"Now that the numbers are out of the way, there are two key areas that management spoke about. An area of concern, which was the opening point from the new CEO Kevin Johnson is the state of US malls. Foot traffic to malls is slowing and a number of malls are closing."

To market to market to buy a fat pig OK, first things first, Macron won and the new French president will be the youngest ever in the history of their democracy. Even though, as we stand now, this is the French Fifth Republic, that dates back to 1958. A time when Charles de Gaulle was large and in charge. In fact, this version is the second longest of all their republics since the abolishment of the monarchy, back in 1789. France has a semi-presidential system, which means that the president and the prime minister and cabinet work together. At least that is the way that I understand it.

Whatever the system of government, the important thing here was the French have a pro business and a pro European president, and I think in light of the anti-establishment votes from last year, this is a good thing for integration, free trade and it also tells you that people rebuffed the idea of isolation and what is plain racism, masked as "nationalism". Another fact, before we shelve this as "good news", the first French president was Louis-Napoleon Bonaparte, or just the nephew of THE Napoleon, to you and I. And he (nephew of Napoleon) then staged a coup in 1851, probably not enjoying the idea of democracy so much. From 1871 onwards however, France has had a president, with regular elections, interrupted by the Second World War. As you can quickly tell, it is difficult to have economic continuity with all these political disruptions. Many people will not invest when governments flip and flop.

That is why I borrow that line from Warren Buffett, when he says something along the lines that the US has had 250 years of uninterrupted economic growth and prosperity. Sure, there have been wars (a big civil one too), the program has been to keep it on the straight and narrow. That is why it works, and will continue to work over the next few decades that we have to look forward to as an investor. France, as you can see, has had too many interruptions. Hopefully this is the start of a long and bright future for Europe, notwithstanding many naysayers. If one thinks about it, the UK used their own currency and had border controls, had their own central banks, the rest of Europe did not. Which is why, in my mind, the longer the European "experiment" proceeds, the more likely it is going to be more and more difficult to unpick in the modern era.

To market quick sticks. Here in Jozi, Jozi on Friday, stocks rose around one-third of a percent. Resources rose over a percent and a half, Anglo, South32 at the top of the leaderboards, with Bidcorp also gaining major traction, up two and a half percent on the day. I suspect that the stronger Pound has something to do with it. At the other end of the spectrum and suffering from a very weak oil price, was MTN. I suspect that their trading update in which they suggested that more capex in all of their territories was less of a "concern", it is rather trading as a proxy for the oil price (Nigeria and Iran) is the reason the price has been weak.

Over the seas and across the oceans, in New York, New York, stocks ended the day in the green. It was jobs Friday - The Employment Situation Summary. The numbers were all generally "good" and moving in the right direction. I just get the sense that it may not get much better than where we are right now, it may be a steady 150 to 200 thousand jobs addition, and the unemployment rate flat. The Dow added one-quarter of a percent to top 21 thousand (again), whilst the S&P 500 touched an all time high, crossing 2400 points for the first time. The nerds of NASDAQ "got close". Apple inc. touched an all time high, I guess the biggest stock in the biggest market both reaching all time highs is not a coincidence.

It was Buffett time again over the weekend, the annual general meeting of Berkshire took place Saturday and the masses that come in their droves to Omaha must both please and irritate the locals. Pleasing, as it creates employment and awareness and irritating, as it must feel like the wildebeest migration for the locals, and they are simple river birds minding their own business. There were more than a few nuggets, including Buffett underestimating the brilliance of Jeff Bezos of Amazon and Munger being sorry about not investing in Google. And saying that he got IBM wrong and was glad that they (Berkshire) had bought Apple recently. Apple being more a consumer company (with wonderful products).

What is so very refreshing is that Buffett and Munger speak about learning all of the time, the fact that they continue to make mistakes, rectify those and then look at themselves long and hard in the mirror. I love that about these two, I love that the company can continue to evolve as they enter their last few years of investing. In the next ten years I suspect that both of them will be gone, at least from an investment point of view.

Even if Charlie makes it beyond 100 and has all the experience in the world, he may not be able to attend these types of meetings. We will continue through the week to bring you some Charlie and Warren time! See the Bloomberg piece - Buffett Confronts Search for Next Big Thing After Missed Chances.

Company corner

At the end of April we had Q2 numbers from Starbucks which missed what the market was hoping for. The result was a 1% drop in the share price, so not a huge miss. Having a look YTD, Starbucks is up 10% when the broader market is up a little over 7% so the company is still doing better than the average. Onto the numbers!

Revenues were up 6%, with Global and US comparable sales up 3% and Chinese comparable sales up 7%. For the US based stores the average ticket price was up 4% but transactions were down 2%, which seems to be inline with the change in the rewards program where value is now rewarded instead of transaction numbers. The number that matters to me is what do margins look like? They managed to grow their operating margin by 40 bps to 17.7%. Thanks to the margin increase they increased operating profit by 8.2%, when this fell to the bottom line, net Income came in higher by 13.5% at $653 million.

Now that the numbers are out of the way, there are two key areas that management spoke about. An area of concern, which was the opening point from the new CEO Kevin Johnson is the state of US malls. Foot traffic to malls is slowing and a number of malls are closing. If people are shopping more online, they are not stopping at Starbucks to get a caffein dose to keep their shopping spree going. On this point Kevin noted that they aren't seeing any significant impact on Starbucks branded stores because the stores are designed to be "destination stores/ experiences". Interesting to note that Teavana (Tea company), which they bought in 2012 is really feeling the heat of the mall slow down. With store upgrades the stores should come right.

To increase the destination offering they are opening up ultra premium stores called their reserve stores, where a coffee sells for around $12. There are only 5 stores currently with another being built in Chicago. Paul did some investigating when he was in Seattle at the end of last year, he said the experience was amazing and that the store is becoming a tourist attraction itself.

The next big theme is their growth in China, where management say you need to actually see what is happening to believe how popular the brand is. Currently they are opening up a new store every 15 hours. China is important because this is where most of the growth is going to come from over the next decade. On a margin basis, China increased margins by 380bps in comparison to the Americas where margins dropped by 130 bps.

Another company that we own, Tencent, has partnered with Starbucks in China. Currently 29% of all transactions are paid with WeChat pay. The easier that you make it for people to pay and for people to gift Starbucks to others, the more orders come through. In the US, including gift cards, 44% of all transactions are prepaid.

Given the huge growth potential in China and the moat created by their premium brand status, Starbucks trades on a premium to other food chains. In our opinion a deserved pricing. Don't expect fireworks from the share price but expect this company to be worth more in 10 years time with a whole lot less shares in issue.

The Amgen share price has been under pressure since Friday the 13th of March this year. Well, let me rephrase that. The Amgen share price took a knock on that day as a result of a fairly innocuous release: Repatha (Evolocumab) Demonstrates Reduced Need For Apheresis In Patients With High LDL Cholesterol In Phase 3 Study. Let us just say that the outcome was not what people expected.

This has seen investors dial back their future revenue calculations (in light of expectations falling on Repatha sales), hence the price coming back to 160 odd Dollars from 180. Mind you, in the lead up to the US presidential election conclusion, Clinton being the likely candidate was going to come down heavy on these businesses. Trump himself has had a bit to say about the pricing of their therapies. The truth is that the company spends double digit amounts in revenues to come up with life saving therapies. I know first hand how emotive the decisions around these therapies can be, they deplete savings at a pace. I can understand that there is a certain responsibility of these businesses to deliver cheap life saving therapies, they cannot do that in perpetuity unless they have the early adopters.

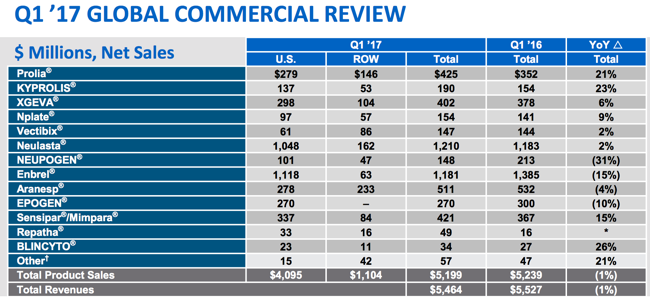

And what that means is that having made their therapies available (which have to get through miles of tests and scrutiny before fit for consumption) to the masses, at least those covered by medical insurance or rich enough to take the therapies. It may be as simple as supply and demand, remembering that competitors and those waiting for the therapies to come off patent will benefit from the cheaper therapies. This company has nearly 4 decades of experience in biotech medicine, their current blockbusters are as per below, growing fast are Kyprolis, Repatha and Prolia.

The guidance for the full year was tweaked, the noticeable difference was upgrading their guidance in non-gaap earnings per share to the range 12.00 to 12.60, 12.30 Dollars at the mid point. The previous mid point was 12.20, a marginal update. There is a good dividend underpin approaching three percent (before tax), pharma stocks are always pretty generous. We continue to accumulate at what we think is a very attractive opportunity, it is cheap and there is a good pipeline to add to existing therapies.

Home again, home again, jiggety-jog. Stocks across Asia are mixed to higher, Hong Kong is up, Japanese markets are up two and one-third of a percent. Cheer the mid road in France. What I find most interesting is that the party that Emmanuel Macron formed is all of 13 months old. The next election in France is in the next few months, this is for the National Assembly. This could be another big moment in French politics.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment