"For a little perspective, Adidas has annual sales of 19.3 billion Euros (nearly 21 and a half billion Dollars), Nike 32.5 billion Dollars. Under Armour is a small, yet growing business in a space that we think has lots of room to move."

To market to market to buy a fat pig Another "nowhere day" for the local bourse, I heard an old timer on the floor, a fellow by the name of Art Cashin suggest that a 13 (or is it 14) session in a row of less than half a percent move (in any direction) was a waste of a fresh shirt and cab-fare. If I am not mistaken, Art has been on the floor longer than anyone else, and that is the floor of the NYSE, corner Broad and Wall Streets. I actually met him once, in the security area at the NYSE, I said "I am a big fan Art", he quickly replied, "wait here" and did an about turn retrieving a copy of his daily printed sheet for how he "saw" markets today. He was very proud of it, he should be! I wondered how long he must have been doing this (for he has been there nearly five decades), the printed sheets and handing them out to his fellows on the floor. And I also wondered what sort of innovations he must have seen in his time too.

Anyhow, in the digital era there is an office to go to, or you can be at the end of an internet connection. There need not be any "desk" in the modern era. That said, it is *nice* to sit in the company of fellow investment professionals and interrogate your thesis over and over again. You are never right and you are going to be wrong at times. Many times ... in fact. Investing is hard. Very hard. And if it was easy, there would be more people with the stomach for it.

Volatility is a tricky thing to deal with emotionally, it can gnaw at your investing bones to the core, trying to flush you out or spook you. I saw a Bloomberg story suggest that in the US, many of the retired generation are not spending money and equally are passing on more and more to the next generation, compounding the inequality issues. Rich Retirees Are Hoarding Cash Out of Fear. Part of it, the non spending and hoarding of assets, was the big sell down in the financial crisis and the imprint it left on the just retired or about to retire generation. The fact that it "happens" every now and again, and is an opportunity, is lost on many people. i.e. You have to have the necessary buffer to take advantage of the prices.

Quick look at the local bourse, financials rallied over half a percent and resources added one quarter, most of that was counteracted by a fall in the industrials (stronger Rand = selling of Rand hedges), with the overall market closing down around 30 points (which is one-twentieth of a percent nowadays), just above 54 thousand points. Vodacom continues to rally, this recent announcement seen as very favourable for the company (see the message yesterday - Vodacom goes on Safari).

Naspers saw some steam come out of the incredible rally, the Tencent price is still trading at and near all time highs (as of this morning). The Rand being stronger was partly to "blame". The company recently sunk 387 million Euros into delivery startup called Delivery Hero. See the BusinessInsider story - Takeaway startup Delivery Hero has just raised EUR387 million to help it take on Deliveroo.

European cities are smaller and logistically (on bikes and bicycles), easier to navigate. Taking on Ubereats and the like in a big hurry. Delivery Hero suggests on their website that they are the largest food network in the world. Really. How about the 200 thousand dabbawala deliveries daily in Mumbai? I suppose those are individually cooked, collected and packaged and then delivered. Humans are pretty organised - Watch this Youtube clip - DabbaWalas - Amazing Meal Delivery in India. Error rate, 1 in a million. Or one undelivered meal a week. Earnings equally divided, all delivery people equally "shareholders". Delivery Hero say that they have 150.000 restaurant partners.

Stocks were mixed again in the Wall Street session, the Dow Jones Industrial Average ended the session marginally lower than where they started, down 0.01 percent by the close, the broader market S&P 500 lost 0.07 percent by the end, the nerds of NASDAQ added one-third of a percent, led by the likes of Microsoft, Alibaba, Alphabet and Amazon. All the A's in there. Technology stocks as a collective added seven-tenths of a percent. Political shenanigans post the market have led to sell off (futures) and currently we are off around half a percent. US manufacturing showed positive signs, weak retail sales led to a broad based sell off of all the majors in that index.

Specialist sporting retailer (which started out as a fishing store), Dicks Sporting Goods, fell sharply, down nearly 14 percent. Dicks is down 15 percent over five years. Michael and Paul have been to a Dicks, Michael remembers the "freedom bucket" of bullets in the store. Ha-ha. Freedom indeed ..... I guess one person's idea is different from another.

Company Corner

Under Armour, the sports apparel and shoes company reported results a number of weeks back. Kevin Plank, the CEO and founder is an interesting guy. He is not without his own set of controversy, making a German football team and Steph Curry (the almost legendary current basketball star) more than a little angry about his supportive Trump comments. At the end of the day, Plank is always going to make his fair share of omelettes (by scrambling the eggs, you know).

Plank ruffles feathers. His story is not too dissimilar to that of Phil Knight, the Nike founder. Not shoes, rather sports apparel (in particular American Football t-shirts) that he manufactured in the house of his grandma. The reason being is that he didn't like the existing sweaty cotton shirts. The funds used to create all of this was money derived from a rose selling business on Valentines Day. Often the trajectory and the success of a business is through the founding efforts and persistence of individuals, that permeates through the DNA of the business. And eventually becomes just part of every day life.

Sales have been growing at a rapid rate, for the last five years an average 27 percent compounded growth rate, from 1.834 billion Dollars in 2012 to 4.825 billion Dollars in 2016. That means, on a comparative basis, that Under Armour is around one-eighth of Nike sales. The mix relative to Nike is very different too, the Under Armour mix is 67 percent apparel (as per the 2016 annual report), 21 percent footwear and 8 percent accessories (hats, bags and the like).

For a little perspective, Adidas has annual sales of 19.3 billion Euros (nearly 21 and a half billion Dollars), Nike 32.5 billion Dollars. Under Armour is a small, yet growing business in a space that we think has lots of room to move. Athletic wear is no longer confined to the sport field, it is also fashion, both with apparel and shoes. In fact, Under Armour was at the New York Fashion show last year with their own range. Take from that what you want, the consumer wants to be comfortable and stylish and the sports brands of the world have responded aggressively. The company has some amazing brand ambassadors, see below. On the recent quarterly numbers conference call, CEO Kevin Plank had the following to say:

"So now, as the third largest athletic brand in the world with more than $15 billion ahead of us to second place and another $15 billion ahead of that to first place, the fact remains that we have significant and scalable opportunities before us."

One of the issues that Under Armour has, is their direct sales to customer channels are not as big as they would like, repressing only 31 percent of total sales. Equally, they are still pretty much confined to North America, which represents 85 percent of all sales. Europe, the Middle East and Africa is around 7 percent, Asia-Pacific is small at 5.6 percent and Latin America is just less than three percent. This represents a huge growth possibility for what is becoming a huge global brand, the likes of Andy Murray, the Welsh Rugby Team, Aston Villa and Southhampton football clubs respectively.

Plus, there are exclusives with the likes of the aforementioned superstar Steph Curry and most recently "The Rock", aka Dwayne Johnson. Who, in case you missed it, was the highest grossing movie star recently. Yes, you heard right. Of course there are the old favourites, Michael Phelps, Jordan Spieth, Tom Brady and Misty Copeland, as well as Lindsay Vonn, crossing over from swimming through skiing, golf, ballet and of course NFL. And in 2020, Under Armour will provide the MLB (Major League Baseball) a 10 year exclusive uniform deal. Yes. That will be big.

The recent quarterly numbers showed a slowdown across the sector that impacted their brand too, revenues increased only 7 percent, homebound revenues declined as a result of a wholesalers going out of business. Expenses increased, margins were crimped a little and the company recorded a marginal loss for the quarter. The stock has halved in the last year, the growth trajectory expectations were just WAY too strong relative to the reality. I think that the share price is now fairly valued, relative to the expectations. Accumulating on weakness, versus the outlook that even for the balance of the year looks decent, sales growth expectations of 12 odd percent increase. The stock is still expensive, it does add something different, a brand that is taking on their two bigger peers, with many opportunities. If you hold them, be patient.

Linkfest, lap it up

I saw this all over the Twitter-thingie yesterday, via a website that you must subscribe to - A Robot Can Print This $32,000 House in as Little as 8 Hours. Now, how about that housing permit, registration fees and associated fees with finding a place to put it? How do you ask the bank for a building mortgage for a house that gets built in one-third of a day? More of a room than a house, you would agree?

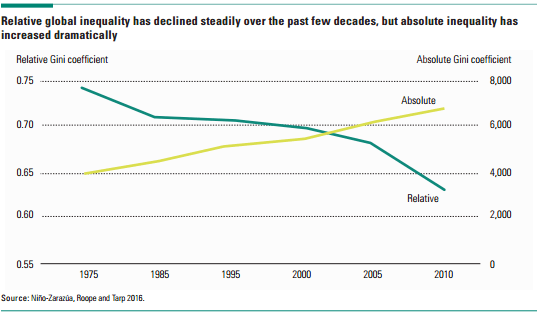

I love this post, via one of my favourite websites - Globalization is slashing inequality - here's how. The original post talks about the "relative global inequality" rather than the absolute number. The post says something different, think about it for a while and let me know if you think it is "right": .... arguably, reducing deprivation and raising living standards are more important than lessening income inequality.

All that said, from above, in the developed world (and you can see it in the anger of people's voting patterns), there is a definite "transition" in wages/skills - Great Divergences: The growing dispersion of wages and productivity in OECD countries. It seems that a number of factors impact on the pay versus productivity reality, including the impact from what company and sector you work for/in. It is tough and hard to tell someone who is 45 with a mortgage and children that they need to re-skill in order to meet the current labour market skillset requirements.

Home again, home again, jiggety-jog. Stocks across Asia are lower collectively. Futures are pointing lower. Markets here have started lower. The words Trump and Impeach in tweets has risen drastically in the last few hours. It won't happen until it happens, OK? Ha ha.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment