"Brian Joffe's Long-4-Life is ten times bigger in market capitalisation than Basil Read. In fact, Long-4-Life is bigger than Basil Read and Group5 put together. Eish. L4L (the share code of Long4Life, which you could mistype L$L) added over ten percent yesterday, a follow through on the news that Kevin Hedderwick (of Famous Brands fame) is the new Chief Operating Officer."

To market to market to buy a fat pig The Rand firmed through the afternoon, emerging markets attracting some inflows. Some suggesting "other" factors too, one can never really be sure when talking about currencies. They certainly do impact on markets. My go to on this is the U.S. Dollar Index, which is trading near the lowest point since last November. It does at some level explain Rand "strength" on a relative basis.

Anyhows, to markets quickly. Stocks locally traded towards the bottom end of the day range by the close, as a result of the dual listed stocks giving some back. We managed a modest gain on the All Share index, stocks moving the needle were the likes of Standard Bank, Nedbank, local industrial business Bidvest and Sanlam, all scoring huge wins on the day. In the minus column were the likes of Glencore (Making a takeover jab at US grain trader Bunge - Glencore-Bunge Deal Would Add G to ABCD Dominating Grain), down nearly three percent on the day. Anything with a slight UK flavour understandably experienced a sell off, Mediclinic and Hammerson sank, as did other Rand Hedges, like Richemont.

There was another 12 month low for Pioneer Foods, the market really disliked their recent results and loss of market share, down nearly another five percent on the day. Sun International also continues to shed value, down another three percent on the day to another 52 week low. In fact, it is worse than that. The share price has not been (Sun International) at these levels since 2005. We are staring at a 12 year low for the leisure business. It certainly tells you something, at some level. In almost exactly the same boat (different industry) is Basil Read, the construction company, also trading at the same levels as they were back in July 2005. The market cap is around one-quarter of a billion Rand.

Brian Joffe's Long-4-Life is ten times bigger in market capitalisation than Basil Read. In fact, Long-4-Life is bigger than Basil Read and Group5 put together. Eish. L4L (the share code of Long4Life, which you could mistype L$L) added over ten percent yesterday, a follow through on the news that Kevin Hedderwick (of Famous Brands fame) is the new Chief Operating Officer. The investment strategy is pretty far and wide ranging, view the stock as a traded private equity fund. i.e. Traditional entry methods are difficult to private equity, this leverages off smart minds and years of experience, which you may, or may not be able to buy. Too small for now to be on our radar, I definitely like the people that are involved. In the words of Lloyd Christmas, I like it a lot. If you are confused, this YouTube clip will help - Dumb and Dumber - I like it a lot.

Across the way, stocks in New York, New York (reachable by tomorrow, thanks to modern technology, Visa permitting) were as a collective marginally higher. The broader market S&P 500 added just under one-fifth of a percent, the Dow Jones Industrial Average a little more than that, whilst the nerds of NASDAQ lagged the broader market by a factor of two. Financials were the biggest winners on the day, up around half a percent by the end of the day. There was a digestion of the Trump budget, as he swoons across the Middle East (Sword dances, a first visit by a US president to the Western Wall) and onwards to Brussels and then onwards to Italy/Sicily for the Group of 7 meetings (and not to catch the Giro). A huge logistics exercise I would think, 9 different places.

Linkfest, lap it up

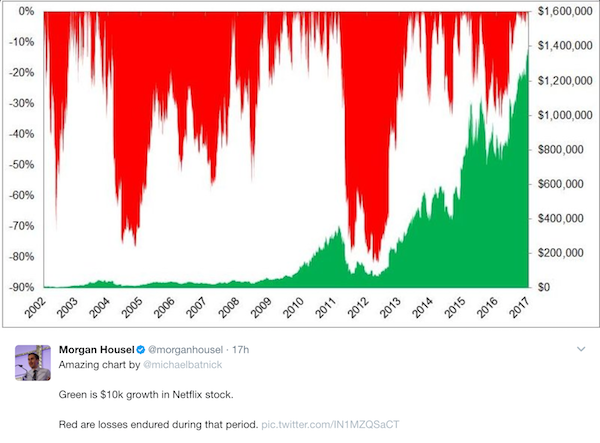

With the recent 20 year listing anniversary of Amazon and the surge in the bitcoin price, there have been many posts about, "If you had invested x it would now be worth . . . ." The thing that people forget is that you would have had to hold the investment for many years through many draw backs and in the case of tech stocks, watch other tech companies go up in smoke. Here is a look at Netflix, assuming you invested on day one. Would you have held all the way through?

As you have probably guessed by now, Ben Carlson is one of our favourite bloggers. Here is another great piece from him talking about the best way to beat the market is by being patient, have a long term time horizon and having a simply approach - Barriers to Entry in the Markets.

Home again, home again, jiggety-jog. Chinese debt flags have been raised, this time as Moody's cuts the sovereign debt rating, worrying about the indebtedness in that country. See "The Journal" - Moody's Cuts Its China Rating for the First Time Since 1989. That has put to some extent a lid on stock price movements this morning in Asia, Shanghai is down a little, Hong Kong less so (Tencent is off over a percent, that will certainly impact us here), whilst Japanese markets are up over half a percent. US Futures are a smidgen lower, hardly anything to talk about. The UK, and Manchester in particular, is putting on a brave face in what is definitely a less safe world than a while back. My heart bleeds for all peoples displaced, loved ones lost in acts of war and terror. The simple question is why did this happen?

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment