pictures and sharing. You need a great tool for that, the iPhone is one of two that people currently "want". We continue to accumulate and continue to rate the business a buy. More in the coming weeks.

Linkfest, lap it up

Is this a good problem to have? This highlights the reliability of solar power by the grid - The US is using so much solar power that it will have to prepare for the August eclipse.

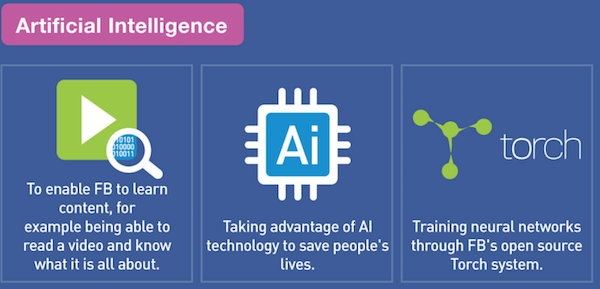

Facebook reports numbers tonight. Here is a breakdown of the vision that The Zuck has for Facebook - The Progress of Facebook’s 10-Year Masterplan

As we spoke about last week the key to financial freedom is having the time to let command returns do its thing, Ben Carlson talks a bit more about it - Urgent vs. Important & the Power of Small Wins. Long term investments are important but never urgent, until it is too late.

"I have two kinds of problems: the urgent and the important. The urgent are not important, and the important are never urgent."

Home again, home again, jiggety-jog. Stocks are up marginally to begin with locally, the US market will be moved at some level by the Fed statement a whole lot later this evening, and no doubt will have a bearing on local markets tomorrow morning. Stay tuned to that, and of course locally (and at a continent level), the WEF Africa meeting is taking place in Durban.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment