"The business more importantly over time has taken control over production during the last few years, everything from tomato paste to fries to muffins to cheese. All big inputs where they can control the quality of the products, and more importantly, for the franchise owners not to get worried about the product delivery and stock. "

To market to market to buy a fat pig A ton of major markets were closed yesterday, it was one of those very rare days that all coincided with one-another. The US was closed for Memorial Day, the UK was closed for Spring Bank Holiday, whilst the mainland Chinese markets were closed for the Dragon boat festival. That same holiday rolls over to today, Hong Kong on the other hand is open for business on both days. I recently found out that Japan has a golden week holiday of their own, at the beginning of May.

With little direction from the major financial centres of the world, we were left to our own devices, a weakening local unit as a result of the president surviving another bout of no confidence. Remember the old Black Cat adverts where the kid eats a peanut butter sandwich and then wins the fight? Our number one may have a giant larder stuffed with tubs of Black Cat.

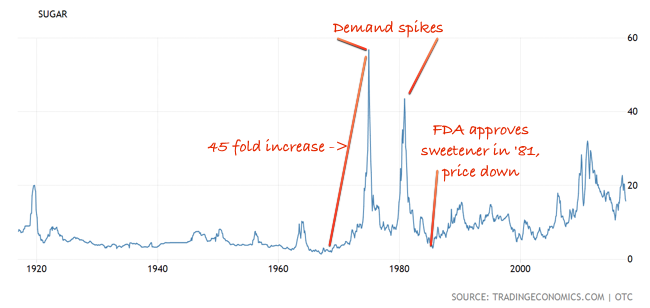

Resources benefitted from a weaker Rand, up seven-tenths of a percent, most of the other major indices were lower and by the end of the session the All Share had given up one-tenth of a percent. Mediclinic taking some heat post their results, the stock was down 2 percent on the day. Remgro, as a large shareholder in Mediclinic, also took a little heat. Hammerson and Anglo American were amongst the winners on the day. Tongaat Hulett, the sugar producer with land for sale in the Durban North area, bounced back after a torrid time of it with the recent drought. That said, the NAV is lower over five years and the share price is flat over that time. Producing a product that may be in demand by emerging markets, there is going to be pushback from the mainstream customers in time, is the best guess.

A couple of years ago the WHO urged all adults and children to reduce their sugar intake - Guideline, saying "A high level of free sugars intake is of concern, because of its association with poor dietary quality, obesity and risk of noncommunicable diseases." Back in 2003 the US Sugar Association wanted Congress to reconsider its funding of the World Health Organization, as a result of recommendations originally made.

I am all for free choices, if people eat vast amounts of anything, there are health consequences (can you eat too much celery?). If the state is funding your healthcare, then the state can decide what you can and cannot eat, as the same report above says: "Noncommunicable diseases (NCDs) are the leading causes of death and were responsible for 38 million (68%) of the world's 56 million deaths in 2012. More than 40% of those deaths (16 million) were premature (i.e. under the age of 70 years)."

So where does the line get blurry? Is sugar really awful and does it have a massive impact on humanity? More studies will give us more information in time. Most developed nations are the eaters of most sugar, per capita, currently the average US person consumes 126 grams per day, more than ten times the recommended dose. If there is broad societal pushback, the price of sugar could come under pressure. See the nearly 100 year sugar price, courtesy TradingEconomics.

Confectionary companies like Nestle have confirmed that they will use less sugar in their chocolate bar - Less sugar, great taste: A scientific breakthrough from Nestle, that meets the demand of the consumer. As the release says - "Nestle is patenting its findings and will begin to use the faster-dissolving sugar across a range of its confectionery products from 2018 onwards." So there ..... Like any commodity company, they have steady demand from an increasing population that is urbanising at a faster rate than at any point in humanity. The weather, politics and increased regulatory pressures are factors not in their favour. I don't know, what do you think?

Company corner

Famous Brands released their annual results for their financial year to end February 2017. These include Gourmet Burger Kitchen, the UK burger franchise that Famous Brands bought for 1,8 billion Rand during the last financial year. They also bought a potato chip (french fries) plant, Lamberts Bay Foods for 73.5 million Rand. There was also the acquisition of half of Mexican Salsa (nearly 5 million Rand) and half of the Italian restaurant (early stages) Lupa Osteria. Other than Lamberts Bay, I have been to all of these, for some "market research". Of course there was also the purchase of 49.9 percent of "By Word of Mouth", a well known, especially around these parts, catering business.

