"Quality attracts quality and Alphabet attracts some of the best minds in the world. They also provide an environment that promotes innovation. These new ideas fall within the Other Bets segment. They take it very seriously and provide great capital for big potential ideas. We expect a lot more coming out of Alphabet in the future. But for now their existing businesses tick all our boxes and we are more than happy to continue buying at these attractive levels."

To market to market to buy a fat pig And we are back, you will have to wait another 7 weeks until the Youth Day long weekend, doesn't seem too bad? There have already been 3 short weeks and this week is another one, bringing the total to 4 short weeks in a row! Sasha always says that public holidays should fall on the nearest Monday or Friday thus making them less disruptive for business. If there was the choice I am sure people would rather have long weekends instead of a day off in the middle of the week. Here is what the CEO of FNB had to say, thanks to Twitter:

Friday saw our market in the green again at the close, Mediclinic held onto its gains finishing the day up 13.3%. Yesterday was also a holiday in London so we are not sure which direction the stock will go today, the Rand is slightly weaker against the Pound compared with the rate on Friday which could help push it up. The currency has played a big part in the poor performance of Mediclinic, over the last 12 months the London listed share is down 9%, over the same period the JSE listed share is down 25%. Ouch! If the Rand weakens going forward the share price performance in Rands will look much healthier but if the Rand strengthens the gap between the London listing and the Joburg listing will get wider. Trying to predict currencies though is a fools game, you own this company because you think they operate in the correct sector for long term growth.

New York, New York The US markets were open yesterday, their Labor Day celebrations fall on the first Monday of September which is the 4th September this year. It was a bit of a mixed bag, the Dow closed 0.13% lower but the S&P 500 was up 0.17% and the Nasdaq had another record close, increasing by 0.73%. The big news for the day came from the man at the top, Trump says he's thinking about breaking up the big banks. You can clearly see on a share price graph when the news broke, banking stocks dropped about 1% instantly. Over the day though they mostly recovered the losses, with Wells Fargo actually finishing up over 1% for the day.

The general principle for what Trump is trying to do is to lower the risks in the banking sector by separating the more risky investment banking division from the vanilla retail banking sector. Having said that, bad lending practices from retail banks can make them just as risky. The end goal is to get banks to a size where they are no longer "too big to fail". Given how intertwined the large banks are with the US economy, if any of them had to face financial difficulty putting them out of action for even a short period of time, the ripple effects would be huge. Imagine the 94 million cards that JP Morgan have in issue stop working for just 2 days, what will the impact be on the retail sector? I have not given this topic too much thought but at first glance I think having smaller banks is not a bad thing. The main reason that companies merge is to create efficiencies through economies of scale, I think these banks are getting to the point where they are so big that their size is creating inefficiencies. This is the case in the US at the moment, where the biggest 8 banks have to have higher capital reserves. So more capital sitting essentially idle than needs be. Expect much to be written about this by financial bloggers and journalists, after which you can make up your mind.

Company corner

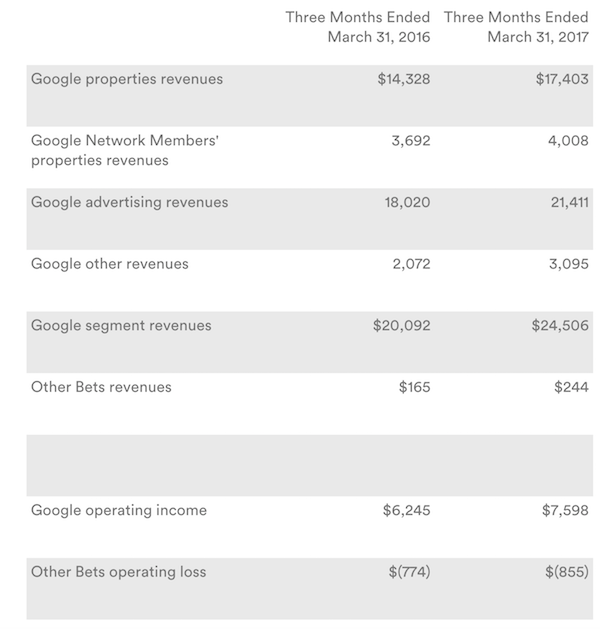

Last week we had a cracking set of numbers come through from Alphabet, the holding company of Google, YouTube, Android, Nexus, Pixel and many other smaller businesses.

Revenues grew 22% yoy to $24.75bn. Of this, advertising contributed $21.4bn which was up 19% versus this time last year. You would think that coming off such a high base, this would start slowing down but the growth remains solid. This in fact was the biggest beat on advertising estimates in 5 years.

For all these online businesses mobile is crucial. Mobile was the biggest driver in ad growth with paid clicks growing by a whopping 53%. This shows the benefit of offering free mobile phone software (Android) which steers all your users towards your own sites. Operating margins remain strong at 38.6%. This all resulted in operating income of $6.6bn for the quarter which equated to $7.62 per share.

Earnings for the full year are expected to come in at $34.70 which puts the share on a forward multiple of 26 times. For a company growing above 20% a year, margins north of 38% and a cash pile of more than $70bn (11% of market cap) I think this company is very well valued, if not borderline cheap. Even after the recent rally of 8.6% since these results were released.

Since Ruth Porat took over as CFO there has been a lot more visibility and transparency in reporting. Take a look at the image below which categorises Alphabets' businesses.

Google Property revenues come from ad results within Google search. This is the big breadwinner of the business and I do not see any slowing down here. People immediately go to Google to look for anything, it is the most incredible advertising tool. Google Network members include ads on Youtube, Google Finance, Gmail and the millions of partner websites that let Google feed ads towards their traffic. Eyes these days are on the screens of phones and computers, Google have almost monopolised adverting in this space and their moat to competition is as wide as it comes. Of course a company like Facebook will be high on the list for online advertising but I think that marketing world is big enough for two dominant players.

Quality attracts quality and Alphabet attracts some of the best minds in the world. They also provide an environment that promotes innovation. These new ideas fall within the Other Bets segment. They take it very seriously and provide great capital for big potential ideas. We expect a lot more coming out of Alphabet in the future. But for now their existing businesses tick all our boxes and we are more than happy to continue buying at these attractive levels.

Linkfest, lap it up

Here are some random facts about gold, the one about why sailors wore gold earrings caught my eye - Fascinating Facts about Gold on the Occasion of Akshaya Tritiya

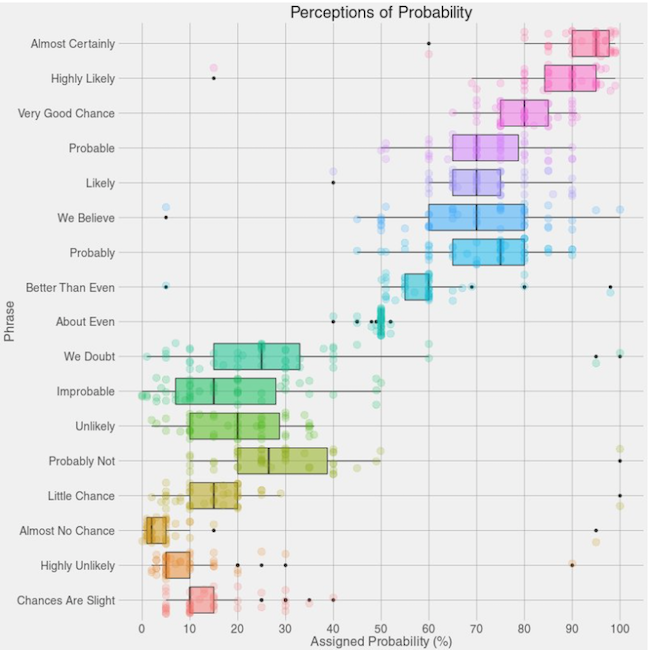

In business and in life generally effective communication is important. Step one in effective communication is that the term you are using means the same thing to the other person as it does to you - Measuring Perceptions of Uncertainty. The scary thing here is that military decisions used to be made based on intelligence reports with these words in them.

With the rise of electric cars, the metals that go into their batteries have seen a big increase in demand levels. The price of Cobalt is up around 70% this year already - The hottest thing in the markets right now is an obscure metal mined in DR Congo. The bigger question for the likes of Tesla is how to find "ethically" mined Cobalt.

Home again, home again, jiggety-jog. Our market is in the green again this morning, having crossed the 54 000 mark in early trade. The big news for the week is "what will the Fed do"? Yellen and her colleagues are meeting today and tomorrow, the market doesn't think a raise will happen tomorrow but more likely in their June meeting. Time will tell though. More exciting though is that we have Tesla and Facebook numbers out tomorrow!

Sent to you by Sasha, Michael and Byron on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

e commerce courier tracking

ReplyDelete