Equally, inside of this financial year, the French bakery PAUL has been opened. And If I was skilled enough, I could throw a cricket ball there from my seat (I would have to stand up). I also happen to know pretty well the fellow in charge of the single PAUL, they are looking to expand that wonderful (no carb clever there sportslovers, it is a bakery) store. Remember that PAUL is a French bakery chain that is "global", there are bakeries in the Americas, across the Middle East and of course in Europe (115 alone in Paris and the surrounds). South Africans are VERY receptive to international brands, not too dissimilar to most foreign markets liking international brands. Provided that they are of a certain quality, they (the consumer) will come. This creates interesting opportunities for employment and skillsets in these parts that fit international norms.

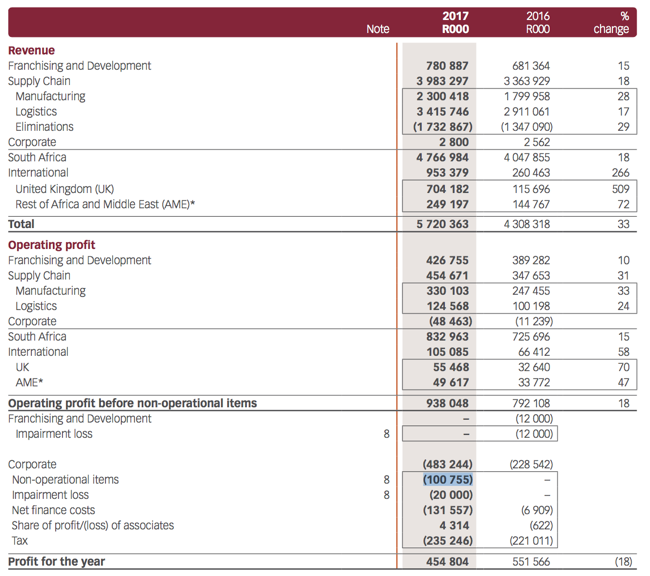

Herewith a breakdown of revenues and profits from all the separate divisions, as well as reasons that profits were 100 million Rand lower (more or less) than the prior reporting period. We can get into that in a minute.

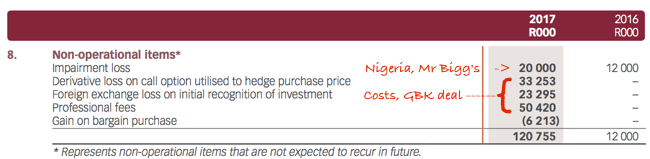

See that piece I highlighted in blue? There is a breakdown of that a little later, which relates to costs associated with getting the GBK transaction and various other transactions done, 50 million Rand in total! And then losses on the currency hedges of roughly 55 million Rand (at the half year stage it was in their favour). Equally, and not small fry, Famous Brands impaired their Nigerian asset (Mr. Bigg's, the pie company) by another 20 million Rand. It can be fair to say that Nigeria has not performed to any expectations, either for the locals or the businesses that bought into what is a huge consumer base. Two-thirds of Nigeria's 180 odd million people are UNDER the age of 30 years. There must be scope for class migration higher in the coming years.

There you see the big difference. I wonder what the value of their half is in the Mr Bigg's business and whether that will eventually be written down to nothing? Not too worry too much, of the 2782 stores, only 125 are in Nigeria. There are only 97 GBK's at the moment. The restaurants that they are opening the most of are Debonairs, they opened one a week last year. Steers and Mugg & Bean, around once a fortnight. Inside of the emerging brands, Milky Lane is being rolled out aggressively.

The business more importantly over time has taken control over production during the last few years, everything from tomato paste to fries to muffins to cheese. All big inputs where they can control the quality of the products, and more importantly, for the franchise owners not to get worried about the product delivery and stock.

Why own Famous Brands? The business is in the sweet spot of more people eating out, the entertainment choices available to consumers is heading in the direction of "experiences". Meeting your friends and family at wonderful venues, be it value for money, higher up the chain or in the "luxury" segment, i.e. Tasha's and perhaps GBK now. Mythos, Lupa Osteria and even Mexican Salsa. The business has displayed in the past strong cashflows, the suspended dividend (for now) will be reinstated when the company is happier that these debts (only 16 percent gearing) can be paid down. We like the space, we are encouraged by the results and we remain buy rated on the stock.

JNJ is made up of three sectors. Pharmaceutical, Consumer and Medical Devices. Pharmaceutical is the biggest sector, making up 46,41% of first quarter sales in 2017. Medical devices come in at second place with 35,42% of first quarter sales. Consumer goods make up the remaining 18,17% of sales. When comparing the first quarter of 2016 to 2017 all of these sectors have grown in sales. The most sizeable change being in the medical devices sector which grew sales by $184 000 000.

The business is going to keep buying different products and companies that are profitable and can boost the areas in which their footprint is currently small. When you look at Johnson & Johnson's size, they have so much distribution power, they have so many relationships with different providers of medical devices, that they're able to take these smaller companies and leverage them and make them more valuable than they would have been as stand-alone.

Pharmaceutical

JNJ's biggest sector by sales and most profitable by margin, with operating margins of 39%. The pharmaceutical sector doesn't include the OTC (over-the-counter) drugs that they make.

Remicade has the biggest sales, making up 9,41% of first quarter sales of the entire business in 2017. Remicade is used to treat many auto-immune conditions including Crohn's disease, ulcerative colitis, rheumatoid arthritis and plaque psoriasis. There are 2,5 million prescribed users worldwide. Sales have fallen between '16 and '17 due to Pfizer releasing a biosimilar. Sales in the next few years depend on how the drug is priced relative to its new competitor.

Stelara is another immunology drug that has sales amounting to $824m (4.6% of sales) in the first quarter. It is an immunosuppressant that reduces the effects of inflammation. It was approved by the FDA for usage on Crohn's disease and sales have increased further.

Xarelto, is a blood thinning drug that is given to patients to prevent or treat blood clots. Since its inception in '11 the drug has gained momentum and sales have grown. It now holds 17.1% of total market share. It continues to take market share away from Walfarin.

Imbruvica, a cancer fighting drug has grown in sales by 56,7% over the last year to $409 million for the 1st quarter. JNJ plans seven new label expansion filings, including four that could add $500 million or more to Imbruvica's annual sales

Darzalex was only launched three months ago, it has already become the most prescribed fourth-line therapy in multiple myeloma, a multibillion-dollar per year indication.

There are many filings in the JNJ pipeline that are expansions on current drugs. What this means is that they are looking to utilise drugs for different uses than they have previously been approved for. Both drugs that treat cancer are in Phase 3. Zygita treats prostate cancer and Yondelis ovarian cancer.

Consumer

This is JNJ's smallest sector and the sector with the lowest margins currently at 20%, which is still an impressive number. It showed valuable sales growth over the last year. The business comprises of a broad range of products used in baby care, oral care, skin care, women's health, wound care and over-the-counter (OTC) medicines. OTC and skin care are the largest sales for the consumer products segment. Some of these products include Tylenol and Neutrogena. JNJ has taken steps to improve the business' profitability over the last couple of years. This includes a new management team, which led it to getting OTC products back on shelves in the United States and implementing new manufacturing quality standards.

Medical Devices

The medical devices sector of JNJ is the 2nd biggest sector but is growing quicker than the bigger Pharma division. In terms of margins it also falls in second place sitting at a juicy 32%. The biomedical realm is a dynamic environment with technology developments taking place all the time. This is a business segment that is very much managed by adding on small acquisitions and getting rid of low performers.

DePuy Synthes, the orthopedic sector of JNJ is the biggest part of their medical-device sales. Hips, knees, spine. There has been some pricing pressure there. It's a highly competitive market.

The other sector that does well is the surgical equipment sector run under the company Ethicon. This is everything from tools to recovery devices.

JNJ Vision has grown significantly in the last year. They bought the medical-optics subsection of Abbott Labs. This rounded out their eye-health offering, particularly within the surgery category of vision care. They are also responsible for the contact lenses brand Acuvue. More people wanting to get laser eye surgery has created good growth for the sector. That vision-care segment was up the most of any medical devices segment, and it now counts for about 13% of medical devices.

The Diabetes care sector had 2,25% of total sales in the first quarter. LifeScan makes blood glucose monitoring systems for home and hospital. This is a sector that is struggling. JNJ is busy looking at options into how they should take this business forward. Some changes might happen in the next year.

Here are some tabled breakdowns for each division:

Pharmaceutical Division Breakdown

Medical Devices Division Breakdown

Consumer Division Breakdown

Company Breakdown

Home again, home again, jiggety-jog. Stocks are up a fraction to begin with. Mr Price is up over five percent, the results are less worse than anticipated. Which I guess is good news at some level, hopefully the consumer really is on the move, even if just a bit.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment